Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Why Choose Generali Central Comprehensive Employee Benefits Plan?

A Unit-linked, non-participating (without-profits), fund based yearly renewable group insurance plan.

Running a business means juggling countless responsibilities, and employee benefit management can quickly become overwhelming. The Comprehensive Employee Benefits Plan simplifies everything by combining Gratuity, Leave Encashment, and Superannuation into one streamlined solution. Instead of managing separate policies with different providers, you get professional fund management, statutory compliance, and investment growth all under one roof.

Transform complex benefit administration into effortless workforce management while your contributions work harder for your employees' futures.

Complete Statutory Coverage

Manage Gratuity, Leave Encashment, and Superannuation all under one plan

6 Investment Options

Choose conveniently from Cash, Income, Enhanced Income, Secure, Balanced, and Growth funds

Loyalty Additions

Enjoy extra financial growth through yearly loyalty bonuses on fund performance

Flexible Contribution

Make contributions as per your funding requirements and cash flow

Tax Efficiency

Optimize your tax planning with compliant employee benefit contributions

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.

Fund Options

Depending on your ability to expose yourself to risks associated with the markets, choose to invest your premiums in any of the following 6 funds under the Comprehensive Employee Benefits Plan. Your premium, net of applicable charges, will be invested in the funds of your choice. The funds in turn, are segregated into liquid investments, fixed income securities and equity investments in line with their risk profile.

Group Cash Fund (SFIN: ULGF004010118GRPCSHFUND133) Investments in assets of low risk

This fund aims to safeguard the nominal value of investment through investment in short maturity liquid instruments. This fund will largely invest in money market instruments.

| Composition | Min. | Max. | Risk Profile |

|---|---|---|---|

| Money Market Instruments and Cash | 75% | 100% | Very low Risk |

| Debt Securities | 0% | 25% | |

| Equity | Nil | Nil |

In case of Gratuity, Leave Encashment or Defined Benefit Superannuation schemes, the Master Policyholder reserves the right to choose Investment Fund(s) and the Member shall not have any such rights.

In case of Defined Contribution Superannuation scheme, the right to choose Investment Fund(s) can be either with the Master Policyholder or the Members as per the scheme rules.

- Contributions shall be mandatorily invested in ‘Group Cash Fund (SFIN: ULGF004010118GRPCSHFUND133)’ or ‘Group Income Fund (SFIN: ULGF005010118GRPINCFUND133)’ or in certain proportion in these funds, depending upon the choice of Master Policyholder or the Member.

- Excess of fund value compared to the Assured Benefit (as defined under Benefits section) can be switched to any of the above 6 segregated funds as per the choice of the Member except where a scheme is entirely funded by the Master Policyholder, where the right to switch shall be with the Master Policyholder.

- At the end of each financial year i.e. on 31-March, if the sum of Fund Value of Group Cash Fund (SFIN: ULGF004010118GRPCSHFUND133) and Group Income Fund (SFIN: ULGF005010118GRPINCFUND133) is less than the Assured Benefit, then, the shortfall amount shall be met by switching units from other segregated funds to the ‘Group Cash Fund’.

A fund can be closed with appropriate approval. In case the existing fund is closed the default fund is the Group Income Fund (SFIN: ULGF005010118GRPINCFUND133)

In case any existing fund is closed, the Company shall seek prior instructions from the Master Policyholder for switching units from the existing closed fund to the any other available fund under the group insurance policy.

Company will also seek instructions for future contribution redirections in case of closure of the existing fund.

On such closure of fund, if the Company does not receive the choice of the fund from the Master Policyholder, the Company shall transfer the units of the Master Policyholder in the fund which is intended to be closed to the Group Income Fund (SFIN: ULGF005010118GRPINCFUND133) and all future redirections related to the closed fund shall be redirected to the Group Income Fund (SFIN: ULGF005010118GRPINCFUND133).

A fund can be modified with appropriate approval.

In case any existing fund is modified, the company shall seek prior instructions from the Master Policyholder/Member for switching units from the existing modified fund to any other fund available under the policy.

Company will also seek instructions for future contribution redirections in case of modification of the existing fund.

On such modification of the fund, if the company does not receive the choice of the fund from the Master Policyholder/Member, the company shall continue to invest in the modified fund.

Eligibility

Choose the plan that fits your life

Benefits of Generali Central Comprehensive Employee Benefits Plan

In case of death of a member,

- Death benefit will be paid as per scheme rules

- However, at all times, the liability of company is limited to the fund value subject to minimum Assured Benefit applicable in case of Superannuation scheme.

- In case of gratuity or leave encashment, an additional amount equal to Sum Assured of ₹ 10,000/- shall be paid over and above the fund value.

- The claim amount requested by the Master policyholder will be paid from the policy fund to the Master policyholder, to allow them to make benefit payment to the beneficiary.

- At all times, the liability of company is limited to the fund value.

- For schemes where defined benefits are subscribed to by an employer, where the scheme does not maintain individual member accounts and only maintains a superannuation fund

- The company shall make payments from such funds only subject to the availability of funds in the respective unit fund of the respective group policyholder’s superannuation fund.

- Except for exits as per the scheme rules, no other withdrawals shall be allowed.

- For schemes where defined contributions are subscribed to by an employer, where the scheme maintains individual member accounts:

- The company shall make payments from such individual member funds only subject to the availability of funds in the respective unit fund of the respective member of the group policyholder.

- Except for exits as per the scheme rules, no other withdrawals shall be allowed.

- Where the master policyholder maintains superannuation funds with more than one insurer, the master policyholder shall have the option to choose any insurer to purchase available annuity.

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability, and a proven approach to supporting your family and financial goals.

6019

6019Our and Partners Branches

897,635

897,635Lives Protected

Since Inception ₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

FY 24-25 99.78%

99.78%Group Claim Settlement Ratio

FY 24-25Data as on 31st March, 2025

Downloads

Everything you need to understand your policy, plan your future, and make informed decisions at your convenience.

Important Information & Resources

Understand your policy better with key details and insights into Generali Central Comprehensive Employee Benefits Plan.

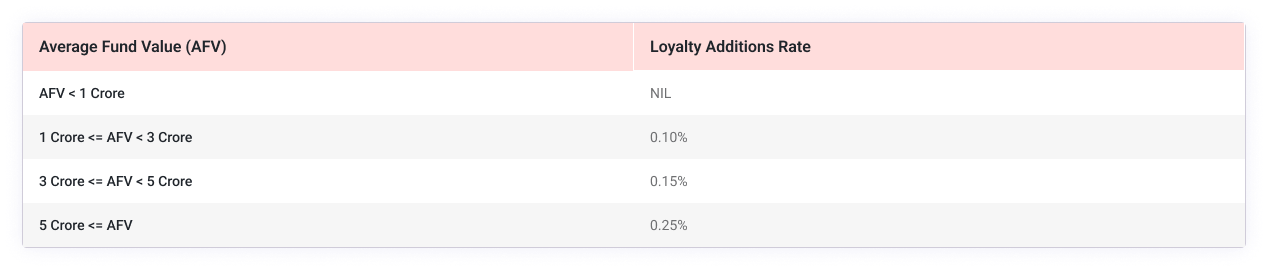

Loyalty Additions

Loyalty Additions as a % of average fund value shall be added at the end of each financial year i.e. on every 31st March as per the below table, subject to policy being in-force at the time of payment of loyalty additions.

Where,

Average Fund Value = Average of Fund values on the first day of each of the calendar months falling in the financial year in which loyalty addition is payable starting from calendar month April in Year (X-1) till calendar month March in Year X for determining loyalty units on 31st March of Year X.

The Loyalty Addition Rate to be applied shall be based on Average Fund Value as computed above.

The Loyalty Addition Rate shall be proportioned for number of days the scheme was with the Company in the financial year in question.

The Average Fund Value of all schemes (Gratuity, Leave Encashment and Superannuation) managed by Generali Central for a given Master Policyholder (one company or all companies belonging to same group) under this product shall be clubbed to determine the size of fund for determining applicable loyalty addition rates.

Under this plan, the liability of Generali Central Life Insurance Company Limited (GCLIC) at any time will be limited to the Fund Value of the Scheme. GCLIC will only be concerned with fund management, and the Master Policyholder will have to bear any shortfall in funds, if it arises at any time. The liability of the company at all times will be limited to the balance of the Fund Value in the scheme.

Auto Renewal

On non-receipt of contribution, the policy will automatically get renewed as per the existing terms and conditions on each renewal date.

Partial Withdrawal

Partial withdrawal is not allowed under the product.

Except for exits as per the scheme rules, no other withdrawals will be allowed.

The amount payable pertaining to that member on exits shall be as communicated by the Master Policyholder to us.

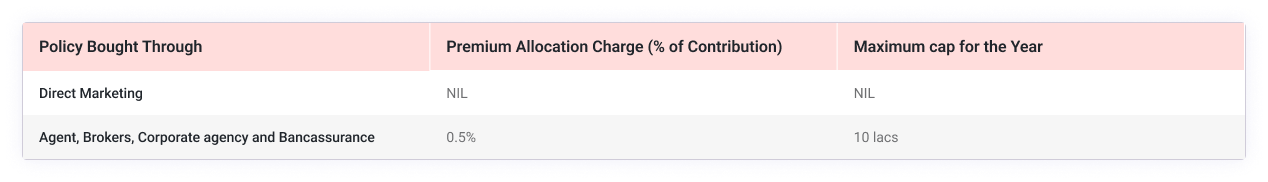

Premium Allocation Charge:

The premium allocation charge depends on whether the group scheme is bought directly or through a sales intermediary. The premium allocation charge for a scheme as a percentage of contributions is as per the table below:

Premium allocation charges are deducted from contributions paid and the contributions, net of premium allocation charges, are used to purchase units in any of the six underlying funds as per choice of Master Policyholder.

Policy Administration Charge:

Nil

Surrender Charge:

0.05% of Fund Value subject to maximum of Rs. 5 Lac in the first policy year and Nil thereafter.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- Emailing at care@generalicentral.com

- You may also visit us at the nearest Branch Office. Branch locator - https://www.generalicentrallife.com/branch-locator

- Senior citizens may write to us at the following ID: senior.citizens@generalicentral.com for priority assistance

- You may write to us at: Customer Services Department- Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli (W), Mumbai – 400083

We will provide a resolution at the earliest. For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

Generali Central Life Insurance Company Limited (Formerly known as Future Generali India Life Insurance Company Limited) offers a wide range of life insurance solutions designed to protect and empower individuals at every stage of life. Whether it’s protecting your loved ones, planning for retirement, or securing long-term financial well-being, our offerings are designed to evolve with your needs. Backed by a robust distribution network and advanced digital tools, we are dedicated to delivering simplicity, innovation, empathy, and care in every experience — all anchored by our unwavering commitment to being your Lifetime Partner.

This commitment is backed by the strength of our joint venture between Generali, a global insurance leader with over 190 years of expertise, and Central Bank of India, a trusted name with a rich legacy in Indian banking.

Generali Central Comprehensive Employee Benefits Plan (UIN: 133L080V02)

- Unit Linked Insurance products are different from the traditional insurance products and are subject to the risk factors.

- The Premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the policyholder/insured is responsible for his/her decisions.

- Generali Central Life Insurance Company Limited is only the name of the Life Insurance Company and Generali Central Comprehensive Employee Benefits Plan is only the name of the unit linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

- Please know the associated risks and the applicable charges, from your insurance agent or the intermediary or policy document of the Company.

- The various funds offered under this group insurance schemes are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Past performance is not indicative of future performance, which may be different.

- Tax benefits are subject to change in law from time to time. You are advised to consult your tax consultant.

- For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made there to from time to time. Generali Group’s and Central Bank of India’s liability is restricted to the extent of their shareholding in Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited (Formerly known as ‘Future generali India Life Insurance Company Limited’) (IRDAI Regn. No.: 133) (CIN: U66010MH2006PLC165288). Regd. Office & Corporate Office address: Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai - 400083

Email: care@generalicentral.com

Call us at 1800-102-2355

Website: https://www.generalicentrallife.com

For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

What Our Happy Customers Are Saying

Real stories, real people— hear from those who’ve taken the step of strengthening their financial security with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

The plan is bought by an employer as the master policyholder for groups with at least ten members. Member entry ages are between 18 and 79 years and maximum maturity age is 80 years. The minimum sum assured per member is Rs 10,000 for gratuity and leave encashment and nil for superannuation.

Claims requested by the master policyholder are paid from the policy fund to the master policyholder so they can make the benefit payment to the beneficiary. For gratuity and leave encashment an additional amount of Rs 10,000 is payable over and above the fund value.

The Systematic Transfer Option is an automated facility to move units monthly from a selected fund to a target fund through 12 staged transfers. It is requested and controlled by the master policyholder, is not applicable for superannuation schemes, carries no charge and can be stopped by the master policyholder.

Yes. Loyalty additions in the form of units are credited at the end of each financial year based on average fund value bands. The stated rates are nil for AFV below Rs 1 crore, 0.10 percent for AFV of Rs 1 crore to less than Rs 3 crore, 0.15 percent for AFV of Rs 3 crore to less than Rs 5 crore and 0.25 percent for AFV of Rs 5 crore and above.

Yes. On non receipt of contribution the policy will automatically renew on each renewal date under the existing terms and conditions.