Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Why Choose Generali Central Dhan Vridhi Plan?

An Individual, Non Participating (without profits), Unit

linked, Life Insurance plan.

You work hard to give your loved ones a secure and happy future.

The Generali Central Dhan Vridhi Plan helps you grow your money while protecting the people who matter most. It gives you the flexibility to make changes or withdraw funds when you need them, so your dreams stay on track.

Whether it is your child’s education, your retirement, or a well-earned break, this plan gives you peace of mind that your goals are on track. And with life cover as an integral part of the plan, your family stays protected always.

Guaranteed Additions

Get 2% added to your fund value every year from the 6th policy year

Smart Fund Switches

Move your money between funds anytime based on your goals

Partial Withdrawals

Access funds after 5 years for life's urgent needs

Choice of 9 Fund Options

Select from 9 expert-managed funds based on your risk appetite

Add Riders for Extra Safety

Boost your cover with add-ons for accidents, illness, and more

Tax Benefits

Save on premiums and payouts under applicable tax laws

Lump Sum at Maturity

Get your fund value at maturity and achieve your life goals

A Roadmap to a Secure Future

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.

Fund Options

Your premium, net of applicable charges, is invested in unit funds of your choice. Currently you have a choice of nine investment funds, providing you the flexibility to direct your investments in any of the following unit linked funds of the Company. The funds invest in a mix of liquid investments, fixed income securities and equity investments in line with their risk profile.

Future Secure Fund (SFIN: ULIF001180708FUTUSECURE133)

To provide stable returns by investing in relatively low risk assets. The fund will invest exclusively in treasury bills, bank deposits, certificate of deposits, other money market instruments and short duration government securities.

| Composition | Min. | Max. | Risk Profile |

|---|---|---|---|

| Money Market Instruments | 0% | 75% | Low |

| Short Term Debt | 25% | 100% |

Eligibility

Choose the plan that fits your life

8 to 65 years (as on last birthday)

18 to 85 years (as on last birthday)

Yearly, Half Yearly, Quarterly and Monthly

Sum Assured is defined as Death Benefit Multiple * Annualized Premium (excluding taxes, rider premiums and underwriting extra premium on riders, if any). Where, Death Benefit Multiple Options available under this product as below:

Minimum:

2,000

Maximum: No Limit, subject to underwriting

1. Premiums mentioned above are excluding applicable taxes,rider premiums and extra underwriting premium, if any.

3. Age wherever mentioned is age as on last birthday.

Benefits of Generali Central Dhan Vridhi Plan

Here’s how this plan helps you secure your goals and safeguard your loved ones:

Receive a lump sum at the end of the policy term when all premiums have been paid, helping you achieve your financial goals.

At maturity, the Fund Value as on the date of maturity is payable to the life assured, provided the policy is inforce.

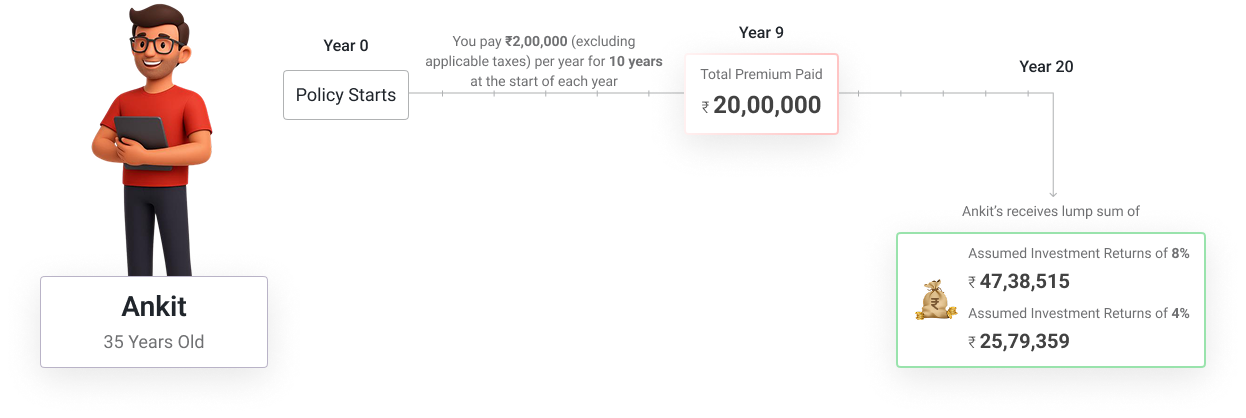

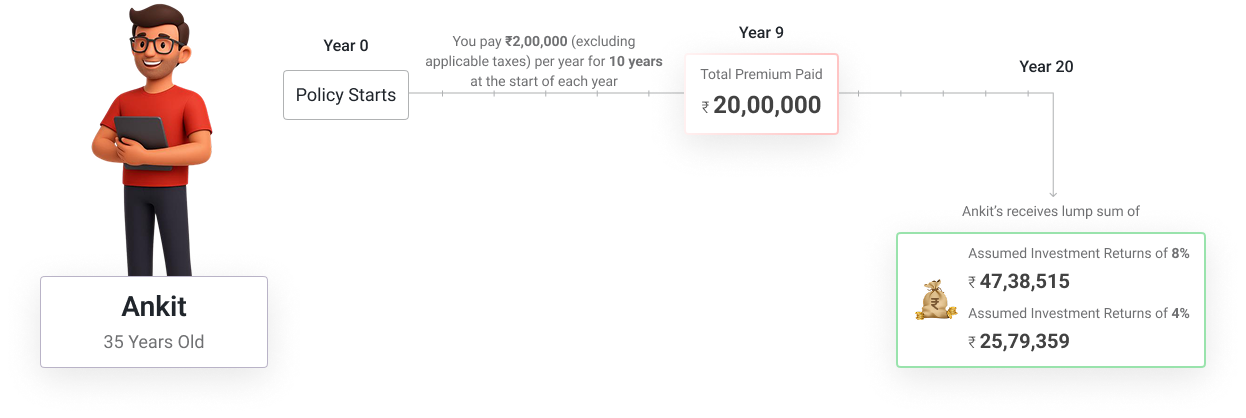

Ankit’s Example

To clearly understand how the death benefit works, let us refer to Ankit’s story.

Ankit is 35 years old and has chosen to invest in Generali Central Dhan Vridhi Plan, with a Policy Term of 20 years, an annual premium of Rs. 2,00,000 for 10 years. His Death Benefit Multiple is 10 times and a Sum Assured (cover amount) of Rs. 20,00,000.

Protect your family with a payout to your nominee in case of your untimely demise during the policy term.

In case of an unfortunate demise of the Life Assured during the Policy Term while the policy is in force, the nominee receives the higher of:

- Sum Assured less Deductible Partial Withdrawal, if any

- Fund Value

- 105% of total premiums paid under the base product (including top-up premiums paid, if any) till date of death - less deductable partial withdrawals, if any is payable.

Deductible Partial Withdrawals are partial withdrawals made 2 years immediately prior to the date of death, of the life assured.

Note

- On death of the life assured, the policy will be terminated by paying the death benefit.

- Risk will commence immediately for minor lives

- If the life assured is a minor at the time of issuance of the policy and the proposer predeceases the life assured during the minority of the life assured, no immediate benefit will be payable. On the death of the Policyholder while the life assured is a minor, the policy may be continued by the appointment of a new Policyholder under the policy. However where a new policyholder is not available and / or the legal guardian(s) is not interested to continue the policy, then the policy proceeds would be paid to the Legal Representatives/Legal Guardian(s) of the Policyholder who would take out representation for the moneys under the policy from a Court of a State or Territory of the Union of India that the moneys will be utilized for carrying out day to day expenses /benefit of the minor. The policy proceeds in case of discontinuance of policy will be paid and the policy will be terminated thereafter.

Surrender Benefit

Policy can be surrendered any time during the Policy Term. The Surrender Value will be Fund Value less Discontinuance Charge, if any, as mentioned below:

- If policy is surrendered before the completion of lock-in period of 5 policy years from the Policy Commencement Date, the Surrender Value equal to Fund Value less applicable Discontinuance Charge will be kept in Discontinued Policy Fund and no subsequent charges other than Fund Management Charges for Discontinued Policy Fund will be deducted. The Surrender Value will accrue a minimum guaranteed return as specified by IRDA, from time to time. Such accumulated Surrender Value will be paid immediately after completion of the lock-in period. In case of death of the Life Assured during this period, the proceeds will be payable to the nominee/ legal heirs as applicable.

- If the policy is surrendered after the lock-in period, then the Surrender Value is the Fund Value at the prevailing NAV without deduction of the Discontinuance Charges. It becomes payable immediately.

Target Group

For customers looking for an investment cum insurance plan that will also help them save taxes

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability, and a proven approach to supporting your family and financial goals.

6019

6019Our and Partners Branches

897,635

897,635Lives Protected

Since Inception ₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

FY 24-25 99.78%

99.78%Group Claim Settlement Ratio

FY 24-25Data as on 31st March, 2025

Downloads

Everything you need to understand your policy, plan your future, and make informed decisions at your convenience.

Important Information & Resources

Understand your policy better with key details and insights into the Generali Central Dhan Vridhi Plan.

Riders

- Generali Central Linked Accidental Death Benefit Rider (UIN: 133A053V01):

This rider provides 100% of Rider Sum Assured as an additional coverage in case of death due to accident of Life Assured during the rider term and such unforeseen event shall occur within a period of 180 days of the accident.

- Generali Central Linked Accidental Total & Permanent Disability Rider (UIN: 133A055V01):

This rider provides 100% of Rider Sum Assured as an additional protection in case of total or permanent disability due to accident of Life Assured, to such an extent that the Life Assured cannot perform 3 out of 6 daily life activities without continuous assistance from another person during the rider term. The Life Assured has to deemed disable by a suitable medical practitioner (appointed by the company) and the disability should persist continuously for a period of 180 days.

- Generali Central Linked Term Rider (UIN: 133A059V01):

This rider provides 100% of Rider Sum Assured as an additional coverage in case of death of Life Assured during the rider term.

- Generali Central Linked Critical Illness Rider (UIN: 133A057V01)

This rider provides financial support on diagnosis of any covered critical illness during the rider term, helping the Life Assured manage treatment and recovery without financial stress. The Rider Sum Assured is payable if the Life Assured is diagnosed with one of the specified critical illnesses and survives for 30 days after such diagnosis. The rider offers three coverage options—10, 30, or 60 critical illnesses—allowing flexibility based on protection needs. The benefit can be received as a lump sum, regular income for a chosen period (2 to 10 years), or a combination of both.

For further information on these riders including risk factors, exclusions, terms and conditions etc., please refer the rider/s brochures available on the website at https://www.generalicentrallife.com or contact us at Email care@generalicentral.com, Customer Care Number 1800 102-2355

Premium Allocation Charge

The Premium Allocation Charge will be deducted from the premium amount at the time of premium payment and the remaining premium will be used to purchase units in various investment funds according to specified fund allocation.

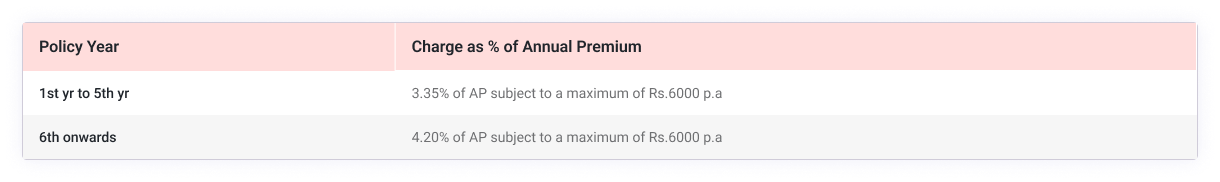

Policy Administration Charge

These charges are determined using 1/12th of the annual charges given above and are deducted from the unit account monthly at the beginning of each monthly anniversary of the policy by cancellation of units for equivalent amount till the end of the Policy Term. The Policy Administration Charge is subject to a maximum of Rs. 500 per month.

Exclusion & Other Restrictions

No benefit will be payable in respect of any condition arising directly or indirectly through or in consequence of the following exclusions and restrictions

Suicide Exclusion

In case of death of life assured due to suicide within 12 months from the date of commencement of the policy or from the date of revival of the policy, as applicable, the nominee or the beneficiary of the policyholder shall be entitled to fund value, as available on the date of intimation of death.

Further, any charges other than Fund Management Charges (FMC) and Guarantee Charges recovered subsequent to the date of death shall be added back to the fund value as on the date of intimation of death.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Calling the Customer helpline number 1800-102 2355 for assistance and guidance

- Emailing at care@generalicentral.com

- You may also visit us at the nearest Branch Office. Branch locator - https://www.generalicentrallife.com/branch-locator

- Senior citizens may write to us at the following ID: senior.citizens@generalicentral.com for priority assistance

- You may write to us at: Customer Services Department- Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli (W), Mumbai – 400083 We will provide a resolution at the earliest. For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

Generali Central Life Insurance Company Limited (Formerly known as Future Generali India Life Insurance Company Limited) offers a wide range of life insurance solutions designed to protect and empower individuals at every stage of life. Whether it’s protecting your loved ones, planning for retirement, or securing long-term financial well-being, our offerings are designed to evolve with your needs. Backed by a robust distribution network and advanced digital tools, we are dedicated to delivering simplicity, innovation, empathy, and care in every experience — all anchored by our unwavering commitment to being your Lifetime Partner.

This commitment is backed by the strength of our joint venture between Generali, a global insurance leader with over 190 years of expertise, and Central Bank of India, a trusted name with a rich legacy in Indian banking.

Generali Central Dhan Vridhi Plan ( UIN : 133L050V04)

- Unit Linked Insurance plans are different from traditional insurance plans and are subject to risk factors.

- The Premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of the fund and factors influencing the capital market. The policyholder/insured is solely responsible for his/her decisions.

- Generali Central Life Insurance Company Limited is only the name of the Insurance Company and Generali Central Dhan Vridhi only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its prospects or returns.

- Please know the associated risks and the applicable charges from your insurance agent or the intermediary or policy document of the Company.

- The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their prospects and returns.

- Past performance is not indicative of future performance, which may be different. The investments in the Units are subject to market and other risks and there can be no assurance that the objectives of any of the funds will be achieved. The funds do not offer guaranteed or assured return.

- Tax benefits are subject to change in law from time to time. You are advised to consult your tax consultant.

- The linked insurance plans do not offer any liquidity during the first five years of the contract.

- The policyholder will not be able to surrender/withdraw the monies invested in linked insurance plans completely or partially till the end of the fifth year.

- Life Coverage is included in this Product. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

What Our Happy Customers Are Saying

Real stories, real people— hear from those who’ve taken the step of strengthening their financial security with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

ULIPs offer life insurance protection plus investment, tax benefits under 80C and 10(10D), and flexibility to switch between funds based on market conditions.

Premium allocation charges (reducing over years), policy admin charges (max ₹500/month), mortality charges, fund management charges (0.50-1.35% annually), and discontinuance charges if applicable.

After deducting charges, remaining premium buys units at current NAV. You receive units in chosen funds proportionate to your allocation.

NAV calculated daily = (Market value of investments + current assets - liabilities) ÷ number of units existing.

9 different fund options allow you to create diversified portfolios. Switch between debt and equity based on market cycles.