The Resurgence of ULIPs:

Unit-Linked Insurance Plans (ULIPs) have been in the news ever since the Budget re-introduced Long-Term Capital Gains (LTCG) tax on equity investments. Fortunately, ULIPs have not been affected by this blow as they are treated as insurance products. Moreover, switching between equity and debt fund options in ULIPs does not attract any tax, unlike mutual funds.

ULIPs are a kind of life insurance product that offers risk cover along with investment options to policyholders under a single plan. Since the investments are related to market fluctuations, it becomes imperative for you to assess your risk appetite and undertake a detailed ULIP comparison before you make an investment decision. Nowadays, reformed ULIPs are being presented as products that could help you achieve your financial goals through disciplined investing, market-linked returns and lower charges.

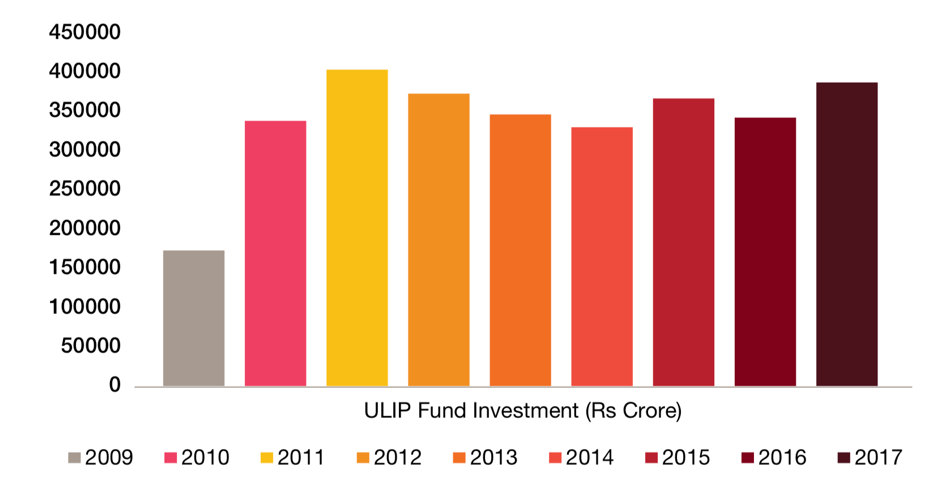

Over the last decade, ULIPs have gained popularity among insurance companies and customers. As shown in graph 1, there has been a significant increase in the investment amount of ULIP funds in India.

-

Graph 1- Current trends in ULIPs in India:

Moreover, ULIPs have been more efficient in the long term. If a customer has an investment horizon of over 10 years, ULIPs would offer a better Internal Rate of Return (IRR).

-

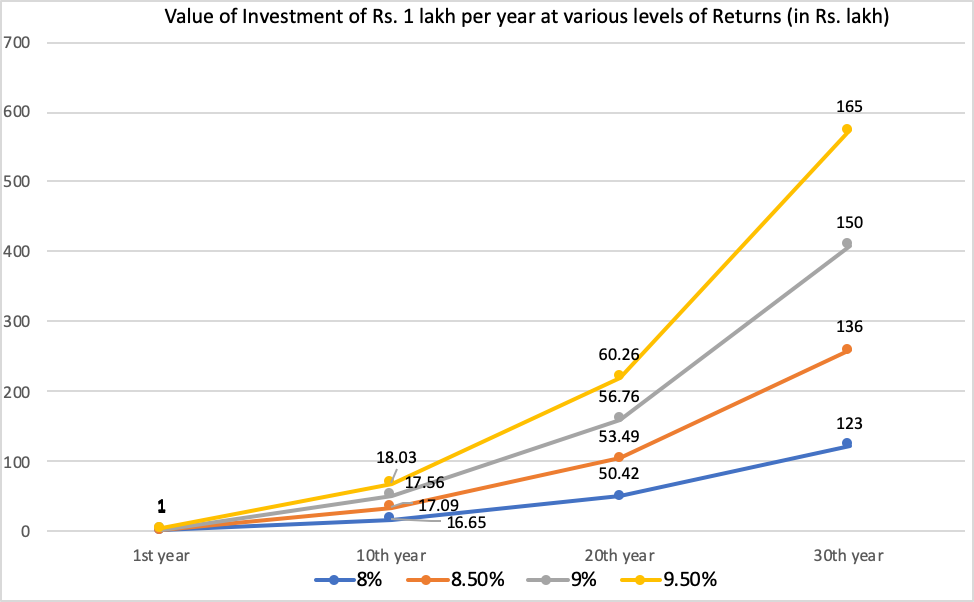

Graph 2- Even a minor difference in returns can have a big impact on the corpus:

As shown in graph 2, a 0.5% difference in returns can translate into Rs. 15 lakh over 30 years. Though the difference is not very significant in the initial years, it balloons into substantial savings in the long term.

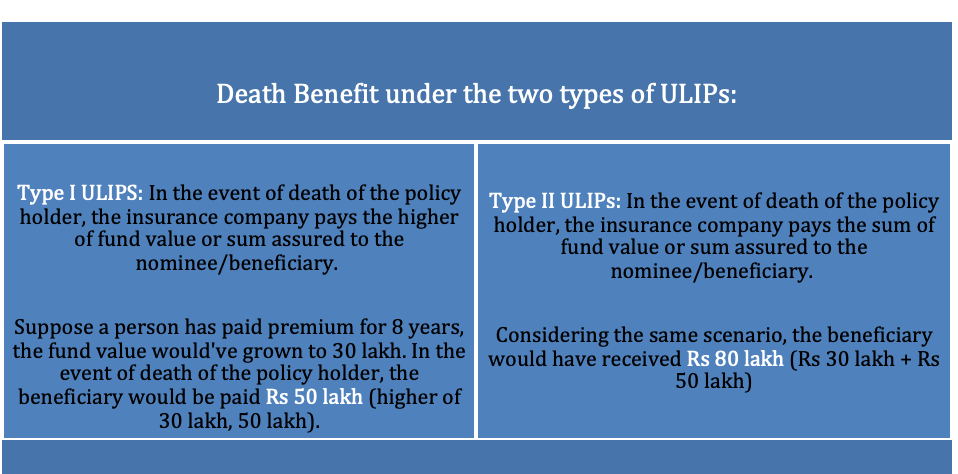

Thus, for higher returns in the long term, it’s critical for ULIP buyers to know the difference between the two types of policies that exist in the market today. In the case of your unfortunate death, type I policies would pay your dependents the higher of the sum assured and your accumulated fund value. Type II policies, on the other hand, would pay the sum assured plus the accumulated fund value.

Bogged down with confusion? An example would help ease the pain of understanding complex insurance terminologies.

How does it impact the return?

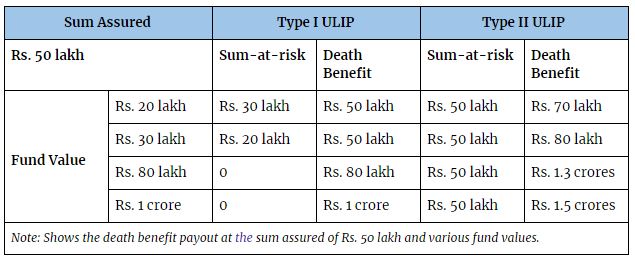

An insurance company charges a mortality charge on ‘sum-at-risk’ for the insurance company. The sum-at-risk is the amount that the insurance company would have to pay from its own pocket in the event of the death of the policyholder. Expectedly, the higher the sum-at-risk, higher is the mortality charge. Under type I ULIP, since the insurance company would only need to pay the higher of the fund value and sum assured, the sum-at-risk goes down as the fund value grows. Considering the above example, if the fund value after 5 years is Rs. 20 lakh, the sum-at-risk would be Rs. 30 lakh (Rs. 50 lakh – Rs. 20 lakh). In the event of the death of the policy holder, the insurer would need to pay only Rs. 30 lakh from his/her pocket since Rs. 20 lakh is with the company already in the form of fund value.

As depicted in the table below, if the insured event (death of the policy holder) occurs after the fund value has grown to be Rs. 30 lakh, the sum-at-risk for the insurance company would go down to Rs. 20 lakh. Furthermore, if the fund value has grown to be Rs. 80 lakh, there would be zero sum-at-risk for the insurance company since its entire liability (Rs. 80 lakh) could now be met through the fund value only. Therefore, under Type I ULIP, sum-at-risk keeps on decreasing as the fund value grows and eventually becomes zero. As the sum-at-risk keeps decreasing, the mortality charge also goes down and eventually becomes zero.

On the other hand, in case of a type II ULIP, sum-at-risk is constant (sum assured) during the term of the policy. Therefore, the mortality charge does not go down. In fact, it increases every year as the policyholder ages.

Thus, the policyholder would pay much lower mortality charges in a type-I ULIP and the amount of premium that would get invested is much higher. Under Type-II ULIPs, sum-at-risk remains constant and thus, mortality charges would be higher. This would, in turn, impact the returns negatively. Therefore, type-I ULIPs would substantially offer better returns than type-II ULIPs.

Prima facie, it is difficult to gauge which type of ULIP is better. One provides better maturity benefits (policy holder survives the policy term) while the other provides better death benefits. To answer this question, you have to look at why you purchase insurance products in the first place. If you purchase insurance products in order to ensure that your family is taken care off in case something were to happen to you, then death benefits would be given priority over maturity (survival) benefits. In this situation, type-II ULIPs would become better insurance products than type-I ULIPs.

However, there's no 'one size fits all' answer when it comes to choosing financial instruments. The decision to choose a ULIP plan, available on Generali Central, must hinge on your unique financial priorities and money goals. Since an investment in a ULIP Plan is an important one, you should understand all the variants of ULIPs after visiting the Generali Central website and make the decision thoughtfully.

With the help of these ULIP facts, your investment decision in either of the ULIPs would never go wrong. If you’re looking forward to gaining the best out of the death benefit, then type II of ULIPs would be your calling. If you’re solely aiming to generate wealth, then type I ULIP would surely work in your favour. Now that you know the difference between the two types of ULIP plans, visit the Generali Central website and explore one of the leading ULIP plans in India available today.

Comments