Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

What is the impact of age on life insurance premiums?

4 mins

4 mins 8.2K

8.2KAt what age should one reasonably get a life insurance policy? Your neighbour may already have a life insurance policy, even though he is only 24 years old. You might decide to buy a life insurance policy at the age of 45. As such, it is never too late to buy life insurance, and there is no right or wrong age to do so. Life insurance plans provide protection to your family and dependents from financial hardship, so it is definitely wise to hold one. When you get it depends on what aligns with your financial and investment needs. But it would be useful for you to know how your age affects life insurance, more specifically the life insurance premium you will be paying under such plan.

What is life insurancepremium?

A life insurance premium is an amount paid by the policyholder periodically to the life insurance company to maintain the insurance coverage. The premium pays for the cost of insurance in pure protection plans, whereas in plans with an investment component, part of the premium goes into an investment. Such premium payments are required to be made regularly. An inability to make these payments could lead the policy to lapse. Considering that life insurance premium is the price of the insurance policy, it is an important element in the process of buying insurance . There are multiple factors that determine what premium you will pay. These factors include your medical history such that being susceptible to a critical illness translates to higher premiums. Your smoking habits and alcohol consumption are seen in similar light for premium calculation. Other factors include gender, occupation, your hobbies, family medical history.

Finally and most importantly, age. Your age is one of the biggest determinants of the premium under life insurance plans.

How does age affect life insurance

In general, the rule of thumb says that the best time to buy insurance is while you're young, because the premiums will be low, everything else remaining constant. The logic is simple: it is considered that if you are young you are healthier, less susceptible to illnesses that come with the decay of life. Therefore, you have lesser health-related risks, and by extension a lower premium. Insurance companies may require you to undergo medical tests before issuing a policy above a certain age, so youth plays in your favour.

The younger you are, the relatively cheaper plan you get owing to the low risk of mortality. At older ages, you will have more responsibilities, debts, obligations which means you will require greater financial protection to secure your family’s future. It will be advisable to buy a term policy with a large cover. This would, again, translate into a higher insurance premium .

It is always wise to get life insurance early in your professional life - the sooner, the better. The benefits of life insurance are worth considering: besides providing protection, life insurance premium also helps save on tax. As per the current provisions of Section 80C of the Income Tax Act, 1961, policyholders can avail deduction from gross taxable income as per old tax regime of up to Rs.1.5 lakhs on life insurance premiums and tax benefit thereon at the tax rate applicable to policyholder. Also, the proceeds received under the death/maturity benefit are tax-free subject to qualifying conditions as specified under provisions defined under Section 10(10D) of Income Tax Act 1961, as amended from time to time.

If you opt for a good insurance policy like Generali Central Care Plus. A plan like FG New Assure Plus will accord flexibility to choose any combination of the policy term and premium payment term based on your financial goals. It will even give an opportunity to enhance your maturity payout by way of bonuses.

Now, while the premiums might be low if you buy a term plan when you’re young, you should also make an assessment of the coverage you need. You will need coverage only if you have dependents to look after. That said, if you buy a life insurance plan in your 20s you will benefit from shelling out lower premiums than say, someone in his 50s. Always read the fine print, choose wisely and act early!

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

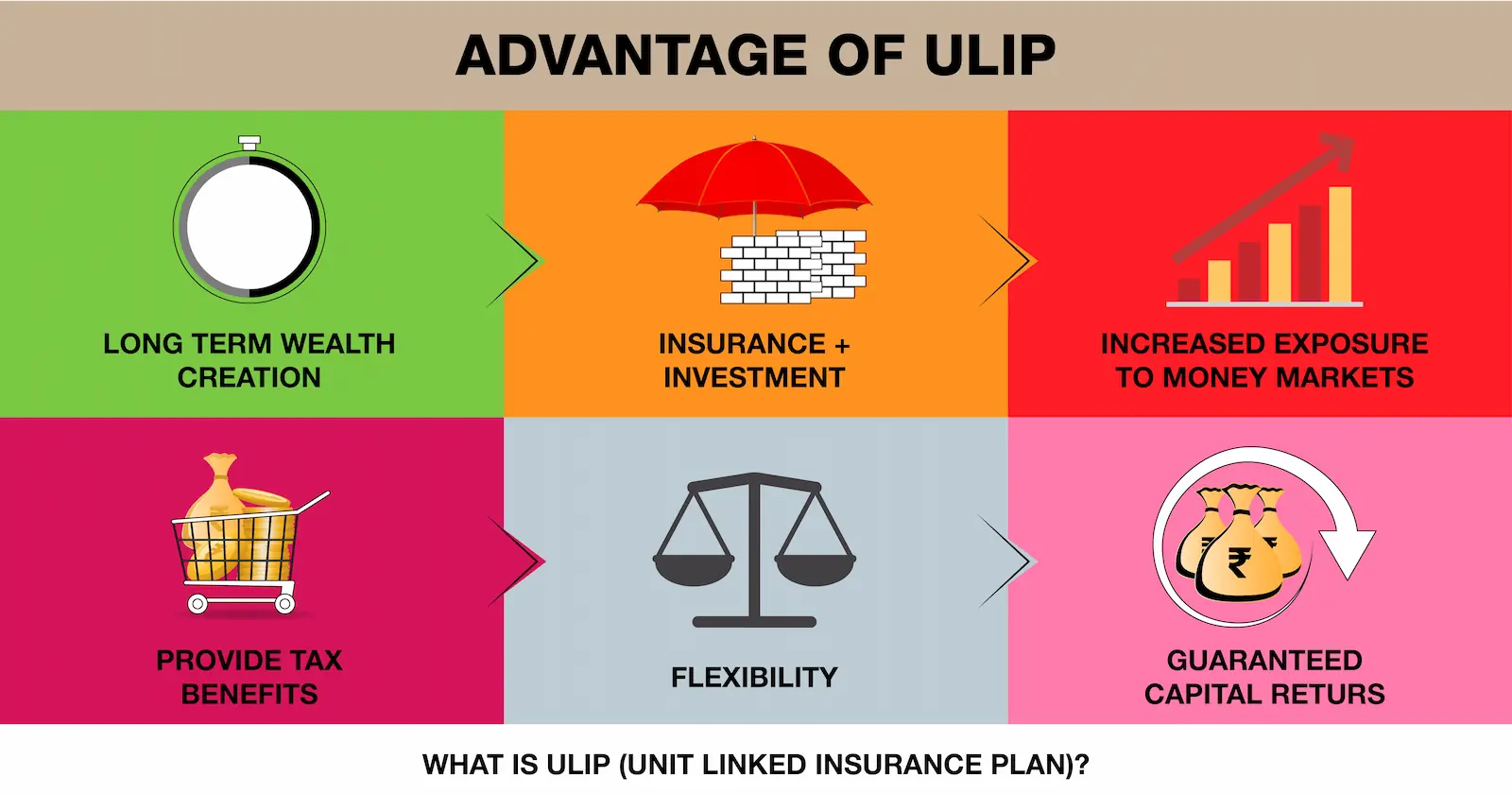

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.