Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Can Death Be Denied? A Brief History Of Humanity’s Obsession With Immortality

4 mins

4 mins 2.7K

2.7KHumans are perpetual seekers, intrigued by everything enigmatic and ambiguous. The eternal quest for immortality is one such fascinating subject that cuts across time and space in human history. From the 16th century Nobles who drank gold to extend their life, to the Sumerian King, Gilgamesh who was in search of the magic herb that could make him immortal - history is replete with tales of humans harboring an obsession to live forever . More recently, this obsession has led the scientists to research on deceiving death through experiments in genetics, robotics, cryonics, and more. Here’s are some lore that paint a history of humanity’s obsession with immortality:

Qin Shi Huang is remembered as the first emperor of a unified China. Despite the vast wealth, power, prestige and territorial supremacy he commanded, he decided what he had wasn’t just enough. The only thing he didn’t have was the ability to live eternally, and he sent scouts to various places rumored to be knowing something about immortality. Meanwhile, the Emperor was making use of the alchemical elixirs made by the Chinese medicine man who suggested that drinking mercury would be a great idea. Shi Huang bought this idea and greedily consumed mercury. As fate would have it, he died an early death at 49.

Gilgamesh was a demi-god Sumerian king who ruled an area called Uruk. He was very successful leader responsible for rise of city-states, but also a cruel tyrant who enslaved and tortured his subjects. Along with his god-send friend and lieutenant, Enkidu, he conquered large swathes of territory until Enkidu was killed one day. Enkidu’s death made Gilgamesh distraught, but also strengthened his ambition to conquer death in order to avoid meeting a similar fate as his friend. He later came to know of a rare magic herb that could keep him alive forever. Gilgamesh did manage to find this amazing herb, the very last of kind in its existence, but it was seized out of his hand by a snake that swallowed it to become immediately young before his eyes. After this, Gilgamesh surrendered to death, and hope to live on forever through his deeds that he had left behind.

Historical records reveal that Buddhist monks always took part in a practice called self-mummification that began with a grueling diet and training process spanning several years. The special diet that includes a disgusting embalming potion, is believed to preserve their bodies. Then, they seal themselves up inside a closed chamber and meditate for years. After a few years, the chamber is opened to check the body for decay. If there are no visible signs, then the mummification process is believed to be successful.

With medical advances over the years , multiple people have insanely gone to the extent of cryogenically preserving their bodies after death with all of them pinning their hopes on some futuristic technology that can systematically unfreeze and replenish their bodies. Given that there is no proven technology for uploading one’s brains after death it simply may not be possible in the future, this has not weakened the people’s obsession to live forever.

Funded by Silicon Valley elites, researchers believe they are a few steps away from achieving immortality by tweaking the human body, although the scientific nature of the methods is still debatable. Scientists and entrepreneurs are rigorously researching a variety of techniques, from blocking the process of ageing and the practice of transfusing young blood into old people’s bodies to gene therapy and telomere lengthening treatments. In a bid for super long life, noted silicon valley billionaires like Google founders Sergey Brin and Larry Page, Amazon founder Jeff Bezos have pumped in monetary funds into secret health ventures like Calico, and companies such as Unity Biotechnology, Sierra Sciences, BioViva, et al, that aim to solve death or at least hope to combat the effects of ageing .

Can death be denied?

Thanks to the wonders of modern medicine and holistic nutrition in the last few decades, global life expectancy has steadily increased for nearly 200 years, leading to a decline in late-life mortality during the latter half of the 20th century . However, the shifting focus from lifespan to health span today poses new queries if humans can really deny death and continue to live forever. A relatively recent concept, doctors and scientists are increasingly alluring to lengthening the patients’ health span, by staying youthful. Because being old is difficult, and one would want to live longer only if these longer lifespans include ever-longer youths, free of extended period of struggle . So, as it stands today, clearly, death cannot be denied.

As humans are mortal beings, they cannot afford to ignore the importance of term insurance that not only provides a financial guarantee in case of the insured’s demise but also lets him live in peace. Term life insurance covers an individual’s financial liability and ensures his family’s financial safety by providing a death benefit in his absence. Term insurance plans are usually cost effective, and online term plans are even cheaper allowing you to save on premium by 40 to 60 percent.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

What are the documents required for online term insurance?

3 mins

4.2K

Posted on: Aug 02, 2025

Life Insurance

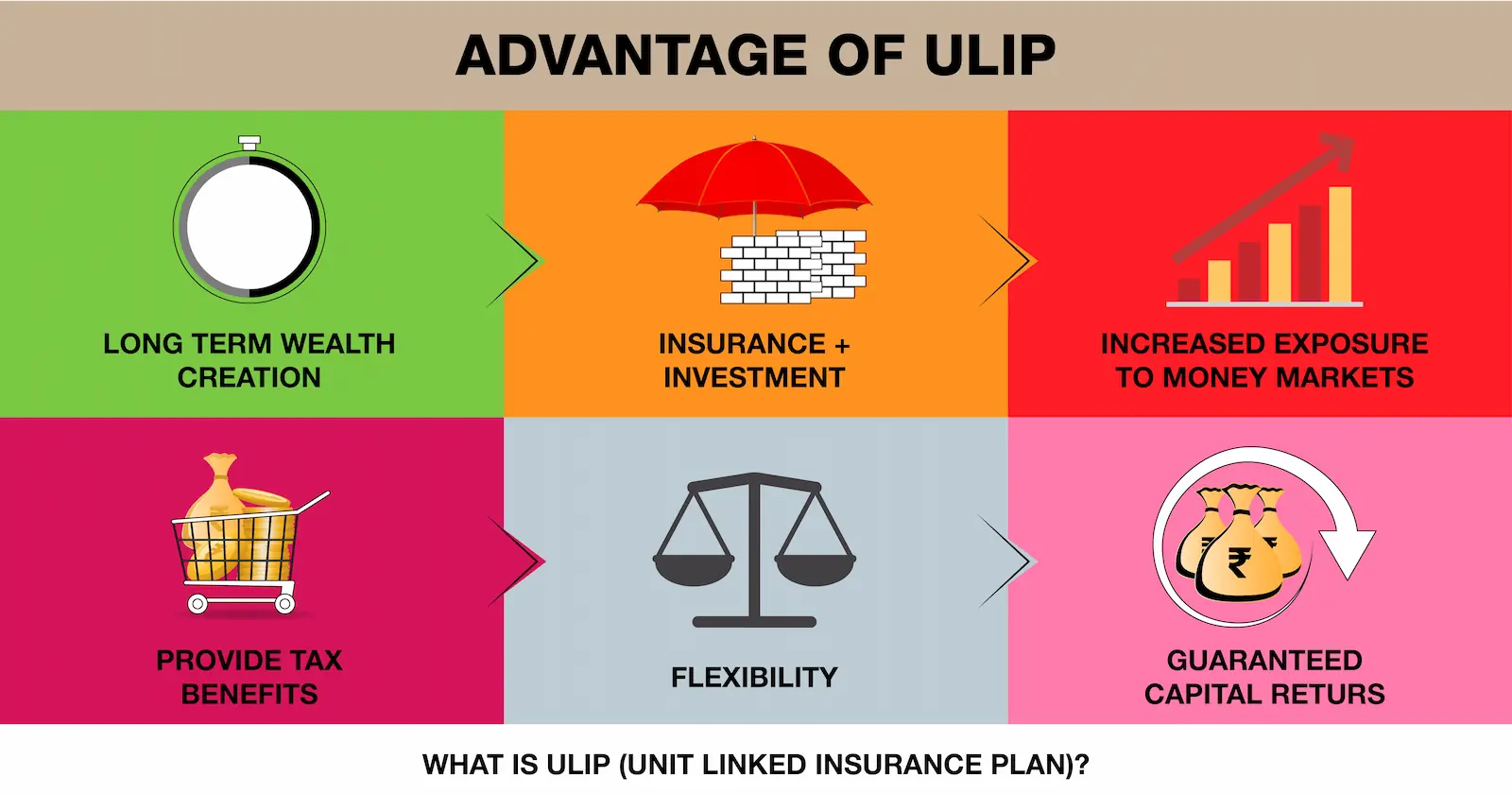

Long Term Investing: Are ULIPs a Good Option?

6 mins

3.3K

Posted on: Jul 29, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.