Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Got a Salary Hike? 5 Ways to Save Taxes on Your Increment

5 mins

5 mins 4.9K

4.9KTax Relief and Tax Rebate

Tax Rebate– You may be eligible for a tax rebate (refund) under section 87A of the Income Tax Act,1961 of up to Rs 12,500 if your total taxable income is less than Rs 5,00,000. After taking into account all applicable deductions, exemptions, and allowances, the total taxable income is determined. Both the old and new tax regimes allow for the tax rebate.

Tax Relief– If you received any salary delays during the fiscal year, you may be eligible for tax relief under Section 89.

Effect of Salary Hike on Taxation

Let us take an example to understand the effect of salary hike on taxation.

Let's say you previously earned Rs. 5,00,000. Due to your great performance, your updated remuneration has been raised to Rs 5,50,000 by 10%. Your salary is now taxable, and in order to avoid a fine, you must pay a 5% tax on Rs. 5,00,000, which comes to Rs. 12,500. On any amount larger than Rs. 5,00,000, you will be compelled to pay 20% tax, which in this case equals Rs. 10,000. You must therefore pay the government a total of Rs. 22,500 (exclusive of cess) in taxes because your remuneration was increased to Rs. 5,50,000.

How do taxes work?

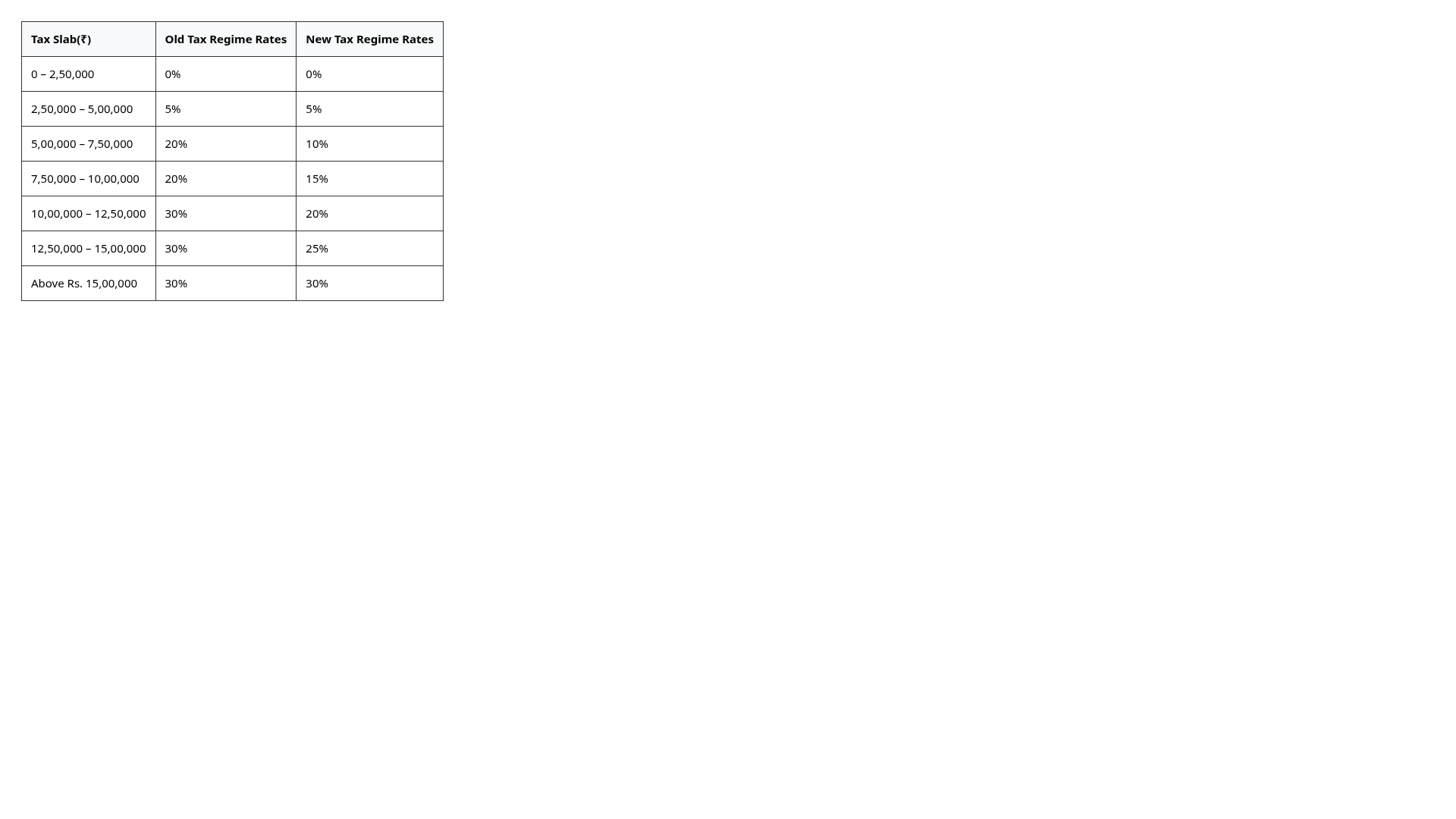

Once an individual earns more than the basic exemption limit which is chargeable to tax as per the provisions of Income Tax Act, 1961, they would have to pay taxes as per the slab rates. The following is a comparison of the old tax rates and new tax rates:

Suggested Read: Old Tax Regime vs New Tax Regime

Here is a list of five steps to decrease your tax liability:

- Claiming tax exemption under Section 80C of the Income Tax Act: You can invest your hard-earned money in a wide variety of tax saving schemes, and claim a maximum exemption of ₹1.5 lakh under Section 80C of the act. By purchasing tax-saving products, you can benefit from Section 80C 's benefit of lowering your tax obligation. For investments made in Public Provident Fund (PPF), Employees' Provident Fund (EPF), Equity Linked Saving Schemes (ELSS) ,5 Year Fixed Deposits with Banks and Post Office , Life Insurance Premium, Principal Repayment on Housing Loan, Unit-Linked Insurance Plans (ULIPs), etc., a maximum of Rs 1,50,000 p.a. can be allowed as a deduction under this section.

- Claiming tax exemption for making contributions to the National Pension Scheme: Another way to receive exemption from tax is to invest in the government sponsored NPS. After retirement, the NPS provides a worker with both a lump sum payment and a monthly pension, or set monthly income. Employer contributions to NPS are tax deductible up to 10% of salary, with a maximum deduction of Rs. 1.5 lakh. A further exemption of Rs. 50,000 is also provided if the employee contributes to the NPS.

- Claiming tax exemption for making premium payments for health insurance: Section 80D allows you to deduct the premiums you paid for health insurance that covered you, your spouse, and/or your dependent children. The maximum deduction that may be made each year is Rs 25,000. (or Rs 50,000 p.a. in case you are a senior citizen). You qualify for an additional deduction of Rs 25,000 per year if you additionally pay your parents' medical insurance premiums (or Rs 50,000 p.a. in case your parents are senior citizens).

- Claiming tax exemption on House Rent Allowance and on payment of rent: It is a sum of money that an employer gives to employee to cover the cost of living at the workplace. Although HRA is eligible for a deduction under Section 10(13A) of the Income Tax Act, it may also be partially or entirely taxable. Your salary, the HRA you got, the rent you pay, the location of your employment and dwelling, and other factors all play a role in calculating the HRA deduction.Least of the following is exempt:Actual HRA Received40% of Salary (50%, if house situated in Mumbai, Kolkata, Delhi or Chennai)Rent paid in excess of 10% of salary.If you live with your parents, and you are paying them rent and getting a receipt for the same, you can claim the HRA deduction for the same. Additionally, your parents must report the rental income in their tax return.

- Tax deduction on interest of home loan: As per Section 24 of the act, Interest on loan taken for the purchase of a house property is available for deduction. If the property is occupied by you, the maximum deduction is Rs 2,00,000, however in this section there is no limit on deduction if the property is rented but limited to interest actually paid. However maximum deduction that can be claimed under the head income from house property is Rs. 2,00,000 for the relevant Financial Year.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.