Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Why Choose Generali Central Care Plus Plan?

An Individual, Non-Linked, Non-Participating (without profits), Pure Risk Premium, Life Insurance Plan.

Life moves fast, and your family’s future deserves to be protected.

You have many dreams for your loved ones—a secure home, quality education for your children, a comfortable life for your spouse. Generali Central Care Plus helps you prepare for life’s unexpected events, so your family doesn’t have to shoulder the burden of uncertainty.

It safeguards your family’s lifestyle, giving them the financial confidence to face the future, even if you’re not there to guide them.

Choice of Cover

Pick life cover or add accidental benefit

Flexible Policy Terms

Choose how long you pay and stay covered

Tax Benefits

Save more with eligible tax benefits

Claim Service Guarantee

Quick claims for eligible policies up to ₹1 Cr

Lower Premiums for Women

Enjoy discounted rates for women policyholders

Custom Payout Options

Lump sum, monthly or both. Select what suits you best

A Roadmap to a Secure Future

Talk to an Advisor

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.

Tailored Plan Options to Secure Your Future

Choose the policy option that fits your life goals.

Option 1

Ensure your family’s future stays secure with a life cover of ₹1 crore that helps maintain their lifestyle and provides reliable support when it’s needed the most.

Option 2

Strengthen your protection with Extra Life Cover that offers a ₹1 crore life cover along with an additional benefit of ₹1 crore in case of accidental death, so your loved ones are doubly safeguarded.

Offered Across All Plans

Offered Across All Plans

18 years to 65 years

10 to 30 years

Regular Pay

Minimum - ₹5 Lacs

Maximum - Base Sum Assured or ₹2 Crores,

whichever is lower (Subject to Board Approved

Underwriting policy)

Yearly, Half Yearly, Quarterly and Monthly

Minimum:

Age: 0 years - 50 years

₹1,325

Maximum: As per Maximum Sum Assured

1. Premiums mentioned above are excluding applicable taxes,rider premiums and extra underwriting premium, if any.

2. Age, wherever mentioned is age as on last birthday.

Benefits of Generali Central Care Plus Plan

Here’s how this plan helps you secure your goals and safeguard your loved ones:

A payment made to your nominee in case of your unfortunate demise during the policy term, ensuring your family’s financial protection.

Option 1: Life Cover

- This is a pure term plan.

- In this option, the death benefit shall be paid on Death of the Life Assured.

- The policy shall terminate on the death of the Life Assured.

Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit)

- This option provides life cover as specified in Option 1 and also provides an additional Accidental Death Benefit equal to Accidental Death Sum Assured which shall be payable in case the death happens due to an accident i.e. an amount equal to the Death Benefit plus Accidental Death Sum Assured shall be payable upon accidental death.

- The policy shall terminate on the death of the Life Assured.

The death benefit under all Options and all Categories shall be higher of:

- 10 times Annualized Premium (excluding the applicable taxes, rider premiums and underwriting extra premiums, if any), or

- 105% of total premiums paid (excluding any extra premium, any rider premium and applicable taxes) as on the date of death, or

- Sum Assured

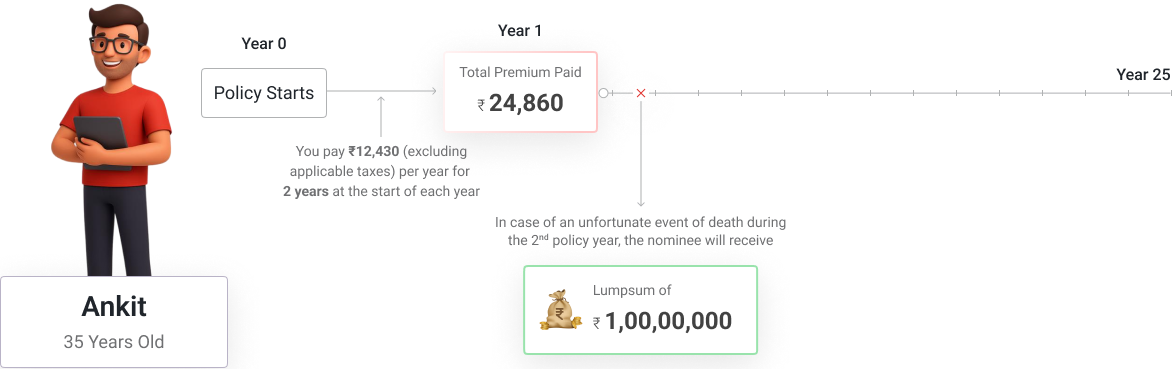

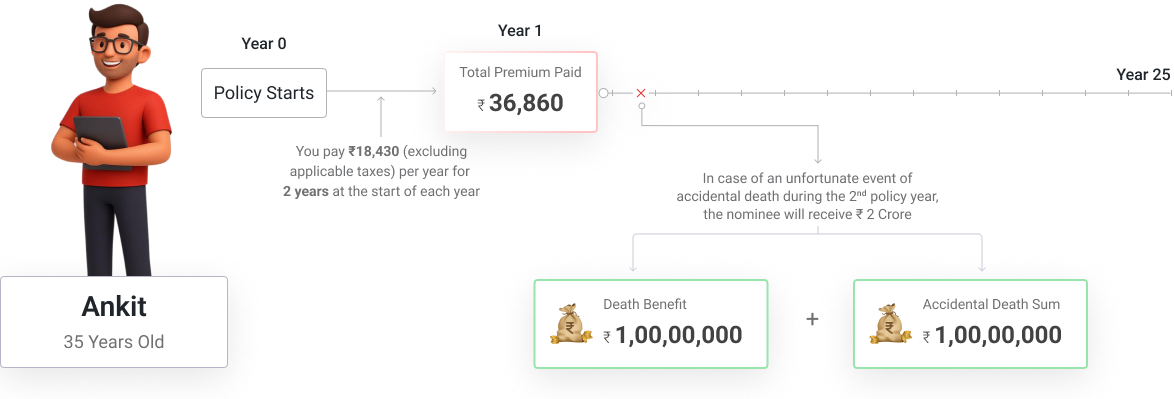

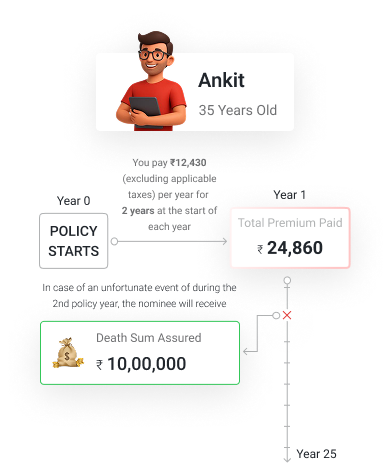

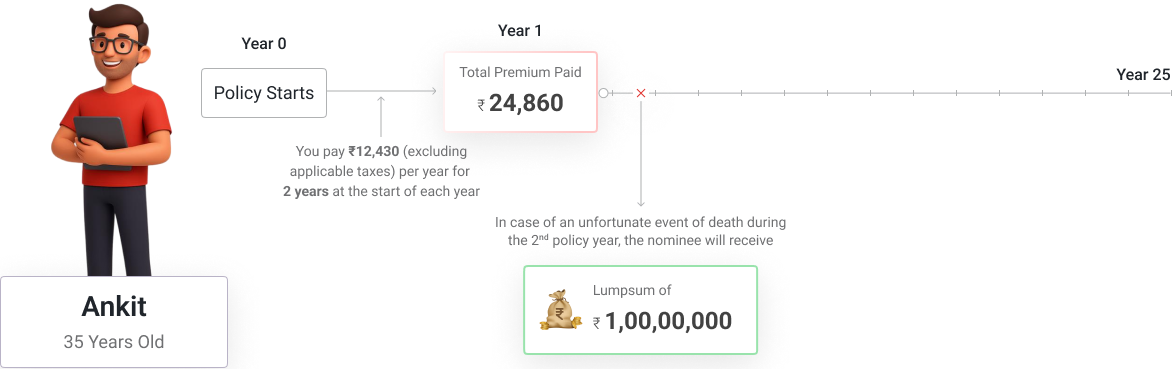

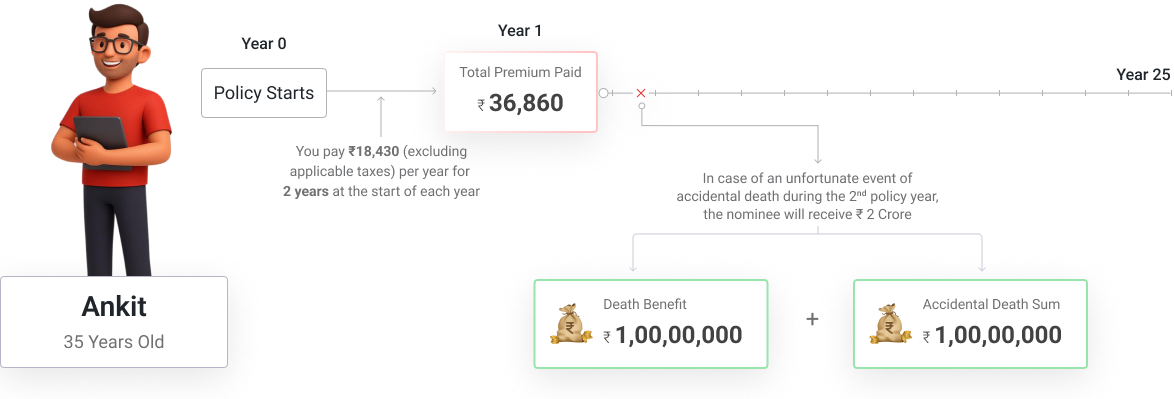

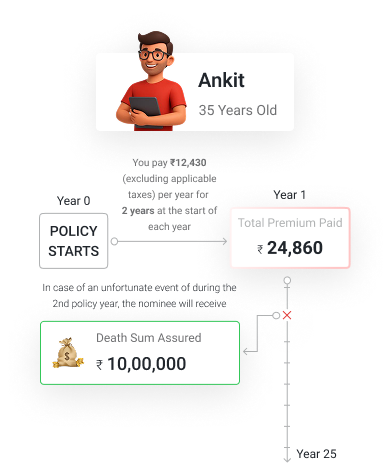

Ankit’s Example

To clearly understand how the death benefit works, let us refer to Ankit’s story.

Scenario 1: He chooses Option 1: Life Cover with Base Sum Assured of ₹ 1 Crore

Ankit, a 35 years old healthy non-smoker male, buys the Generali Central Care Plus for 25 years and chooses to pay annual premium for 25 years.

Scenario 2: He chooses Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit) with Base Sum Assured of ₹ 1 Crore and Accidental Death Sum Assured of ₹ 1 Crore.

In the above example, in case of death other than due to accident under Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit) only Death Benefit of Rs 1 Crore shall be payable and no Accidental Death Sum Assured shall be payable.

Definitions:

Definitions of Terms used:

- Accident – An accident means a sudden, unforeseen and involuntary event caused by external, visible and violent means.

- Injury – Injury means accidental physical bodily harm excluding illness or disease solely and directly caused by external, violent, visible and evident means which is verified and certified by a Medical Practitioner.

- Medical Practitioner – Medical Practitioner means a person who holds a valid registration from the Medical Council of any State or Medical Council of India or Council for Indian Medicine or for Homeopathy set up by the Government of India or a State Government and is thereby entitled to practice medicine within its jurisdiction; and is acting within the scope and jurisdiction of his license, but excluding:

- Insured/Policyholder himself or an agent of the Insured

- Insurance Agent, business partner(s) or employer/employee of the Insured or

- A member of the Insured's immediate family.

The Accidental Death Benefit is payable only under Option 2, where Accidental Death Benefit is equal to Accidental Death Sum Assured.

If the life assured sustains any bodily injury resulting solely and directly from an accident caused by outward, violent and visible means and such injury shall within a period of 180 days of the occurrence of the accident; solely, directly and independently of all other causes, result in the death of the life assured, then the accidental death benefit shall be payable.

In case the “event” which has caused death due to accident has occurred during the policy term and accidental death occurs after the policy term but within 180 days from the date of accident, the accidental death benefit shall be payable.

A lump sum amount payable at the end of the policy term, provided all due premiums have been paid.

There are no maturity benefits under this plan.

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability, and a proven approach to supporting your family and financial goals.

6019

6019Our and Partners Branches

897,635

897,635Lives Protected

Since Inception ₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

FY 24-25 99.78%

99.78%Group Claim Settlement Ratio

FY 24-25Data as on 31st March, 2025

Downloads

Everything you need to understand your policy, plan your future, and make informed decisions at your convenience.

Important Information & Resources

Understand your policy better with key details and insights into the Generali Central Care Plus Plan.

A claim service guarantee of communicating Claim Decision within 2 working days (from the submission of last necessary document) to the nominee/beneficiary shall be applicable under this product for all eligible policies subject to following definitions and eligibilities:

- The policy should be in in-force status at the time of insured event.

- The policy should have remained in-force for a period of three (3) years prior to the date of insured event and thus not lapsed at any time during the last 3 years prior to the date of Insured event.

- The claim does not warrant any investigation/field verification.

- Claim amount eligible under claim service guarantee is up to Rs. 1 crore of Death Benefit for each life assured.

- Necessary documents as required by the company needs to be submitted to the company.

- Working day is defined as Monday to Friday of every week excluding any holiday as per norms of the company.

- Working day shall be counted from receipt of last necessary document.

- All documents submitted till 3 PM on working day will be counted as ‘0’ day and further 2 working days required to provide Claims Service Guarantee.

- For documents received post 3 PM, ‘0’ day would be counted from next working day and further 2 working days required to provide claim service guarantee.

- In case the claim decision is not communicated within 2 working days from the receipt of last necessary document from the claimant, an interest @ bank rate plus 2 % p.a. shall be payable on the claim amount from the date of receipt of last necessary document, provided the claim is accepted thereafter.

Flexibility to Receive Benefits:

In each of the policy options, the policyholder can choose to receive the Death Benefit as per the following payout options. The default payout option is Lump-sum payout. The policyholder can change to any of following the payout options during the policy term but before the occurrence of insured event.

Lump-sum Payout: Death Benefit amount is paid to the nominee in Lump-sum.

Fixed Income Payout: Fixed monthly payouts of 1.8955% or 1.0738% of the Death Benefit is paid to the nominee for a period of 60 or 120 months respectively as chosen by the policyholder with the first payout being made at the time of claim settlement and the remaining installments payable on each of the following monthly death anniversary of the Life Assured. Upon death of the Life Assured, the nominee has the option of taking these monthly payouts as lump sum at any point in time during the payout period. In such case, we shall pay the present value of all outstanding monthly payouts as lumpsum discounted at the rate of 5.5% per annum compounded yearly.

Mixed Payout: The policyholder can opt for any combination of the Lump-sum Payout and Fixed Income Payout for Death Benefit. The percentage of Lump-sum and Fixed Income chosen can be changed during the policy term but before the occurrence of insured event.

Free Look Period

If you disagree with the terms and conditions of the policy, you can return the policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise). To cancel the policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk premium for the period of cover, stamp duty charges and expenses incurred by us on the medical examination of the Life Assured (if any)

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e-mail confirming the credit of the Insurance Policy by the IR.

For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Grace period:

You get a grace period of 30 days for Yearly, Half-yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the due date, to pay your missed premium. During these days, you will continue to be covered and be entitled to receive all the benefits subject to the deduction of due premiums. If any Instalment Premium remains unpaid at the end of the Grace Period, the policy shall Lapse.

Flexibility to make changes:

Premium payment mode can be changed among Annual/ Half-yearly/ Quarterly/Monthly modes.

The alteration of premium mode will be applicable from policy anniversary and will be allowed subject to minimum installment premium conditions.

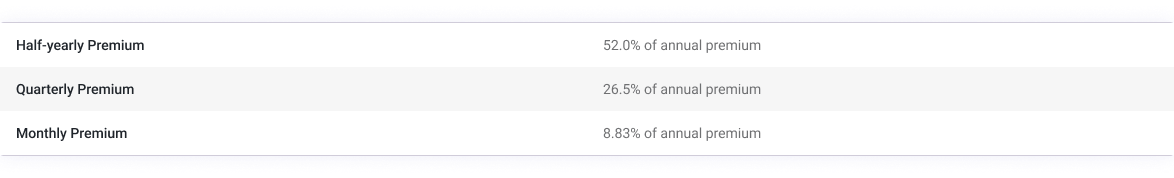

The Modal premiums for various modes as up to percentage of annual premium are given below:

The Company will offer waiver of modal premium loadings for Annualized Premium of Rs. 1 crore and above.

Premium Rate Guarantee

Premium rates are guaranteed for the entire policy term.

Exclusion under Death Benefit:

Suicide exclusion:

In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the Policy or from the date of Revival of the Policy, as applicable, the Nominee or beneficiary of the Policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the policy cancellation value available as on the date of death whichever is higher, provided the Policy is in-force.

Exclusion under Accidental Death Benefit:

You will not be entitled to any accidental death benefit directly or indirectly due to or caused, occasioned, accelerated, or aggravated by any of the following:

- Suicide or self-inflicted injury, whether the life assured is medically sane or insane;

- War, terrorism, invasion, act of foreign enemy, hostilities, civil war, martial law, rebellion, revolution, insurrection, military or usurper power, riot or civil commotion. War means any war whether declared or not.

- Taking part in any naval, military or air force operation during peace time.

- Any condition that is pre-existing at the time of inception of the policy. Pre-existing Disease means any condition, ailment, injury or disease:

- That is/are diagnosed by a physician within 36 months prior to the effective date of the policy issued by the insurer or its reinstatement; or

- For which medical advice or treatment was recommended by, or received from, a physician within 36 months prior to the effective date of the policy issued by the insurer or its reinstatement.

This exclusion will not be applicable to conditions, ailments or injuries or related condition(s) which are underwritten and accepted by Us at inception or at reinstatement.

- Committing an assault, a criminal offence, an illegal activity or any breach of law with criminal intent.

- Alcohol or Solvent abuse or taking of Drugs, narcotics or psychotropic substances unless taken in accordance with the lawful directions and prescription of a registered medical practitioner.

- Poison, gas or fumes (voluntary or involuntarily, accidentally or otherwise taken, administered, absorbed or inhaled).

- Service in the armed forces, or any police organization, of any country at war or service in any force of an international body.

- Participation in aviation other than as a fare-paying passenger in an aircraft that is authorized by the relevant regulations to carry such passengers between established aerodromes.

- Taking part in professional sport(s) or any adventurous pursuits or hobbies. "Adventurous Pursuits or Hobbies" includes any kind of racing (other than on foot or swimming), potholing, rock climbing (except on man-made walls), hunting, mountaineering or climbing requiring the use of ropes or guides, any underwater activities involving the use of underwater breathing apparatus including deep sea diving, sky diving, cliff diving, bungee jumping, paragliding, hand gliding, parachuting and selfie mishaps.

- Nuclear contamination; the radioactive, explosive or hazardous nature of nuclear fuel materials or property contaminated by nuclear fuel materials or accident arising from such nature. Exclusion under Death Benefit:

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- Emailing at care@generalicentral.com

- You may also visit us at the nearest Branch Office. Branch locator - https://www.generalicentrallife.com/branch-locator

- Senior citizens may write to us at the following ID: senior.citizens@generalicentral.com for priority assistance

- You may write to us at: Customer Services Department- Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli (W), Mumbai – 400083

Generali Central Life Insurance Company Limited (Formerly known as Future Generali India Life Insurance Company Limited) offers a wide range of life insurance solutions designed to protect and empower individuals at every stage of life. Whether it’s protecting your loved ones, planning for retirement, or securing long-term financial well-being, our offerings are designed to evolve with your needs. Backed by a robust distribution network and advanced digital tools, we are dedicated to delivering simplicity, innovation, empathy, and care in every experience — all anchored by our unwavering commitment to being your Lifetime Partner.

This commitment is backed by the strength of our joint venture between Generali, a global insurance leader with over 190 years of expertise, and Central Bank of India, a trusted name with a rich legacy in Indian banking.

This Product is not available for online sale.

For detailed information on this product including risk factors, terms and conditions etc., please refer to the policy document and consult your advisor or visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Generali Group's and Central Bank of India's liability is restricted to the extent of their shareholding in Generali Central Life Insurance Company Limited.

Life Coverage is included in this Product. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

Generali Central Life Insurance Company Limited (formerly known as Future Generali India Life Insurance Company Limited). (IRDAI Regn. No. 133) CIN:U66010MH2006PLC165288 Regd. and Corporate Office address: Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai 400083.

Email - care@generalicentral.com

Call us at - 1800-102-2355

Website: www.generalicentrallife.com

UIN: 133N030V06

What Our Happy Customers Are Saying

Real stories, real people— hear from those who’ve taken the step of strengthening their financial security with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Generali Central Care Plus is a term life insurance plan designed to provide comprehensive long-term protection at affordable rates. It offers customized coverage to suit individual requirements with flexibility in policy terms and premium payment options.

If you miss a premium payment, you receive a grace period to make the payment without losing coverage. For yearly, half-yearly, and quarterly payment frequencies, you get 30 days from the due date, while monthly payment frequency provides a 15-day grace period. During this grace period, your policy remains active and you continue to receive all benefits, subject to the deduction of due premiums when a claim is made.

Yes, there's a 30-day free look period from receipt of the policy document. You can return the policy within this period for a refund (after deducting proportionate risk premium, stamp duty, and medical examination expenses, if any).

No, this product is not available for online sale. You need to contact an advisor or visit a branch office.