Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

What is the base year and how does it affect your taxes?

4 mins

4 mins 3.5K

3.5KCost-adjusted inflation:The purchase price of a capital asset needs to be fixed as per the rate of inflation for the duration of its holding. This is referred to as indexation. When calculating the long-term gains on goods at the time of sale, this inflated cost is assumed as the price at which it was purchased.

The government fixes cost inflation index (CII) numbers in its official gazette every year to account for inflation. CII for 2001, the base year for income tax purposes, is fixed at 100 and increases for every subsequent year. CII values allow for inflation adjustment in the cost of capital to arrive at its actual value as per the market rate at present.

The cost inflation index:-

Impact of the base year:The revision of the base year to 2001, means that if a capital asset bought prior to April 1, 2001 is sold in 2015, its cost would be its FMV as on April 1, 2001, the base year for income tax purposes. Since gold prices have appreciated only after 2007, those holding on to it would not feel much impact.

Individuals with unlisted shares on which securities transaction tax (STT) has been paid would get an advantage. Their tax outgo could be reduced by considering the FMV on April 1, 2001, as the purchase price when calculating profits on shares that increased in value between the time that they were bought and April 1, 2001.

Who benefits the most?

The revision of the base year has been most beneficial to property owners. This is because while property prices have risen nearly around10 times between 1981 and 2001, the index has only quadrupled from 100 to 406. Those who have invested in property will thus get the full benefit of indexation with the index being in tune with the corresponding rise in the property.

Calculation of cost of acquisition :

- 1. F.M.V. of property on 1-04-2001 XXX

OR

S.D.V. of property on 1-04-2001 XXX

Whichever is lower XXX

2. cost of acquisition XXX

= Whichever is higher XXX

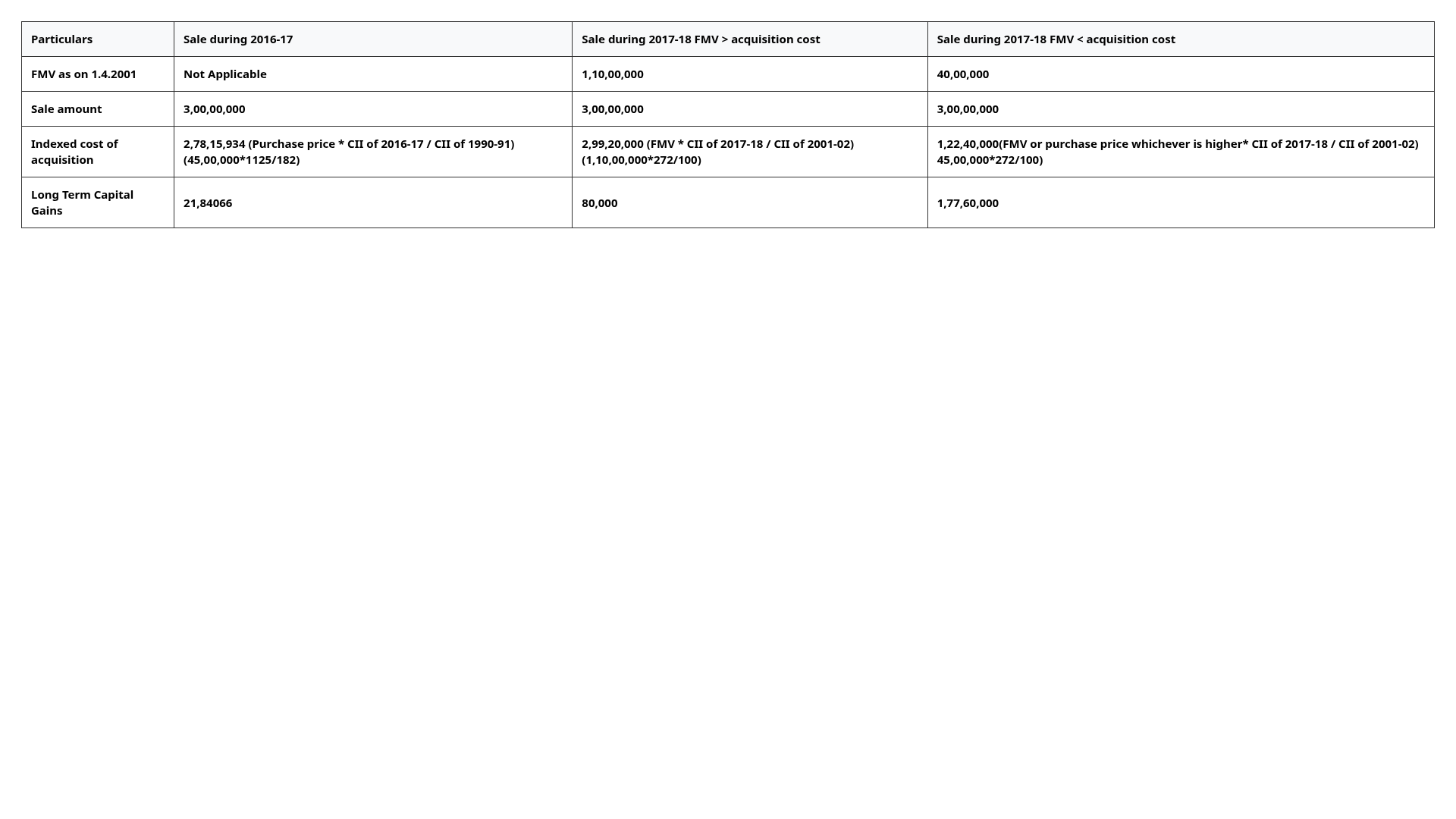

Suppose Mr. X bought a house for ₹ 45 lakh in 1990 and sold it for ₹ 3 crores. His long term capital gains would be as follows:

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.