Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

What Is the Impact of Smoking on Health and Life Insurance Premiums?

4 mins

4 mins 5.3K

5.3KAre you a habitual or chain smoker? If yes, then you should know that the puff of smoke is not the only thing thinning as you inhale nicotine wrapped in cigarettes. Your finances also take a blow due to your smoking habit, especially when it comes to insurance.

Health Hazards of Smoking

Consumption and smoking of tobacco results in grave ailments like oral cancer, lung cancer, coronary heart disease, weaker bones leading to arthritis; damages blood vessels, increases risk of cataract and lowers fertility. Pregnant women have more complications and risks: chances of stillbirth, early delivery, ectopic pregnancy, sudden infant death syndrome increase if the smoking doesn’t cease.

Apart from detrimental effects on personal well-being, heavy alcohol consumption and frequent smoking of tobacco can have an impact on your medical insurance policy.

Impact on Health and Life Insurance Premium

Since smokers pose a greater risk of contacting this wide array of diseases mentioned above, it makes them more prone to health complications. Thus, most insurers will charge a higher premium amount for smokers compared to non-smokers. A The higher premium charged is actually a way for insurers to offset their overall costs incurred during a claim settlement, which, by the way, increases in probability.

Sometimes the medical coverage excludes ailments resulting from smoking, even though the insurer doesn’t explicitly ask about your status on that particularly. It is imperative you read the fine print of the policy carefully.

The impact is not limited to medical insurance only; it extends to life insurance premiums as well. Smokers are more likely to file for a claim on an insurance policy due to premature death or suffering from a critical illness in later stages of life, making them a cost for the insurer. Again, insurance companies charge higher premiums from smokers.

For Long-time Smokers

If you are a long-time smoker, your health conditions could bound to get worse as you age. Smokers with a poor health condition will have a hard time getting into a comprehensive medical insurance plan. Your best bet, in this case, is to start young when you are healthy and active. When you enter a policy at a young age, you may get higher benefits in the form of cumulative bonus and other loyalty rewards.

Lying Is Not the Way Out

When you sign up for a policy, your insurer will ask you if you smoke, and gather detail about your smoking habits. If you have smoked for more than four times a week and continued this for six months, you are termed as a smoker. If you've stopped using tobacco for at least three to five years, companies typically will charge you the same rate for life and health insurance as they would a non-smoker.

Considering how this habit can push you to a higher premium bracket, you might be tempted to withhold this information or lie about this. However, be informed that such misrepresentation or lie would be insurance fraud . Do not falsify this information since this might become a major roadblock during the claim settlement process. If the deterioration of your health is found to be associated with your tobacco consumption or smoking, and you haven’t declared this in the proposal form, or in case the insurer gets suspicious about this when you raise a claim, the company will order an investigation into the medical status. You don’t want to have to deal with an ugly legal battle when you’re already stuck in a medical contingency.

Not only will you have to bear the enormous medical expenses out-of-pocket, you could also be sued by the insurance company for providing incorrect information.

- it is advisable that you come clean and disclose your smoking habits.

It goes without saying that smokers are bound to pay higher premiums for health insurance compared to non-smokers. If you are a long-time smoker trying to kick the habit , this gives you an added incentive to get on track. Health emergencies come unannounced and untimely deaths can throw a sharp curve ball to your family. So why risk draining out funds for other medical conditions, or leave your family dealing with financial paucity? You should rather stay insured, adopt a healthy lifestyle, and keep your finances healthy. If you keep smoking, your health and finances are both in jeopardy.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

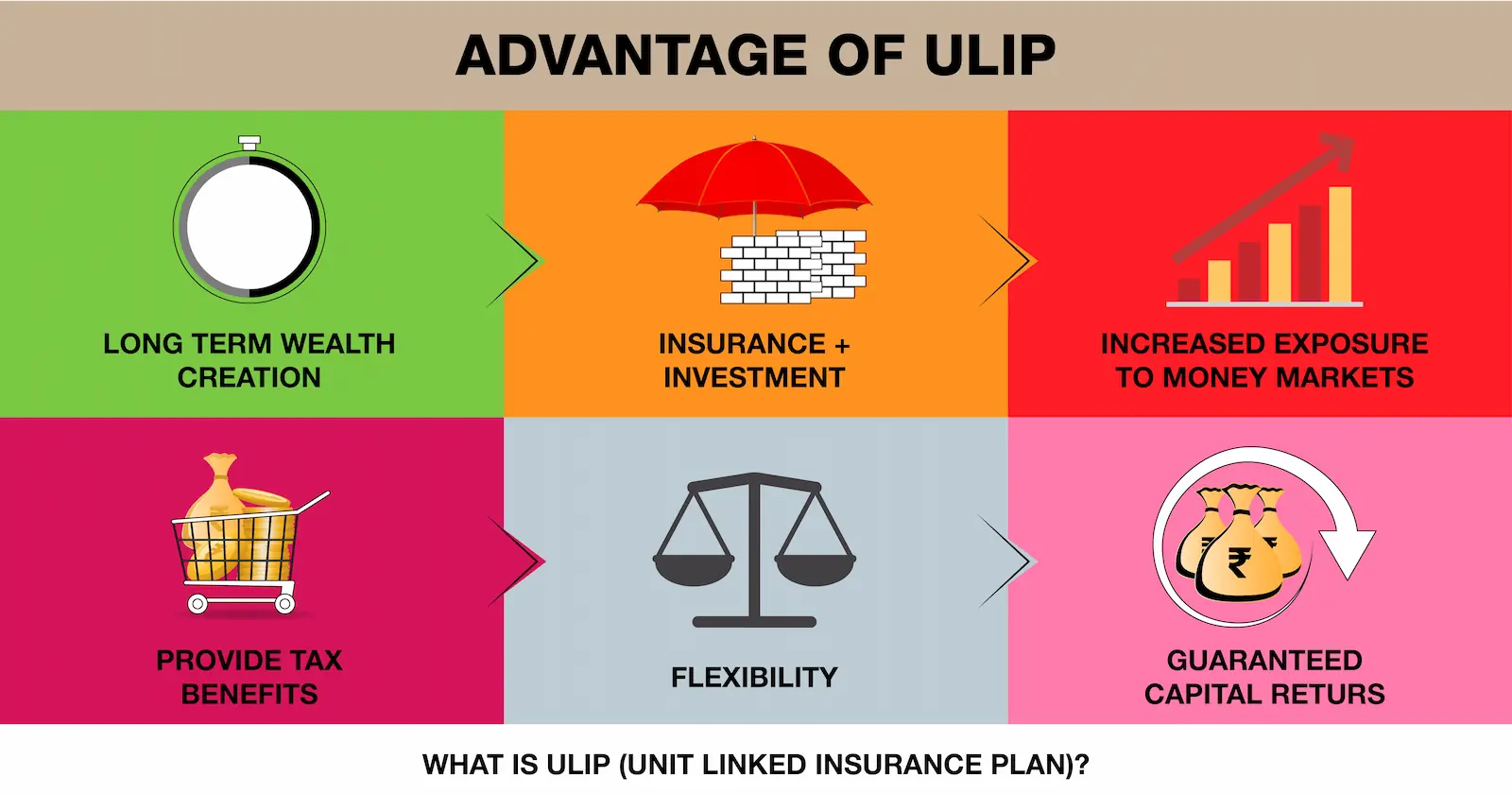

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.