Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Long Term Investing: Are ULIPs a Good Option?

6 mins

6 mins 3.3K

3.3KBeing a father of a two year old, Kedar was looking for an insurance plan to safeguard the future of his family. At the same time, he also sought to invest a portion of his income periodically to meet his future financial demands. After being unsure for a while, he finally called up his father-in-law, sound in financial instruments, to seek advice. His father-in-law suggested opting for Unit Linked Insurance Plan (ULIP).

However, one question still bugged him:

Is ULIP Good for the Long Term?

A Unit Linked Insurance Plan (ULIP) is a financial tool holding double benefits of insurance and market linked investments. It becomes promising for individuals who wish to connect their investment with financial security.

A part of the premium you pay is dedicated towards Life Cover and the rest is assigned to a shared pool of money, which invests in debt, equity, or a combination of both. With a minimum lock-in period of 5 years, it acts as a financial tool that helps individuals move towards their financial goals. When compared with other financial instruments, equity-linked options like ULIPs emerge as one of your best bets.

2.90% - 5.50%

Debt

Yes

10 years

7.1%

Debt

Yes

15 years

6.8%

Debt

Yes

5 years

6.7%

Debt

Yes

5 years

7.6%

Debt

Yes

21 years

7.40%

Debt

Yes

5 years

9% - 12% Expected

Equity, Debt

No

Till retirement

10% - 12% Expected

Equity

No

3 years

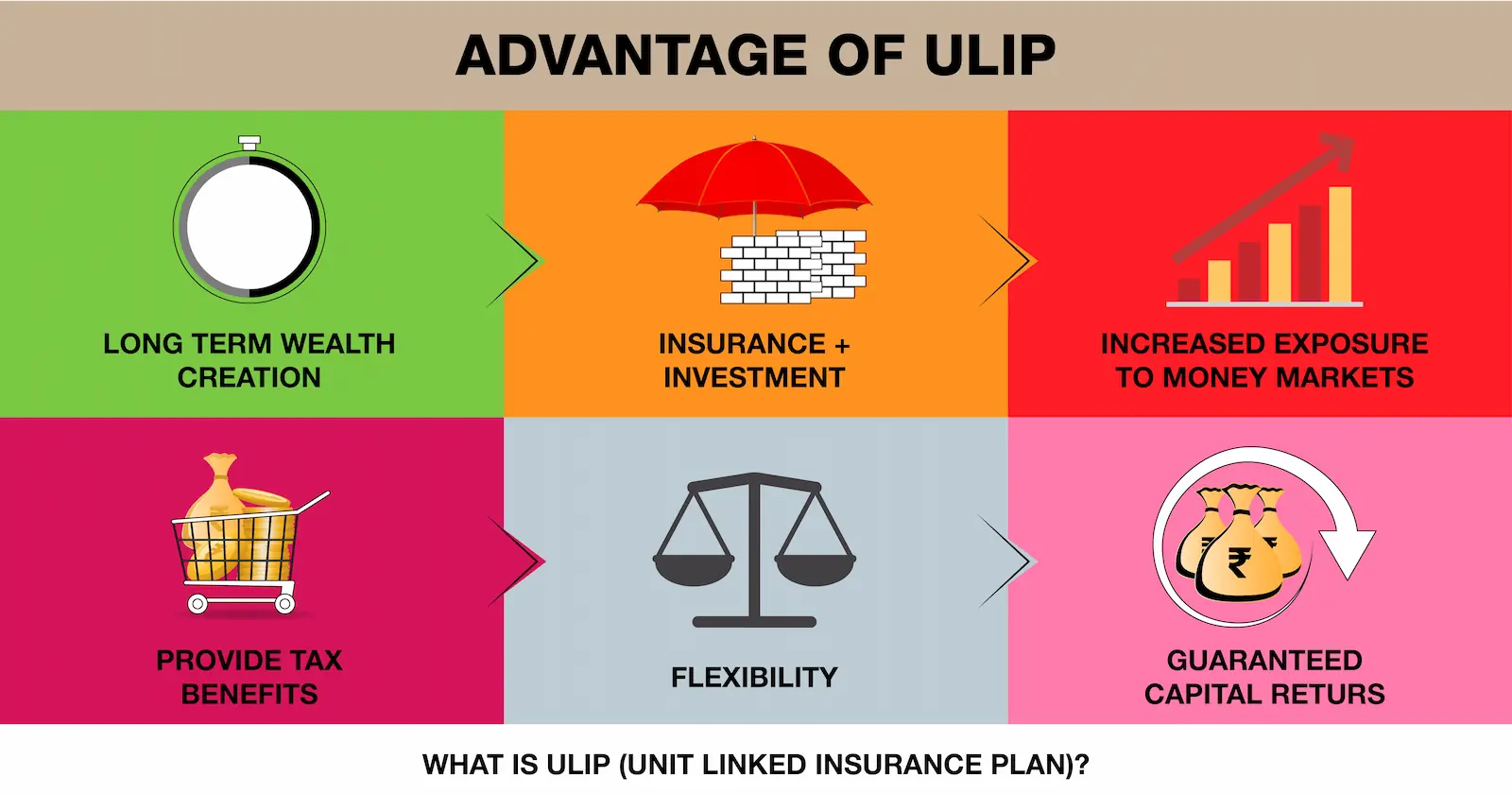

Benefits of ULIPs

The various benefits that decisively answer the question of whether ULIPs are good for the long term are:

A common nickname for compounding is "the eighth wonder." Any investment is worth the wait because of its unseen power. Compounding is the ability of an asset to provide income that is then reinvested by the fund to produce its own income. By doing this, your investment money stays exactly where it is while your earnings from interest and other sources continue to grow. If everything is done correctly, your fund should be able to produce large gains over a number of years.

Unit-linked insurance plans (ULIPs), take advantage of compounding while requiring you to commit to making regular payments and allocating your money toward specific objectives. In addition, it protects your loved ones financially in the event of your untimely death through the Sum Assured .

So, in essence, investing consistently over a long period of time is the key to utilising compounding.

India has been ranked as the nation with the worst retirement conditions. With lack of care and minimal savings, elders lead a fragile life after retirement.

Individuals are given the option of switching funds with ULIPs.

One prime reason you should place your savings into a ULIP is that ULIPs primarily focus on long term wealth creation, and help you achieve the same. How?

Tax exemption is one of the biggest reasons why one should invest in ULIPs.

The above mentioned diverse benefits make ULIPs an ideal investment tool for your long-term financial goals. If, like Kedar, you are seeking a cover for your family and at the same time looking for a suitable financial instrument for market-linked growth, ULIP becomes a reasonable choice with such benefits. To know more about ULIPs, feel free to connect with our trusted financial advisors today!

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

Which Is a Good Term Insurance Policy for Women?

4 mins

3.7K

Posted on: Oct 01, 2025

Life Insurance

Up to what age can I get term life insurance coverage?

4 mins

6.4K

Posted on: Oct 01, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.