Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Why Choose Generali Central Saral Jeevan Bima Plan?

An Individual, Non-Linked, Non-Participating (without Profits), Pure Risk Premium, Life Insurance Plan.

Life doesn't come with guarantees, but your family's financial future can. Give them the solid protection they truly deserve with a term plan built for strength and reliability.

That's where Generali Central Saral Jeevan Bima comes in. It's a pure term insurance plan designed for one simple purpose: to protect your family's financial future. With affordable premiums and substantial coverage, it ensures your loved ones can continue living with security and freedom, even when you're not there.

Because protecting your family isn't just a responsibility. It's the greatest gift you can give them.

Flexible Plan Options

Select your own Policy term and Premium Policy Term

Standardized Benefits

IRDAI-regulated plan with transparent features

Pure Risk Cover

Maximum life protection at the most affordable cost

Comprehensive Death Benefit

Secure your family's future with substantial coverage

Tax Benefits

Save under Sections 80C and 10(10D), as per prevailing tax laws

Flexible Payment Options

Choose from Regular, Limited, or Single Pay modes

A Roadmap to a Secure Future

Talk to an Advisor

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.

Eligibility

Choose the plan that fits your life

18 years to 65 years (as on last Birthday)

23 years to 70 years (as on last Birthday)

Yearly, Half Yearly and Monthly (Only under ECS/NACH)

Minimum - Rs. 5 Lacs

Maximum – Rs. 25 Lacs

(SA would be allowed only in multiples of ₹ 50,000)

Minimum:

₹135

Maximum: As per the maximum Sum Assured

| Policy Term | Premium Payment Term |

|---|---|

| 5 years to 40 years | Single Pay |

| Limited Pay - 5 Years | |

| Limited Pay - 10 Years | |

| Regular Pay |

| Age | Sum Assured | Policy Term | Regular Pay (25 yrs) | Limited Pay (5 yrs) | Limited Pay (10 yrs) | Single Pay (1 time) |

|---|---|---|---|---|---|---|

| 30 | ₹20 lakhs | 25 years | 6,660 | 24,900 | 13,420 | 85,840 |

| 35 | ₹20 lakhs | 25 years | 9,520 | 36,240 | 19,240 | 1,26,040 |

| 40 | ₹20 lakhs | 25 years | 14,140 | 53,400 | 28,220 | 1,86,220 |

| 45 | ₹20 lakhs | 25 years | 21,300 | 78,040 | 41,520 | 2,71,720 |

1. Premiums mentioned above are excluding applicable taxes and extra underwriting premium, if any.

2. Age wherever mentioned is age as on last birthday.

Benefits of Generali Central Saral Jeevan Bima

Here’s how this plan helps you secure your goals and safeguard your loved ones:

A payment made to your nominee in case of your unfortunate demise during the policy term, ensuring your family’s financial protection.

On death of the Life Assured during the Waiting Period and provided the Policy is in force, the Death Benefit amount payable as a lump sum is:

- In case of Accidental Death, for regular premium or limited premium payment policy, equal to Sum Assured on Death which is the highest of:

- 10 times the Annualized Premium, or

- 105% of all premiums paid as on the date of death, or

- Absolute amount assured to be paid on death.

- In case of Accidental Death, for single premium policy, equal to Sum Assured on Death which is the higher of:

- 125% of Single Premium (excluding any extra premium, any rider premium and applicable taxes), or

- Absolute amount assured to be paid on death.

- In case of death due to other than accident, the Death Benefit is equal to 100% of all Premiums paid excluding taxes, if any.

Premiums referred above shall not include any extra amount chargeable under the policy due to underwriting decision, if any

On death of the Life Assured after the expiry of Waiting Period but before the stipulated date of maturity and provided the Policy is in force, the Death Benefit amount payable as a lump sum is:

- For Regular premium or Limited premium payment policy, “Sum Assured on Death” which is the highest of:

- 10 times the Annualized Premium, or

- 105% of all premiums paid as on the date of death, or

- Absolute amount assured to be paid on death.

- For Single premium policy, “Sum Assured on Death” which is the higher of:

- 125% of Single Premium (excluding any extra premium, any rider premium and applicable taxes), or

- Absolute amount assured to be paid on death.

- Premiums referred above shall not include any extra amount chargeable under the policy due to underwriting decision, if any

Absolute amount assured to be paid on death shall be an amount equal to Basic Sum Assured.

Where,

“Annualized Premium” shall be the premium amount payable in a year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any

And

"Total Premiums Paid" means total of all the premiums received, excluding any extra premium, any rider premium and taxes

In case of death of Life Assured under an in-force policy wherein all the premiums due till the date of death have been paid and where the mode of payment of premium is other than yearly, balance premium(s), if any, falling due from the date of death and before the next policy anniversary shall be deducted from the claim amount.

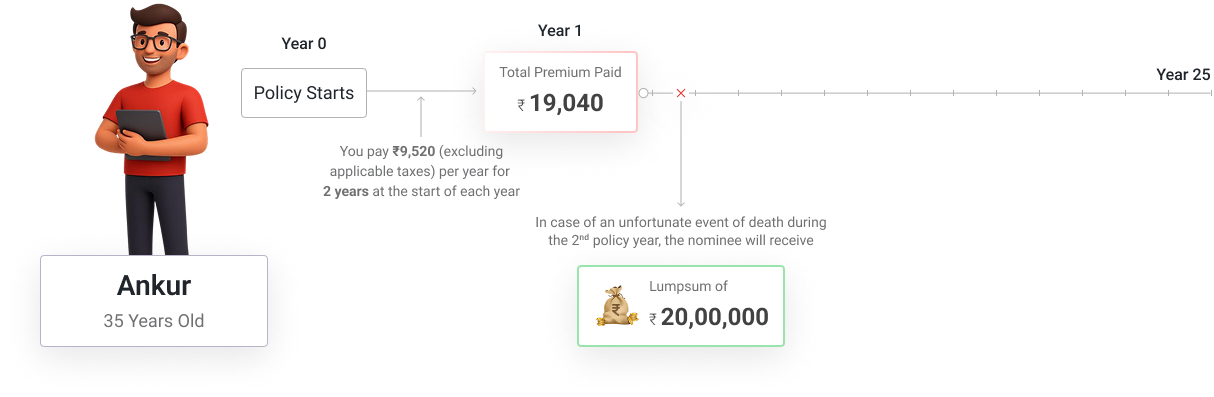

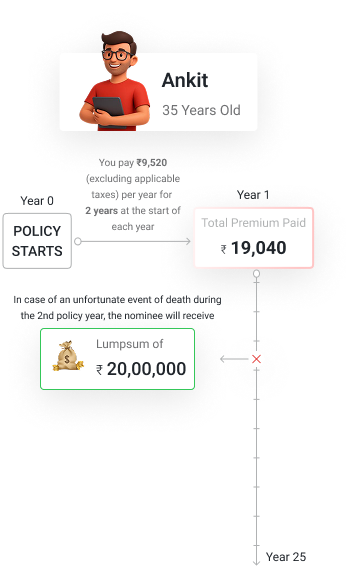

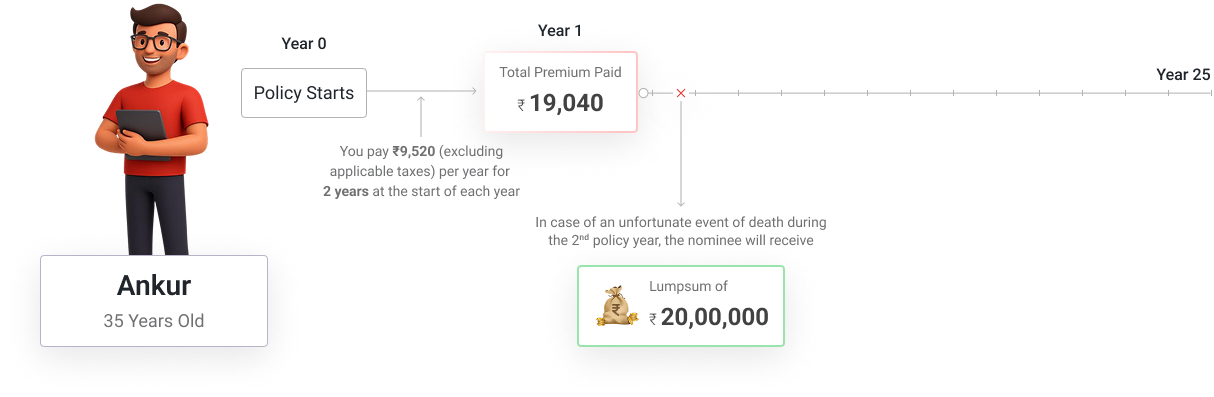

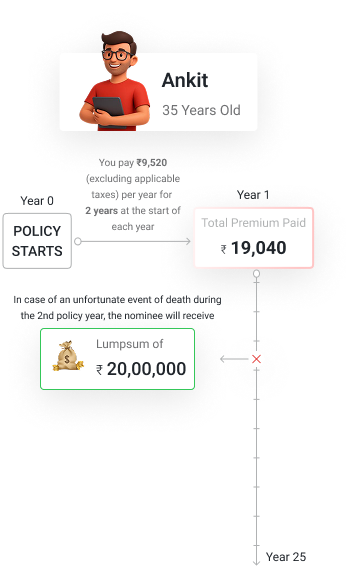

Ankur’s Example

To clearly understand how death benefit works in this case, let us look at Ankur’s story

Scenario 1:

Ankur is a 35 year old healthy non-smoker male. He buys the Generali Central Saral Jeevan Bima with Base Sum Assured of Rs. 20 lacs for a policy term of 25 years and chooses to pay annual premium regularly for 25 years.

A lump sum amount payable at the end of the policy term, provided all due premiums have been paid.

There are no maturity benefits under this plan.

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability, and a proven approach to supporting your family and financial goals.

6019

6019Our and Partners Branches

897,635

897,635Lives Protected

Since Inception ₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

FY 24-25 99.78%

99.78%Group Claim Settlement Ratio

FY 24-25Data as on 31st March, 2025

Downloads

Everything you need to understand your policy, plan your future, and make informed decisions at your convenience.

Important Information & Resources

Understand your policy better with key details and insights into the Generali Central Saral Jeevan Bima Plan.

Free Look Period

The Policyholder has a free look period of 30 days from the date of receipt of the policy document, (whether received electronically or otherwise) to review the terms and conditions of the policy and where the policyholder disagrees to any of those terms and conditions of the policy, or otherwise and has not made any claim,, the policy holder has the option to return the policy to the Company for cancellation, stating the reasons for the objection, then the policyholder shall be entitled to a refund of the premium paid subject only to the deduction of a proportionate risk premium for the period of cover and expenses incurred by the Company on medical examination of the proposer and stamp duty charges.

If the policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

- For existing e-Insurance Account: Computation of the said Free Look Period shall commence from the date of delivery of the e-mail confirming the credit of the Insurance policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the 'welcome kit' from the IR with the credentials to log on to the eInsurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Premium Rate Guarantee

Premium rates are guaranteed for the entire policy term.

Suicide Exclusion

- Under Regular/Limited Premium Policy

This Policy shall be void if the Life Assured commits suicide at any time within 12 months from the Date of Commencement of Risk, provided the policy is inforce or within 12 months from the date of revival and the Company will not entertain any claim except for 80% of the premiums paid (excluding any extra amount if charged under the Policy due to underwriting decisions, taxes and rider premiums, if any) till the date of death.

This clause shall not be applicable for a lapsed Policy as nothing is payable under such policies.

- Under Single Premium Policy

This Policy shall be void if the Life Assured commits suicide at any time within 12 months from the Date of Commencement of Risk and the Company will not entertain any claim except for 90% of the Single Premium paid (excluding any extra amount if charged under the policy due to underwriting decisions, taxes and rider premiums, if any.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- Emailing at care@generalicentral.com

- You may also visit us at the nearest Branch Office. Branch locator - https://www.generalicentrallife.com/branch-locator

- Senior citizens may write to us at the following ID: senior.citizens@generalicentral.com for priority assistance

- You may write to us at: Customer Services Department- Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli (W), Mumbai – 400083

- We will provide a resolution at the earliest. For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

Generali Central Life Insurance Company Limited (Formerly known as Future Generali India Life Insurance Company Limited) offers a wide range of life insurance solutions designed to protect and empower individuals at every stage of life. Whether it’s protecting your loved ones, planning for retirement, or securing long-term financial well-being, our offerings are designed to evolve with your needs. Backed by a robust distribution network and advanced digital tools, we are dedicated to delivering simplicity, innovation, empathy, and care in every experience — all anchored by our unwavering commitment to being your Lifetime Partner.

This commitment is backed by the strength of our joint venture between Generali, a global insurance leader with over 190 years of expertise, and Central Bank of India, a trusted name with a rich legacy in Indian banking.

This Product is not available for online sale.

Life Coverage is included in this Product.

For detailed information on this product including risk factors, terms and conditions etc., please refer to the policy document and consult your advisor or visit our website before concluding a sale. We advise you to visit our website/speak to one of our advisors to know about range of products offered by us. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Generali Group's and Central Bank of India's liability is restricted to the extent of their shareholding in Generali Central Life Insurance Company Limited. www.generalicentrallife.com

Life Coverage is included in this Product. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

Generali Central Life Insurance Company Limited (formerly known as Future Generali India Life Insurance Company Limited). (IRDAI Regn. No. 133) CIN:U66010MH2006PLC165288 Regd. and Corporate Office address: Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai 400083.

Email - care@generalicentral.com

Call us at 1800-102-2355

Website: www.generalicentrallife.com

What Our Happy Customers Are Saying

Real stories, real people— hear from those who’ve taken the step of strengthening their financial security with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Saral Jeevan Bima is a pure term insurance plan that provides financial protection to your family in case of your unfortunate demise during the policy term. It offers high life cover at affordable premiums without any maturity or survival benefits.

Yes, absolutely. Premium rates are guaranteed for the entire policy term. Your premiums will not increase during the policy tenure.

The maximum entry age is 65 years, and the maximum maturity age is 70 years.

You get a grace period of 30 days (for yearly/half-yearly payment modes) or 15 days (for monthly payment mode). If the premium is not paid within the grace period, the policy will lapse. However, if death occurs during the grace period, the policy remains valid and benefits are payable after deducting unpaid premiums.

No, this product is not available for online sale. You need to contact an advisor or visit a branch office.