Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

What is term insurance its benefits

3 mins

3 mins 2.7K

2.7KWhat is Term Insurance?

Term insurance is a kind of life insurance policy that provides coverage for a limited duration, or a particular ‘term’ period. If the policy holder dies during the active years of the policy, then the family of the deceased is entitled to receive a death benefit from the insurance provider[1]. It is less expensive compared to a permanent life insurance policy when taken at an early age. Also, a term insurance plan generally has no surrender or maturity value for the policyholder or the insured, unlike the permanent life insurance that pays the surviving policy holder.

What are the criteria that matter while buying a term insurance?

Every insurance plan operates on a premium, and term insurance plans , like most life insurance plans charge premiums by evaluating criteria like the policy holder’s and

The age of the policyholder at the time of buying the policy determines the premium amount to be paid towards the term insurance. The younger the policy holder, the lesser will be the premium paid. For most term insurance plans the minimum entry age of the policy holder starts at 18 years.

Insurance companies exclusively tailor their term policy premiums for women. Few term insurance policies offer the benefit of comparatively lower premium rates to women policyholders than those offered to men. This can be attributed to the simple fact that women largely outlive men, as demonstrated by the life expectancy data[2].

Like most insurance, term insurance policies cover the unexpected risks, and higher the risks, the heavier are the premiums. So, if your profession falls into sectors like mining, fishing, manufacturing, construction that entail physical and health risks, be prepared to pay heavier premiums for your term insurance plan.

The policy term you choose also determines the premium of your term insurance policy. The longer the policy term, the lower the policy premium. So, term insurance plan with a longer duration is cheaper than a shorter duration term insurance.

The sum assured in the event of the policy holder’s death, i.e., the policy’s coverage amount is another parameter that weighs upon the premium of a term insurance plan. The higher the policy coverage, the bigger will be its premium. So, it is advisable to select the coverage amount keeping in view of your family’s future needs and inflation costs.

Buying a term insurance policy online is a better idea since it is convenient, and also relieves you of any intermediaries. It also facilitates lower premiums upon each renewal.

Above all these factors, buying a term insurance plan varies according to the stage of your life. Each stage of your life throws up a new set of responsibilities and needs, in the form of family and kids’ future. The risk-taking abilities in your 20s and 50s differ. As you age, the count of your dependents rises, and your risk-taking abilities wither away since you look for security. Taking these into consideration, insurance companies are now devising a variety of term insurance plans tailored for every age group to meet their futuristic needs. Term insurance providers also account for circumstances of family ending up in debt or loans, in the absence of the policy holder. Generali Central Care Plus Term Insurance plan provides an excellent option to protect your family against your loans and liabilities, when you are not around. It ensures financial security to your family by offering a high cover at a low premium.

Conclusion:

Choosing a term insurance plan to cover your family’s financial needs in your absence can be tedious. It would be a wise move to carefully analyse your family’s futuristic financial needs before opting for a term insurance plan. You might be in a haste to buy a term insurance cover, but it is better late than never!

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

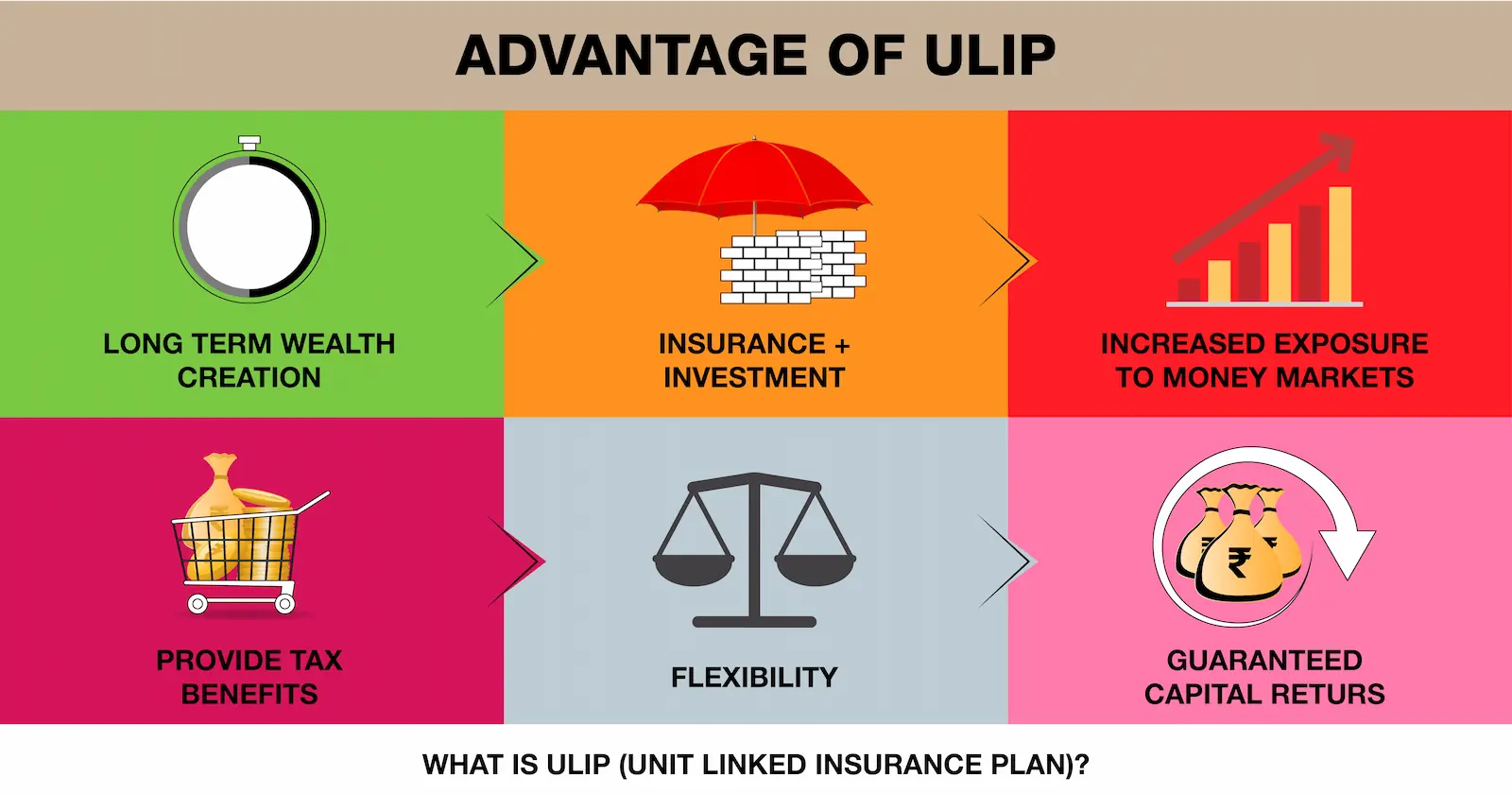

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.