Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Best Way to Save on Taxes Under Indian Income Tax Laws

4 mins

4 mins 3.7K

3.7KNothing is certain in life except for death and taxes

— Benjamin Franklin

Taxes. Just hearing the word can make some people break out in a cold sweat. But why do taxes evoke such a strong reaction, and why are they often seen as the enemy?

We At Generali Central Life Insurance, believe celebrating taxes as a tool for collective progress and societal well-being can lead to a more positive and constructive attitude towards them. Taxes are to be celebrated! Thanks to tax-saving investments tools. Here’s why:

- Regular contributions to tax-saving instruments instill financial discipline. This can lead to a healthier financial future and greater financial security.

- Fosters long-term savings and wealth creation, as the invested amount grows over time with interest or returns.

- Investments in insurance premiums not only offer tax benefits but also provide a safety net against unforeseen events.

- These tools can help individuals achieve specific financial goals, such as funding a child's education, buying a home, or planning for retirement, while also benefiting from tax deductions.

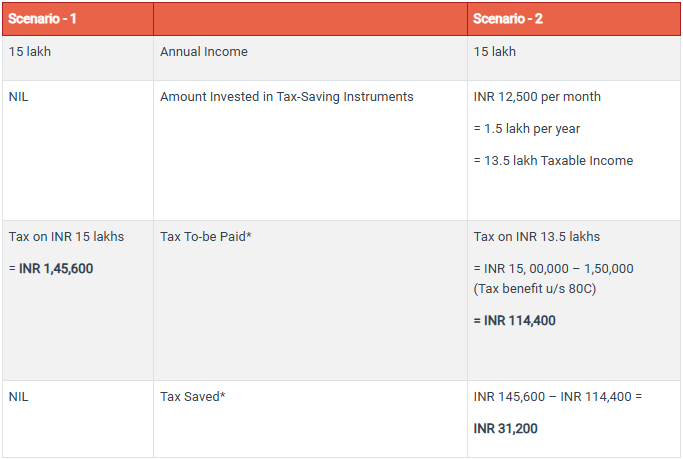

For instance, below are 2 scenarios that will help us understand better. In scenario -1, a 30-year-old male does not plan his taxes properly, whereas in scenario -2 he does. Let's see what happens.

Assuming taxes computed for an Individual assessee for AY 25-26 as per old tax regime

To conclude, if tax planning is done wisely, taxes can be your best friend!

Tax Saving Instruments

Saving taxes is a fine-tuned act that requires smart and affordable investments as well as a long-term vision. It's important that you don't invest so much for tax purposes that you end up with little liquidity.

Ideally, we encourage monthly tax-saving investments and instruments that offer tax benefits in as many stages of investment, accumulation, and withdrawal as possible. Investing in the following plan will allow you to save taxes for a long time while growing wealthy slowly and consistently.

Guaranteed Savings Plans – Debt Investments

Guaranteed savings plans help you plan and save today so you can fulfill important goals at different stages of life. Some of the major benefits of guaranteed plans include:

- Tax benefits are available under Section 80C for premiums paid, please consult your tax advisor for more details.

- Guaranteed plan payouts are tax-free subject to fulfilment of conditions prescribed u/s 10(10D), please consult your tax advisor for more details.

- Flexible to choose the policy term as well as premium payment terms.

- Avail guaranteed payouts.

- A small amount of savings becomes a large sum of money by the time you need it, thanks to compounding.

- Depending on the policy chosen, you get the option of choosing between lump-sum payouts, monthly payouts, or both.

ULIPs – Equity Investments

Unit-linked insurance policies (ULIPs) are excellent equity investments. Over the long run, ULIPs give the same return as equity investments, as well as offering many other amazing benefits, such as:

- Section 10(10D) of Income Tax Act, 1961 provides an exemption for any sum received under a life insurance policy. However, with amendment coming from Finance Act 2021, no exemption shall be available for the ULIP’s issued on or after 01-02-2021, if the amount of premium payable for any of the previous year during the term of such policy/policies exceeds Rs. 2,50,000. In case if the premium is payable for more than one ULIP, if the aggregate amount of premium exceeds Rs. 2,50,000, then the amount received on maturity of each policy shall be taxable.Further, in the event of the policyholder's death, the death benefit continues to be tax-free under Section 10(10D).

- ULIPs typically have a lock-in period of 5 years, encouraging long-term investment and financial discipline

- Gains from ULIPs are tax-free

- There is a low fund-management fee

- The returns are the same as other equity investments

- It is easy to switch between debt and equity.This can help optimize returns while managing risk.

- Comes with dual benefit of insurance coverage and investment growth

--

Don't wait until it is too late to invest in tax savings instruments.By leveraging these government-approved tax-saving options, one can effectively reduce their tax liability while securing financial future. Making smart, informed investment choices will turn taxes burden into a strategically. Connect with our financial advisor today, click here .

--

Disclaimer:

It is advised to consult your tax consultant for proper tax planning.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.