Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

How Health Insurance Premium varies by Gender?

4 mins

4 mins 8K

8KWith an increase in medical inflation and sedentary lifestyle-induced diseases, it has become imperative to get a health insurance policy to protect yourself against the gigantic financial burden that diagnosis and treatment of an illness can incur. There are a number of factors that determine what amount of premium you’d need to pay, depending upon how susceptible you are to falling sick, to accidents or to being diagnosed with a critical illness. Premiums are determined individually for everyone because the insurance company would review your risk profile and medical history against company benchmarks, and assess if a policy would just be a dead weight for them. These factors include many health-related parameters like Body Mass Index (BMI), tobacco and alcohol consumption, age, pre-existing medical conditions, family medical history. The rationale is to find out if you are more susceptible to falling ill or getting diagnosed. For instance, people with a high BMI can suffer from, or develop, diseases including diabetes, sleep apnea, and heart and joint problems. So if you have a high BMI, you might end up paying more premium amounts.

The determinants of the premium amount also include your profession, residence ,and gender. Yes, as it happens, women usually pay higher premiums than men.

Gender Rating

This practice of charging a different, usually higher premium from women is sometimes referred to as ‘gender rating.’ Insurers operate on risk-based pricing which assesses the policyholder for accident, morbidity and mortality risks. Gender is also a factor influencing these risks. This is because gender differences in medical conditions affect the likelihood of a person needing to bill that insurance policy. Thus, premium tends to be higher for females of childbearing age when compared to men. However, it is lower for females than for males from the age of 60 onwards. Thus, simply put, the premium differentials are reflective of the claim cost differences.

Why the variations?

Women usually pay higher medical insurance premiums than men because, for one, women are more likely to go to the doctor and take prescriptions, especially during their reproductive ages between 15 and 44. Women are also more likely to be diagnosed with chronic diseases; about 20% of women of childbearing age experience heavy bleeding during menstruation, and 15% have chronic pelvic pain. Overall, 1 in 28 women is likely to develop breast cancer during her lifetime.

Further, insurance companies often offer women-centric plans with additional benefits for maternity insurance and the like, which can also be a contributing factor to higher insurance costs. Women being more susceptible to chronic ailments and being more likely to visit doctors regularly, run up a higher medical healthcare bill in their lifetime when compared to men. This is why women pay a higher premium amount.

On the other hand, heart diseases become prevalent at an older age. Studies have shown that the proportion of deaths and disability from heart disease was significantly higher in men than in women. This explains why health insurance premiums are higher for men in the older ages than they are for women.

The overall picture

A report by ASSOCHAM India in 2014, found that about 42 per cent of working women were suffering from lifestyle diseases like backache, obesity, depression, diabetes, hypertension and heart ailments. As more and more women enter the workforce, it becomes important that they are also able to access medical facilities in a timely manner, without it becoming a financial burden. Several companies have women-specific critical insurance policies as their offering these plans cover illnesses specific to women like breast cancer, cervical cancer, fallopian tube cancer, etc. which is in addition to the standalone critical illness plan.

Medical emergencies come unannounced, and in our regular lives too, we all need medical care at some point. One ailment has the potential to wobble your financial health. Therefore, it is advisable to get a medical insurance policy. But not before you are acquainted with the nitty- gritties of coverages and exclusions. Generali Central Health Insurance plans offer a wide array of policies that cater to a particular medical need. You can choose a suitable plan to safeguard yourself against the mounting medical expenses, and even calculate what premium you’d be paying online before finally making the decision to buy one.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

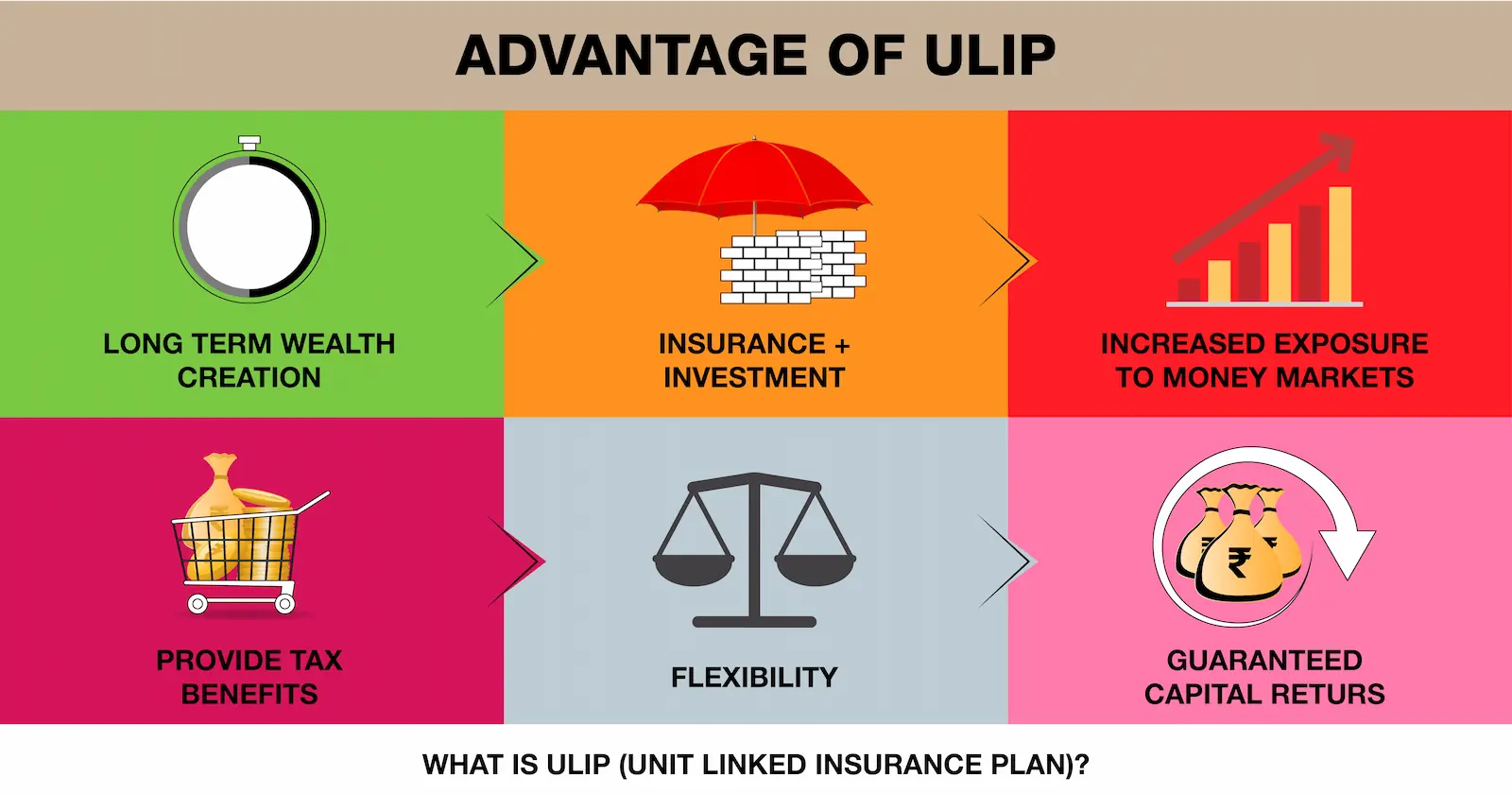

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.