Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

What Are Top-ups in ULIPs and When Should You Use Them?

4 mins

4 mins 2.9K

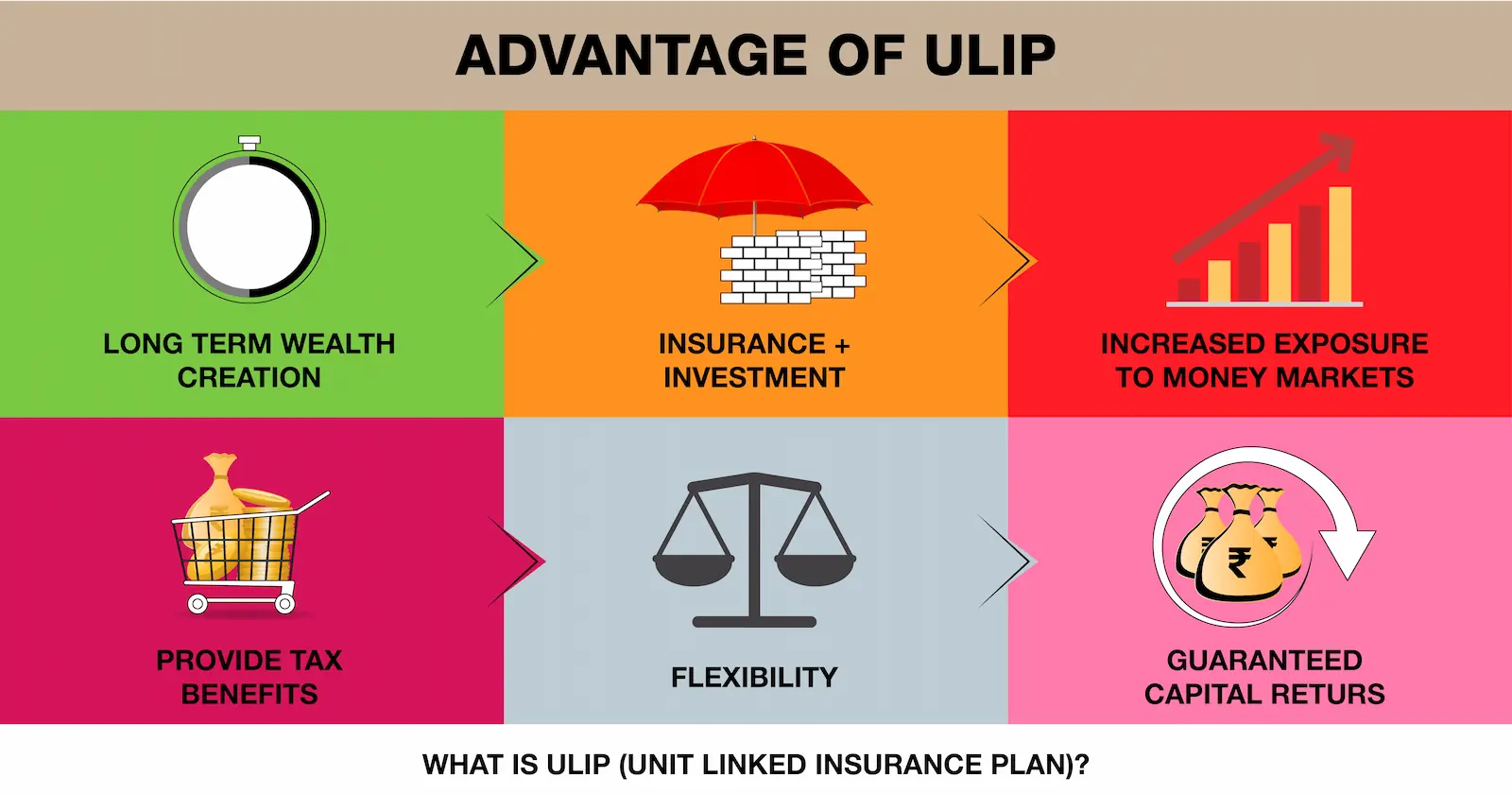

2.9KUnit-linked insurance plans (ULIP) are essentially an insurance plan which offers you both protection of life insurance, the flexibility of investment as well as market-linked returns. This means that while customers can enjoy the security and benefits of a traditional insurance plan, they can also invest in a range of investments such as bonds, mutual funds, stocks, amongst several others. In any ULIP, investors have the option of choosing from four basic funds. These include equity funds (highest risk factor), income/fixed interest/bonds (medium risk), the balanced fund (medium risk) and cash funds (low risk). With Generali Central’s Big Dreams ULIP , you can reach your financial goals quicker by maximizing your wealth with 1% to 7% extra allocation* on your premium while enjoying the benefit of a life cover too. With the Big Dreams ULIP, you get the protection of a life insurance plan, while also having the ability to take advantage of the financial market. ULIPs also offer a top-up function, which can be used by customers. Here’s all you need to know about top-ups in ULIPs and when you should use them.

What are top-ups in ULIPs?

A ULIP like any life insurance policy is a long-term contract in which you are agreeing to pay a fixed premium every year for a specific time horizon or in one go (depending on regular premium or single premium policy ). For the entire duration of the policy you are usually required to pay the same amount of premium every year. However, let’s say after a few years of obtaining the policy, your income increases whether due to an increase in salary or savings, and you wish to pump this into your ULIP. Here is when the top up feature of a ULIP comes into play.

A top-up premium is an amount that is paid at irregular intervals in addition to your basic premium specified in your ULIP policy contract. These top-up premiums are one time payments and need to be treated by your insurer as a single premium contract which should buy you additional insurance cover. Hence, the rule for single-premium policies applies for top-up premium payments. This means that the minimum sum assured will be 125% for individuals up to 45 years old and 110% for those above the age of 45. It is important to note that top-up premiums are not available in traditional insurance policies. These are only available in the case of ULIPs, which offer market-linked returns.

What are the charges associated with top-ups in ULIPs?

The first charge you will be paying is the one-time premium allocation charge, which will be deducted straight from the premium you pay. In addition to this, you will also be paying a recurring mortality charge, which is the charge for providing you life insurance cover and will be charged in accordance to the age of the policyholder and not as per the age at which you bought the policy. This means that if you were 40 when you bought the policy, but you decide to top it up at the age of 45, the mortality charge that will be applicable to you when topping up your policy will be for the 45-year-old individual. The minimum sum assured is also calculated in a similar manner, as per your age attained and not as per your age when purchasing the policy. You will also be required to pay fund-management charges as outlined by your policy. Another important factor to note is that in most regular ULIPs in no point during your policy term can the total top-up premium paid by you exceed the sum total of the regular premiums paid till that point of time.

When should I use a ULIP top-up?

Deciding whether or not to top-up your ULIP plan can be tricky. Top-ups are simple and transparent and you pay a lower premium allocation charge and zero policy administration charge. However, if your goal of topping up your ULIP is to simply up your insurance coverage, you are much better off investing into a pure insurance plan. Similarly, if you are topping up your plan only to increase investment, then you are better off without paying the increased mortality charge. Hence, you should keep your motive in mind and explore other investment options before opting to top-up your ULIP.

Disclaimer

*The amount of extra allocation depends upon the annualized premium and the policy year. The extra allocation applicable to the respective installment premium shall be added only when due premiums are paid within the grace period and the policy is inforce. T&C apply.

References:

1.https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_Layout.aspx?page=PageNo758

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.