Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Goods & Services Tax (GST)

The Goods and Services Tax (GST) is implemented from July 1, 2017 as a step towards a unified taxation system. This structure has replaced a number of Indirect Taxes including Service Tax.

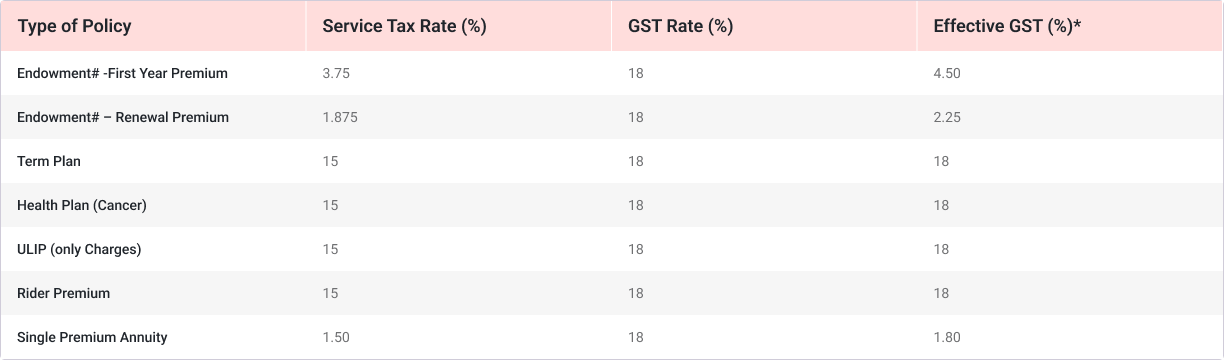

Details of GST rates on Different types of life insurance products are as below:

*As per Rule-32 (4) of CGST Rules, 2017, the taxable value of supply of services in relation to life insurance business shall be 25% for first year, 12.5% for subsequent years & 10% in case of single premium policy on the premium charged. GST @18% is levied on such reduced taxable value.

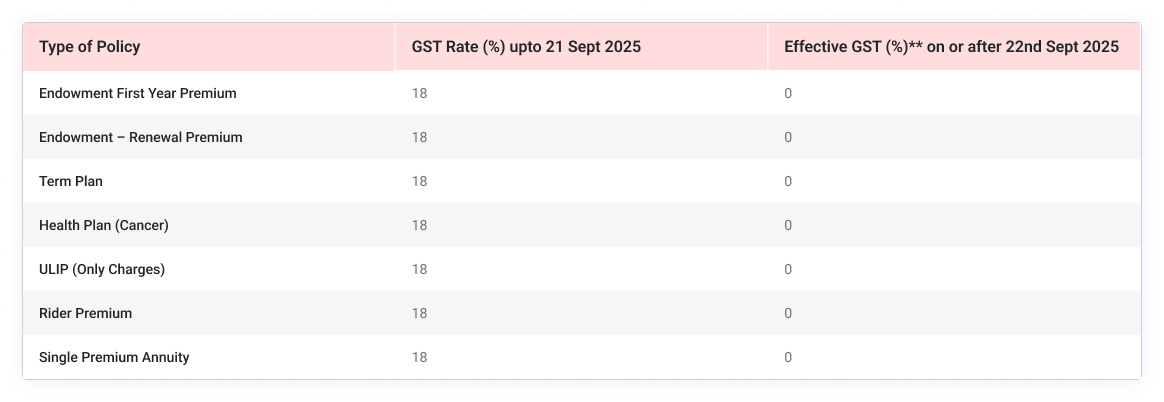

**Effective from 22nd September 2025 the GST rates on life insurance policies provided to individuals is Nil.

Accordingly, following are the GST rates for various life insurance products available to individuals:

Further, group business such as group term, group credit life continues to be taxable under GST @ 18%.

Under GST rules, taxes will be levied as per a customer’s registered address in our records. Therefore, your current communication address will be used for computing GST.

Got Questions? We’ve Got Answers

Here are answers to some of the questions you might have.

FAQs for GST

Goods and Services Tax (GST), is a new Indirect Tax based on the concept of “One Nation One Tax”. It replaces the indirect taxes such as Service Tax, Vat, Excise Duty etc. The law is applicable effective 1st July 2017.

GST will be levied on both, Goods and Services wherever applicable.

Yes GST is applicable on Insurance Premium upto 21st September 2025. However, effective from 22nd September 2025 the GST rates on life insurance policies provided to individuals is Nil.

GST, will be billed along with the Premium wherever applicable.

Yes, the Premium Receipt will separately show the GST component wherever applicable.

Registration Queries

GST registration is known as GSTTIN. It is a 15 digit unique ID provided to a person registered under GST law.

Yes.

Yes. A person having multiple business verticals in a State has an option to obtain a separate registration for each business vertical.

Registration under GST would confer the following advantages to business:

- Legally recognized as supplier of goods or services;

- Proper accounting of taxes paid;

- Authorized to collect tax and pass on the credit of tax paid to the recipients;

- Eligible for claiming input tax credit.

A person who is engaged exclusively in the business of supplying goods or services which are not liable to tax or wholly exempt from tax are not liable to register under GST.

Transactional Queries

In each state, one branch has been identified as Principal Place of Business and other branches are identified as Additional Place of Business. Generali Central would have one GSTIN per state which will be applicable for all branches in that state.

For B2B customers, obtain GSTIN, state name, and state code.

For B2C customers, obtain communication address along with the PIN code/State code.

Yes, however it will not have any impact on the premium already paid. Any future premium will be liable to GST on the basis of the revised location.

Any advance premium received for an insurance policy will be liable to GST.

Scenario 1: Where invoice has been issued and payment is also received after change in rate of tax, time of supply shall be date of receipt of payment or date of issue of invoice, whichever earlier.

Scenario 2: Where invoice has been issued prior to change in rate of tax but payment is received after the change in rate of tax, time of supply shall be date of issue of invoice.

Scenario 3: Where payment is received before change in rate of tax, but invoice for the same has been issued after change in rate of tax, time of supply shall be date of receipt of payment.

Invoicing Queries

A tax invoice is a document to be issued by a registered person for supply of taxable goods or services. It has to be issued showing the description and other information prescribed under GST law.

The liability to discharge tax under reverse charge basis always remains with the recipient.

- If the supplier is a registered person, he must issue a zero-rated GST invoice to the recipient.

- If the supplier is unregistered, the recipient must raise an invoice on itself.

Yes. For transactions with a value less than INR 200, no tax invoice or bill of supply is required to be issued.