Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Why Choose Generali Central Assured Education Plan?

An Individual, Non-Linked, Non-Participating (without profits), Guaranteed, Life Insurance Plan.

When your child’s dreams reach for the stars, financial barriers shouldn’t hold them back. The Generali Central Assured Education Plan is a guaranteed life insurance solution designed to secure your child’s educational milestones. With guaranteed payouts timed perfectly for college admissions tuition fees, it transforms your parental aspirations into educational achievements.

As you plan to provide superior education to your child, this plan supports your journey with life cover, guaranteed returns, and flexible payout options.

Secure your child’s future today.

Complete Life Protection

Safeguard everyday needs and long-term educational dreams of your child

Guaranteed* Return

Grow your savings confidently, knowing they will return as safe, predictable, and guaranteed financial benefits

3 Payout Options

Choose from three flexible payout options tailored to match your child’s different educational stages and needs

Education Milestones

Receive perfectly timed payouts aligned with key stages like graduation, post-graduation, and higher studies

Flexible Pay Plan

Select a premium payment schedule designed around your budget, lifestyle, and long-term financial goals

Loan Facility

Enjoy peace of mind with easy loan up to 85% of your surrender value

Tax Benefits

Save under Sections 80C and 10(10D), as per prevailing tax laws

Payment Waiver

Waiver of future premiums payable in case of death of life assured

*Guarantee is subject to payment of all due premiums.

A Roadmap to a Secure Future

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance

Eligibility

Choose the plan that fits your life

Age of the Child: 0 - 17 years

Age of the Parent: 21 - 50 years

(Parent will be the Life Assured under the plan)

35 to 71 years (as on last birthday)

Yearly, Half yearly, Quarterly or Monthly modes. Monthly premiums can only be paid by Electronic Clearing System (ECS). The premiums for monthly mode is 8.83% of annual premium

Will be same as policy term

7-21 years

Regular Pay

Minimum:Rs. 280,368

Maximum:As per Board Approved Underwriting Policy

Minimum

₹3,532

Maximum :

No Limit as per the Board Approved Underwriting Policy

End of Policy Term

40% of Sum Assured

10% of Sum Assured

100% of Sum Assured

Policy Term + 1 year

30% of Sum Assured

10% of Sum Assured

Nil

Policy Term + 2 year

20% of Sum Assured

10% of Sum Assured

Nil

Policy Term + 3 year

10% of Sum Assured

70% of Sum Assured

Nil

1. For minors, the date of issuance of Policy and Date of Commencement of risk shall be the same.

2. Premiums mentioned above are excluding applicable taxes, rider premiums and any extra premium paid as a part of underwriting requirements, if any.

3. Age wherever mentioned is age as on last birthday.

Benefits of Generali Central Assured Education Plan

Here’s what we offer with this life insurance plan –

Now, you can be in complete control of your child's higher education by receiving guaranteed payouts. These payouts are designed in such a way that you are sure to use it only for payment of admission or tuition fees. Moreover, you have the flexibility to choose between three options, Option A, B or C, to receive these payouts as per your child's education milestones

Maturity Sum Assured is equal to the Sum Assured. Once chosen, the Policyholder shall not be allowed to alter the option during the Policy Term. The policy will terminate on payment of Maturity Benefit under all Plan Options

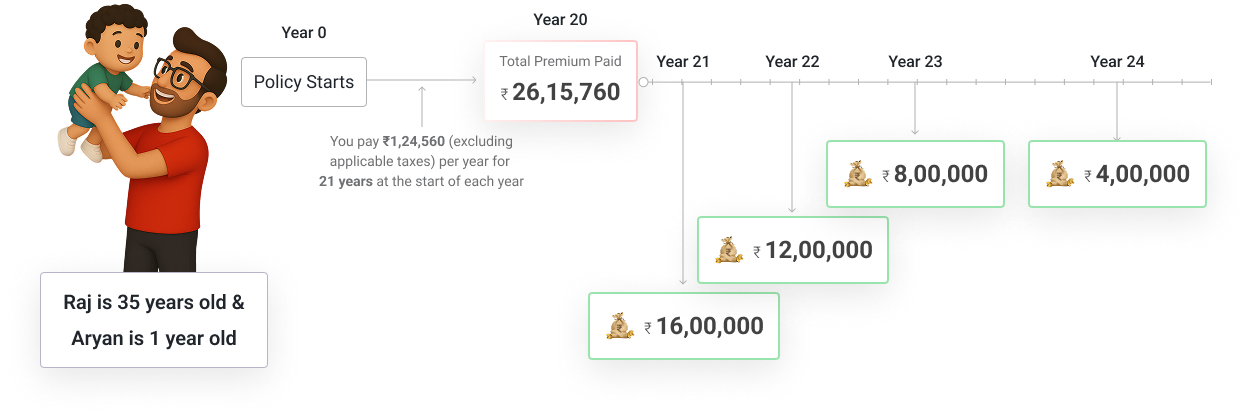

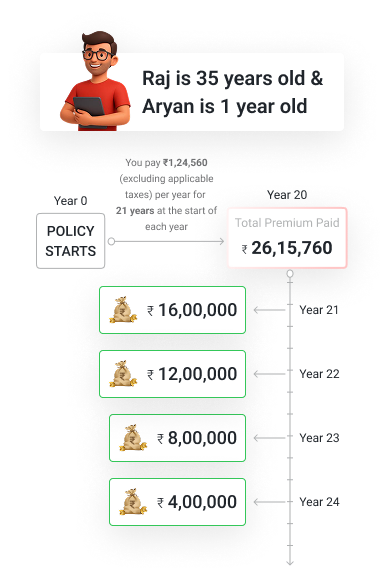

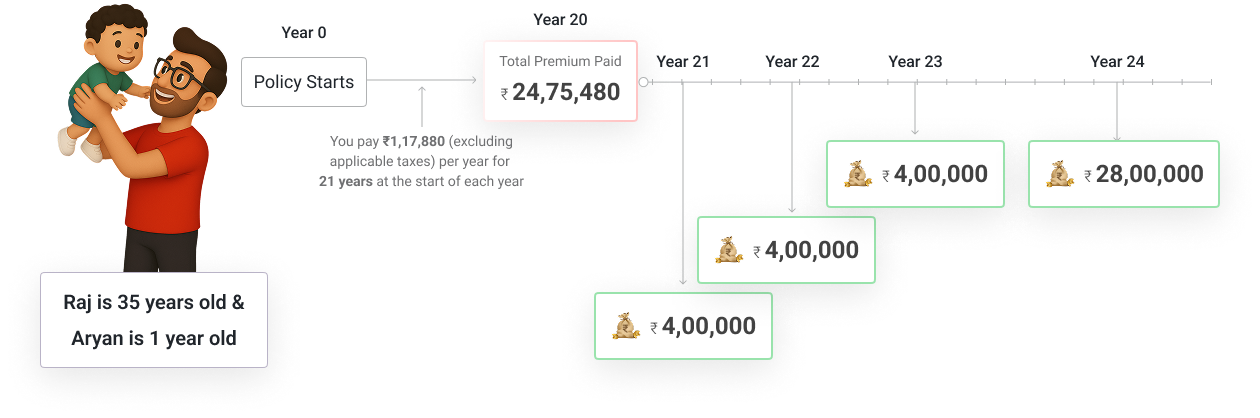

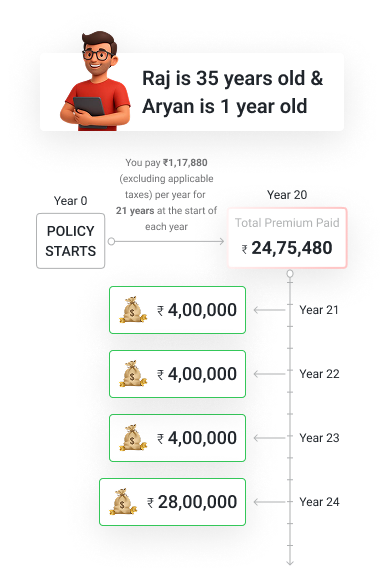

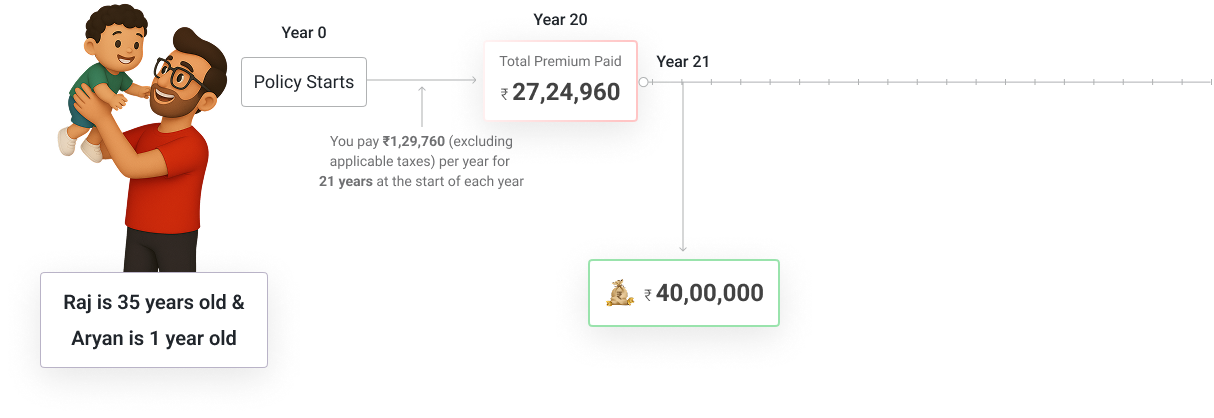

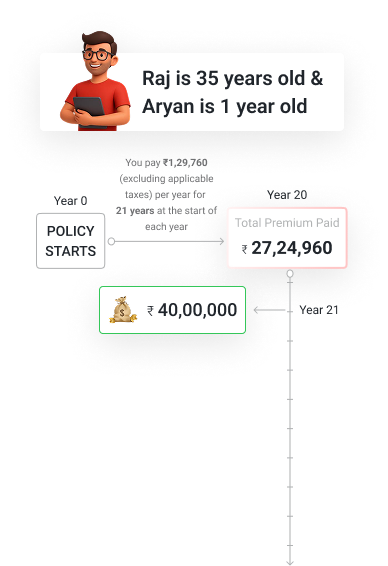

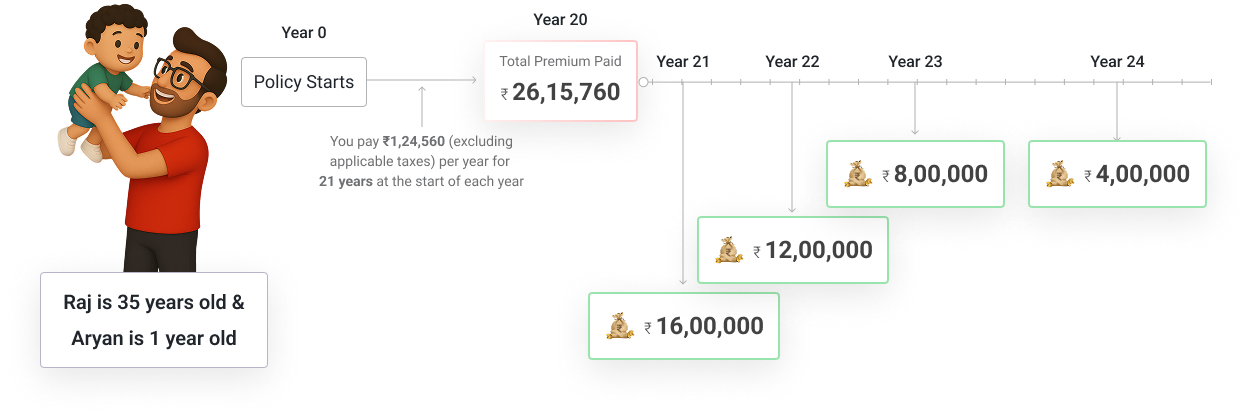

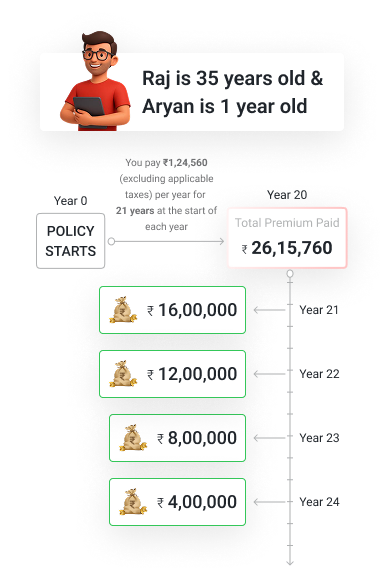

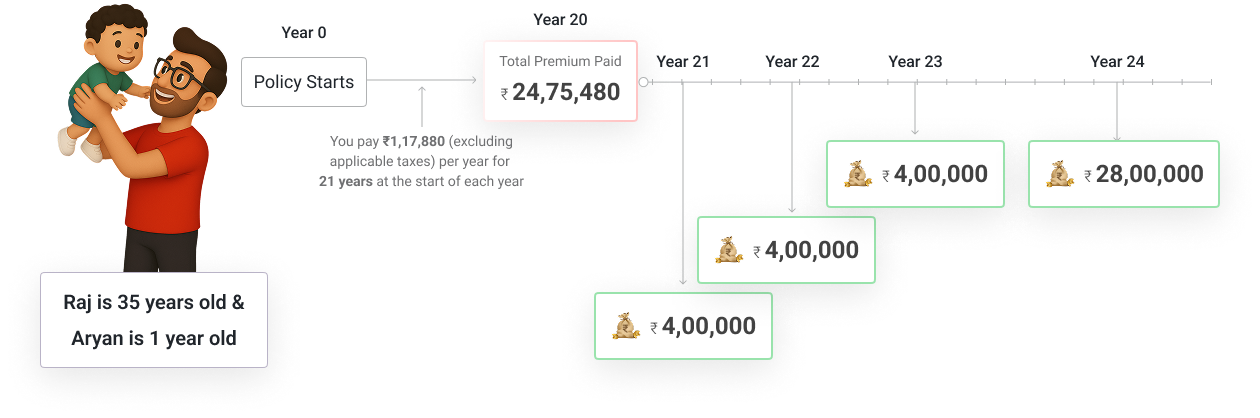

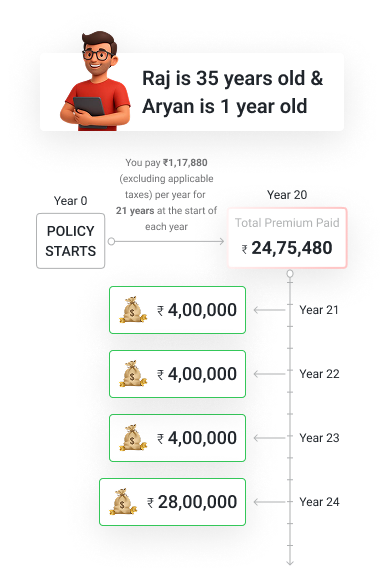

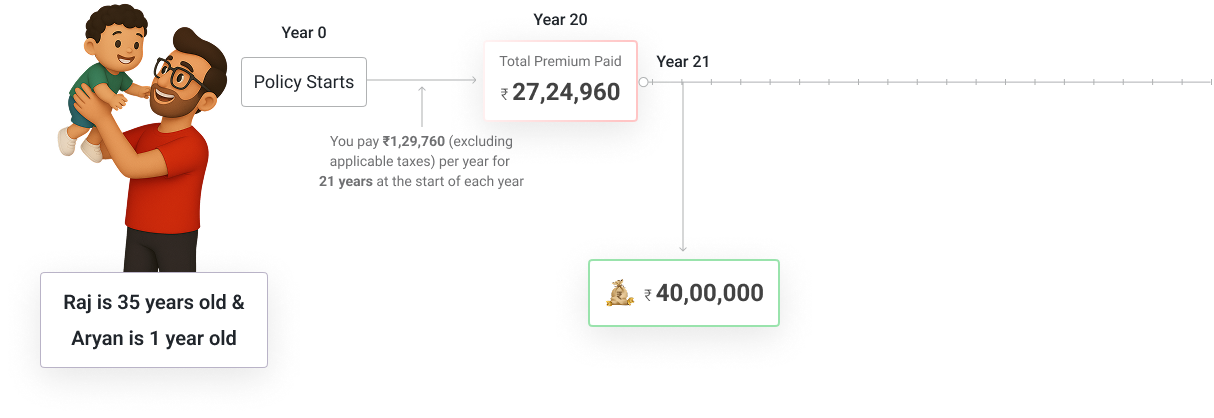

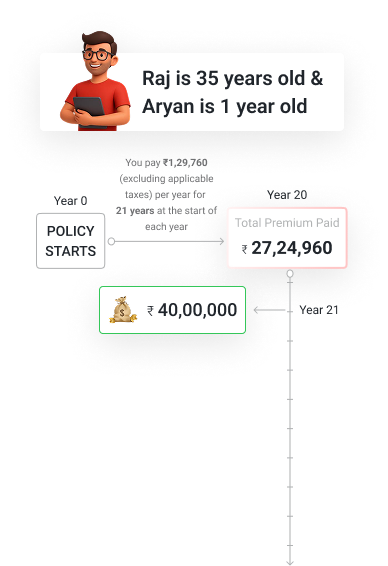

Raj’s Example

To clearly understand how maturity benefit works, let us take a look at Ankit’s story.

Raj is 35 years old and the father of a 1 year old, Aryan. As per his financial plan, he needs to get Rs 40 lakhs to fund Aryan's tuition fees through yearly payouts.

- He can choose to receive the maturity benefits as yearly payouts either as per Option A, B or C.

- The Policy Term and Premium Payment Term is 21 years as Aryan is 1 year old at beginning of the policy

- When Aryan turns 22 years, Raj will receive 100% of the Sum Assured.

- Raj has the option to receive this as under:

Option A: May be used for graduation expenses

Option B: May be used for post graduation expenses

Option C

'With unique product benefits, funds for best colleges and universities, will be within your child's reach!'

A payment made to your nominee in case of your unfortunate demise during the policy term, ensuring your family’s financial protection.

The death sum assured shall be highest of the following:

- 10 times Annualised Premium (excluding taxes, rider premiums, and underwriting extra premiums, if any), or

- 105% of total premiums paid (excluding any extra premium, any rider premium, and taxes, if collected explicitly) as on date of death, or

- Maturity Sum Assured, which is equal to the Sum Assured.

- Absolute amount payable on death, which is equal to the Sum Assured.

On death of the life assured during the policy term, the Death Sum Assured will be payable immediately to the nominee provided the policy is in force

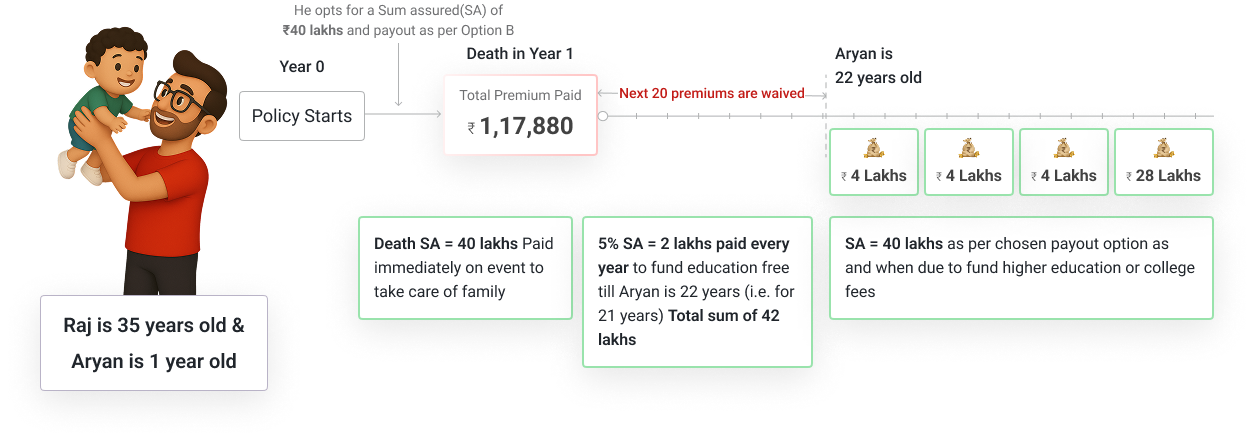

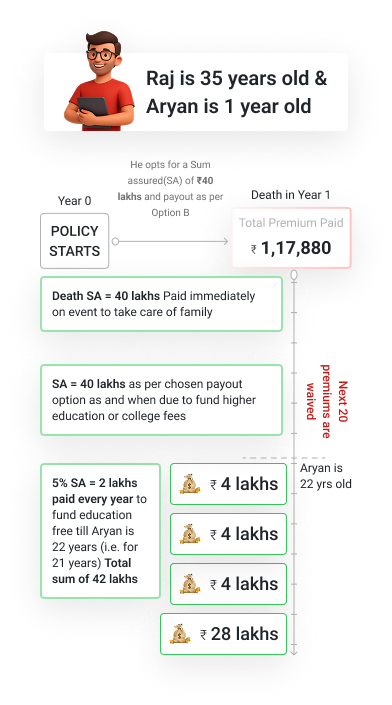

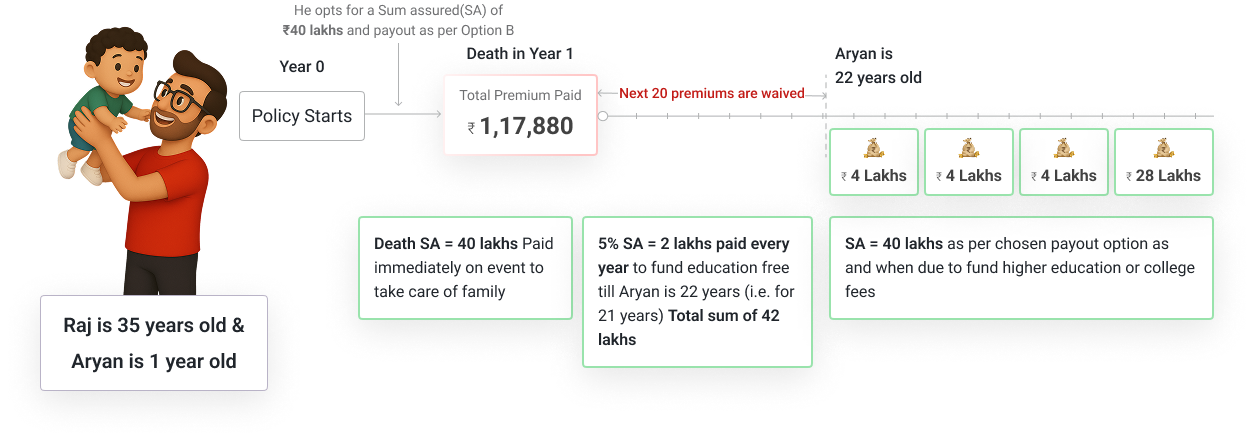

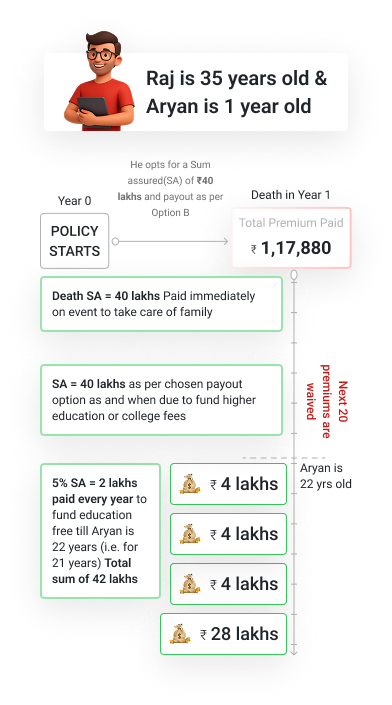

Raj’s Example

To clearly understand how death benefit works in this case, let us look at Raj’s story

Option B

Raj has purchased Generali Central Assured Education Plan and he opted for Option B. He meets with an accident which causes his untimely death within one year after purchasing the policy. The benefits paid out to Raj's family will be as under:

'With unique product benefits, funds for best colleges and universities, will be within your child's reach!'

Uninterrupted protection for your child's education

Our plan ensures your child's education would not suffer in case you are not around. In such an unfortunate event, we will make sure your child gets the following guaranteed benefits to help achieve all the education milestones you have planned for:

We will:

- Waive off all future premiums payable under the policy.

- Immediately pay guaranteed Death Sum Assured to ensure your family's immediate needs are taken care off.

- Pay 5% of the Sum Assured immediately and on every death anniversary of the life assured during the Policy Term. This guaranteed amount can be used to fund your child's regular education fees.

- Pay Maturity Benefit (100% of Sum Assured) as per your chosen option while purchasing the plan

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability, and a proven approach to supporting your family and financial goals.

6019

6019Our and Partners Branches

897,635

897,635Lives Protected

Since Inception ₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

FY 24-25 99.78%

99.78%Group Claim Settlement Ratio

FY 24-25Data as on 31st March, 2025

Downloads

Everything you need to understand your policy, plan your future, and make informed decisions at your convenience.

Important Information & Resources

Understand your policy better with key details and insights into the Generali Central Assured Education Plan

Free Look Period

If you disagree with the terms and conditions of the policy, you can return the policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise). To cancel the policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk premium for the period of cover, stamp duty charges and expenses incurred by us on the medical examination, if any.

If the policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e-mail confirming the credit of the Insurance policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Lapse

If any due premium for first policy year has not been paid within the grace period, the policy shall lapse and shall have no value.

All risk cover ceases while the policy is in lapsed status.

You have the option to revive the plan within 5 years from the date of the first unpaid due premium.

If the plan is not revived by the end of the revival period, the policy will terminate and no benefits are payable.

Suicide exclusion:

In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- Emailing at care@generalicentral.com

- You may also visit us at the nearest Branch Office. Branch locator - https://www.generalicentrallife.com/branch-locator

- Senior citizens may write to us at the following ID: senior.citizens@generalicentral.com for priority assistance

- You may write to us at: Customer Services Department- Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli (W), Mumbai – 400083

We will provide a resolution at the earliest. For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

Generali Central Life Insurance Company Limited (Formerly known as Future Generali India Life Insurance Company Limited) offers a wide range of life insurance solutions designed to protect and empower individuals at every stage of life. Whether it’s protecting your loved ones, planning for retirement, or securing long-term financial well-being, our offerings are designed to evolve with your needs. Backed by a robust distribution network and advanced digital tools, we are dedicated to delivering simplicity, innovation, empathy, and care in every experience — all anchored by our unwavering commitment to being your Lifetime Partner.

This commitment is backed by the strength of our joint venture between Generali, a global insurance leader with over 190 years of expertise, and Central Bank of India, a trusted name with a rich legacy in Indian banking.

This Product is not available for online sale.

For detailed information on this product including risk factors, terms and conditions etc., please refer to the policy document and consult your advisor or visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Generali Group's and Central Bank of India's liability is restricted to the extent of their shareholding in Generali Central Life Insurance Company Limited.

Life Coverage is included in this Product. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Generali Central Life Insurance Company Limited (formerly known as Future Generali India Life Insurance Company Limited). (IRDAI Regn. No. 133) CIN:U66010MH2006PLC165288 Regd. and Corporate Office address: Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai 400083.

Email - care@generalicentral.com

Call us at - 1800-102-2355

Website: www.generalicentrallife.com

Fax: 022-40976600

What Our Happy Customers Are Saying

Real stories, real people— hear from those who’ve taken the step of strengthening their financial security with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

This plan offers guaranteed payouts timed for your child's higher education needs, plus life insurance coverage. If something happens to you, your child continues receiving annual payouts of 5% sum assured until maturity, ensuring uninterrupted education funding.

Option A spreads payments over 4 years, ideal for undergraduate and postgraduate courses. Option B gives a large final payout, perfect for expensive professional courses. Option C provides the full amount at maturity for immediate use or self-managed investment.

The guaranteed payouts are made regardless of your child's actual choices. You can use the funds for any purpose like starting a business, marriage, or other life goals.

Yes, after completing one policy year. You receive the higher of Special Surrender Value or Guaranteed Surrender Value, but lose the planned education funding benefits.

Yes, you can change nominee details by submitting the required forms and documentation to the company.