Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

7 reasons why you have to pay higher premium for life insurance than others

5 mins

5 mins 7.6K

7.6KIf you’re just starting to look for life insurance plans, you may be curious about how much money will you have to pay for the insurance coverage. There are multiple factors that determine the premium applicable to you and it can be quite confusing at times to comprehend why you have to pay a rate that is higher than others for a life insurance plan

Let’s look at the factors that can be cause of higher life insurance premium for your:

1. Higher Age

Life insurance premiums are dependent on age - the older you are, more you pay. If you buy a policy at a younger age, you will pay lower premiums for the policy duration as compared to some one older. How? Because with increasing age, there is higher chance that your health might decline, and the insured event may happen significantly prior.

2. Gender

Women tend to pay less for life insurance plans. Though this isn’t because they are favored more, but that they generally tend to live a longer life than men. Numerous studies have demonstrated that women outlive men by five to seven years.

3. Your Lifestyle Habit Includes Smoking

Because of the proven link between smoking and diseases like lung and throat cancer, smokers statistically live shorter lives and therefore pay higher life insurance premiums . So, if you like to light up, you at a higher risk for all sorts of health ailments, and thereby a red flag for insurance companies.

4. Choice of Higher Sum Assured or Longer Policy Term

The larger the sum assured and longer the policy term, the more you must pay for it. In simple words, this is because the risk of your demise is higher for a policy that covers you for 30 years than a policy that covers for 10 years.

Also, the more the sum assured that will be paid out to your nominees, the more you will be charged for coverage.

5. You Are Not Buying Product Online but From A Distribution Agent

With competition growing intense, insurance companies are offering cheaper premium than offline policies to creating their space online. Most online life insurance plans are around 30-40% cheaper premium compared to offline plans. This is because the purchase directly happens between insurer and customer which reduces the paperwork cost and agent’s commission.

So, if you are buying life insurance plans from an agent and not online, be ready to pay higher premiums.

6. Counter Offer Based on Declarations in The Proposal Form

If your favorite pastime is climbing treacherous mountains and racing cars or you take part in dangerous or extreme hobbies, you will probably have to shell out substantially more for premium. This is because, when you engage in activities, there’s more risk on your life – which is a great concern for insurance companies.

Certain occupations are deemed a higher risk than others. For instance, pilots, soldiers, fishermen, gas industry workers, mine workers can expect to pay more than those who work in safer environment, such as teachers, office goers or shop workers.

The insurance company isn't interested in your last family vacation to Switzerland, however in whether you have been anyplace that would pose a potential risk. For instance, if you have travelled to a country with a high level of tropical diseases or HIV instances. Also, if you travel abroad regularly for business, it could increase your premium.

7. Counter Offer from The Company Based on Medical Investigation

If you weigh more than you should, lead a sedentary lifestyle, or your medical reports show negative signs, you come out as a higher risk and are hence charged higher premiums than an active individual with suitable body weight.

Pre-existing medical conditions can also jack up your premium for life insurance plans. It’s a simple insurance basic: people with medical conditions, are more expensive to insure because of the likelihood that they will require more tests, diagnostics, medication, treatment, and other expenses because of their state of health.

You may be in perfect health, but then your family history shows diabetes, cancer, heart disease, hypertension – or dozens of other conditions. To the insurance company, this means you are a greater risk because you may inherit the same medical conditions and hence, the higher premium.

The Bottom Line Is:

Regardless of the fact that you are charged higher premiums, getting life insurance coverage is important and one must not delay it. Your life insurance premium may sound like a payment today, just like your mortgage, your student loans, or Netflix. But, after your unexpected demise, if your family faces financial uncertainty, the premiums you pay would be more than just another monthly bill. In short, your life insurance plans will offer a doorway to financial stability for your loved ones.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

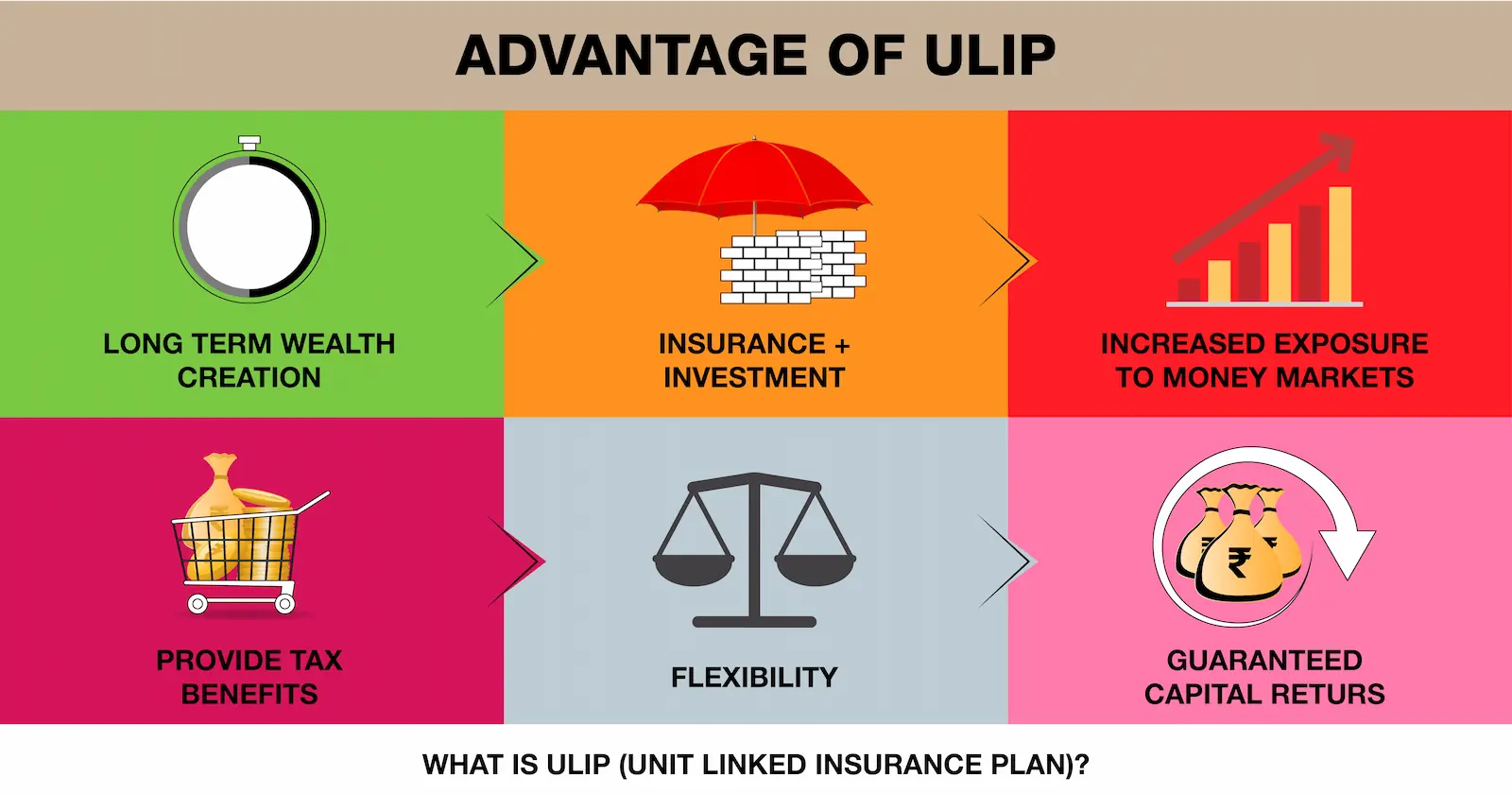

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.