Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

How term insurance plans are helping improve India's insurance coverage ratio

4 mins

4 mins 4K

4KIndians have very low regard about life insurance and term insurance in general. Perhaps this is the reason why life insurance coverage in India is just 25%. 988 million Indians which accounts for 75% of the population is living dangerously without life insurance in the country. [1] Majority of the population doesn’t even know what is term insurance or about term insurance benefits.

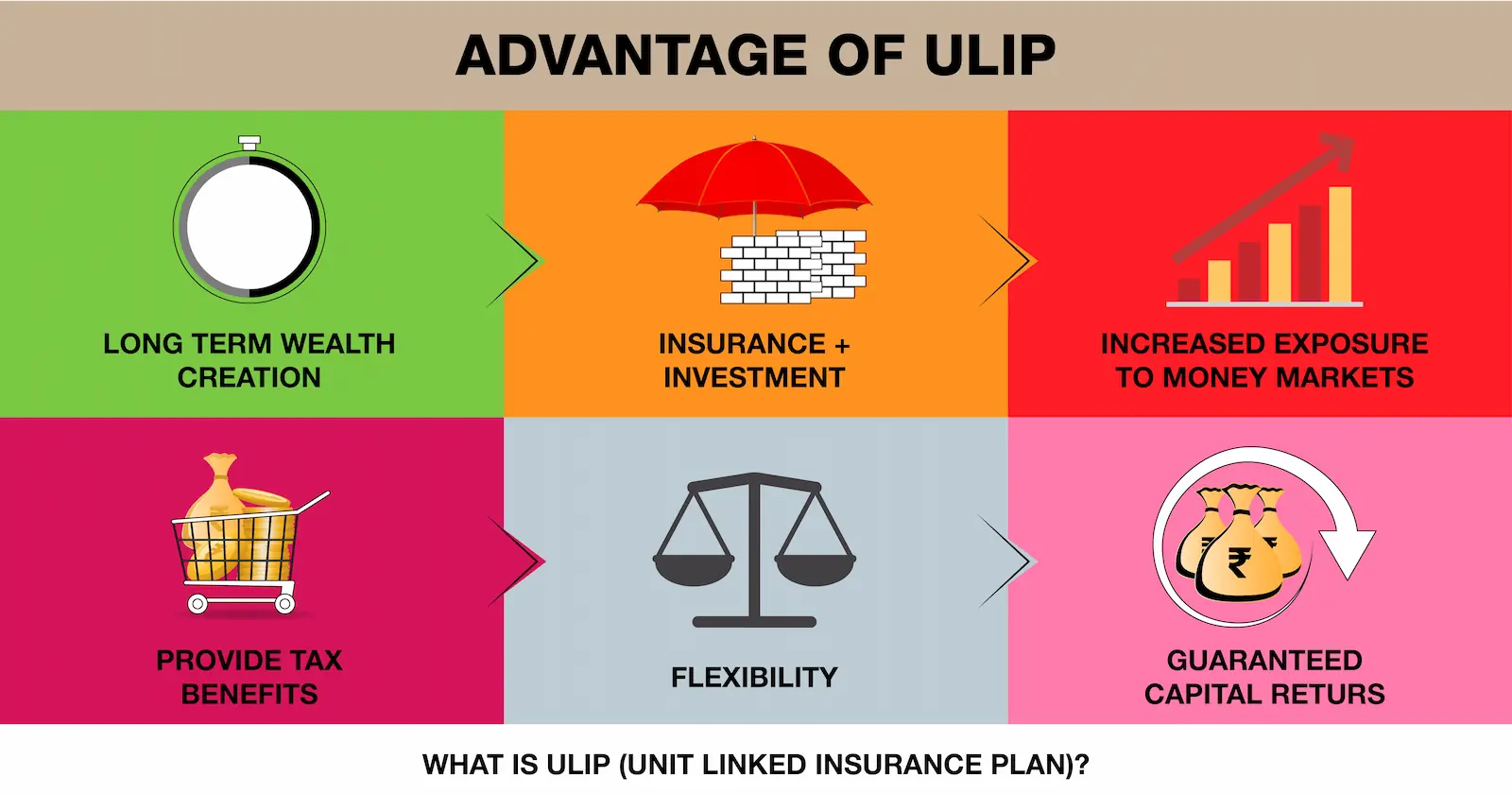

To make matters worse, the life insurance industry is plagued with the problem of low insurance coverage ratio. This means that even the 25% who have life insurance coverage are not adequately covered. One of the reasons for low coverage is that Indians have relied more on endowment policies and ULIPs where life insurance coverage may not be adequate.

However, over the years term life insurance has been playing an important role in improving insurance coverage ratio in India. Therefore, it’s important for citizens to learn about term insurance benefits and get adequate coverage to sustain their dependents in their absence. According to experts, in today’s day and age, one must have minimum 1 crore term insurance coverage to shield the family against inflation and rising costs of living.

What is life insurancecoverage ratio?

In simple words, life insurance coverage ratio is the amount of insurance coverage as per the income of the policyholder. A good life insurance coverage ratio ensures that the surviving members of the family have enough to take care of daily living, healthcare and education costs. Sadly, life insurance coverage ratio is very low in India. To ensure that your family is well-insured you must review your insurance coverage during important life events and get additional coverage to improve your coverage ratio.

How to calculate life insurance coverage ratio

You can easily find out whether your family is adequately covered in your absence by calculating the life insurance coverage ratio. It can be calculated with the following formula:

= Net worth + Death benefits / Annual salary or Annual income

In simple words, life insurance coverage ratio determines how long or for how many years the death benefit and your investments will sustain your family. For example; Suresh’s net worth is 50 lakhs and it includes his investments in mutual funds, EPF, PPF and stocks. He also has an endowment plan that will pay his family Rs. 25 lakh as death benefit and his annual salary is Rs. 10 lakhs.

Suresh’s life insurance coverage ratio = 50 + 25 / 10 = 7.5

This means that with the current life insurance coverage and his investments, Suresh’s family will only be able to survive without him for 7.5 years. And this calculation does not even take into account the impact of inflation.

Suresh’s low life insurance coverage ratio can be easily improved with 1 crore term insurance such as the Generali Central Flexi Online Term Plan that can be bought as low as Rs. 500 per month. This will increase his life insurance coverage ratio to 15 years.

How term plans are helping improve India’s insurance coverage ratio

Typically, Indians policyholders see life insurance not as protection instrument but more as an investment instrument. This led them to invest in endowment plans that gave a decent sum of money on maturity but without adequate death benefit.

However, with the increase in financial literacy, people began to understand how term insurance benefits them and how it helps increase insurance coverage ratio without paying high premiums. Similar to Suresh in the above example, term insurance plans have helped increase the insurance coverage ratio in India.

What is term insurance?

Term insurance is a pure form of insurance that provides a death benefit to the nominee and can be bought for a specific term or tenure. Premiums for term life insurance are cheaper compared to other forms of life insurance. Nowadays, you can also buy term insurance that provides return of premium on maturity.

If you feel that your family does not have adequate insurance protection in your absence, you should opt for the Generali Central Flexi Online Term Plan that provides basic life cover as well as income protection. Under this plan, your family can receive a lump sum pay-out on your death or monthly income till such time you would have turned 60 or 10 years after you death, whichever is higher.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.