Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Taxes on Lottery Winnings in India and Applicable Rates

7 mins

7 mins 28.8K

28.8KAwards are awarded to people in recognition of their talent, skill, success, and brilliance in a specific sector. Awards for excellence in various fields—such as film, television, sports, and national recognition—are given to people. These awards could be local, regional, or global. On the other side, rewards are granted to players who succeed in a specific game type. These prizes can be granted in cash or in kind and might come from games like the lottery, horse racing, and crossword puzzles. There are two ways to hand out awards and prizes, they are as follows:

- In cash

- In kind, such as prizes in the form of gold, real estate, automobiles, appliances, etc.

Many people are unaware of the tax consequences associated with awards and prizes. They worry whether or not the award or prize they got would be subject to taxation. How about you?

There are many variables that affect the rate of taxation on awards and prizes. Prizes are always taxable, but awards may or may not be as well. Let's discuss why and how.

Awards and their Tax Implication

If they are authorized by the Indian government, awards are regarded as being exempt from taxes. Awards can be taxed depending on the circumstance under which they were given, who is granting them, and whether the Central or State Government approve them. According to Section 10 (17A) of the Income Tax Act, if the award is awarded in the public interest and is authorized by the government, it is not subject to taxation. A list of awards that are entirely tax-free in the recipient's hands is maintained by the Indian government. The following are some of these awards:

- National Awards

- Nobel Prize if it is notified by the Government under Section 10 (17A) of the Income Tax Act

- Awards given by the Government to winners of Olympics, Asian Games, Commonwealth Games, etc.

- Arjuna Award

- Bharat Ratna Award, etc.

The award would, however, become taxable in the hands of the recipient under Section 56(2) of the Income Tax Act if it were not given by an authorized authority or by a central or state government entity. The money received as part of the award would be taxed and reported under the heading "income from other sources."

Here are a few typical examples of taxable awards:

- Wisden Cricketer Award

- ICC Cricket Awards

- Film Fare Awards

- Grammy Awards, etc.

Prizes and their tax implication

In the hands of the winner, prizes and winnings are always subject to taxation. The amount of the prize would be reported under the heading " Income from Other Sources ," and it would be liable to tax in accordance with Section 56 (2). The following are some examples of taxable prizes:

- Winnings from lotteries, crossword puzzles, horse racing, etc.

- Winnings from a game show.

- Winnings from sporting events, etc.

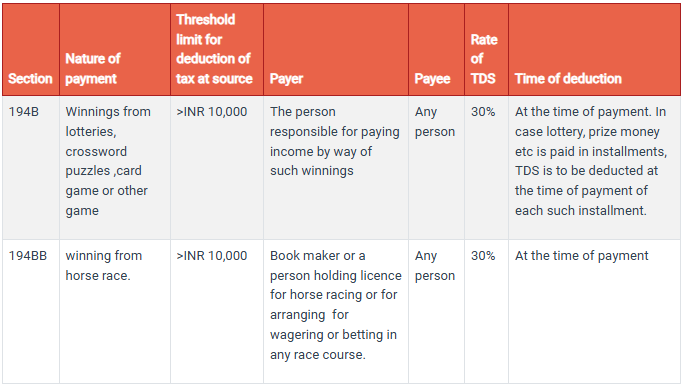

- Section 194B deals with winnings from – lottery/crossword/puzzle/card game etc.

- Section 194BB deals with winning from horse race.

The rate of tax

30% tax is applied to prizes and awards that have not received government approval. The tax rate would also need to be increased by cess. The applicable cess rate is 4% on above 30%, bringing the overall tax rate to 31.2% [30%+(4% of 30%)] . Regardless of the individual's tax slab rate, this rate would apply. This indicates that earnings from awards and prizes would still be subject to a 31.2% tax rate even if the person's income falls under the 20% slab rate. The market worth of the item you receive is taken into account if you receive your prize or winnings in kind. The item's market value is then used to determine how much tax to charge.

Such an income, however, is not liable for deductions under Section 80C or any other section of the Income Tax Act. Unlike salary or professional income where people are allowed to take deductions or allowance, winnings from contests are fully taxable. This is the case even if the basic exemption or tax slab exemption applies if the winner’s income is not that much. The entire amount will be taxable at a flat rate of 31.20%.

For example, if you were to win a prize of ₹4 lakh at a contest and your annual income is ₹5 lakhs. Then you will have to pay tax on ₹4 lakh at the rate of 31.2% while your income will be taxed at the relevant slab rate after deducting exemptions/allowances.

Moreover, if the prize money is received in kind, say a car or a house, then, too, tax is applicable at the same rate. In that case, the prize giver has to deduct tax and deposit it based on the market value of the prize at the rate of 31.2%. This amount can either be recovered from the winner or be borne by the prize provider.

TDS Incidence

According to the rules of Section 194B/194BB of the Income Tax Act, TDS must be subtracted from wins before distributing them to the winner if the award or prize has a value greater than INR 10,000.

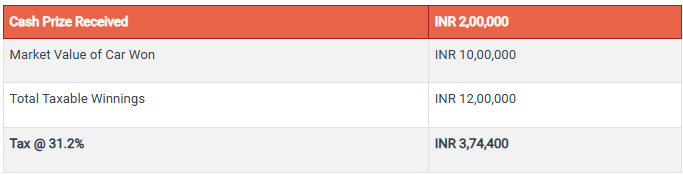

Using Anil as an example, he won a game show and was awarded a car worth INR 10 lakhs and INR 2 lakhs in cash. He made INR 50,000 in interest from fixed deposits and INR 10 lakhs in salary per year. He contributed Rs 20,000 to his health insurance coverage and Rs 1.5 lakhs towards life insurance cover offering tax deduction under Section 80C. The following formula would be used to determine his tax bill:

Tax on Winnings

Tax on other Income

Conclusion

Whenever you receive awards or rewards, make sure the government has approved them. You are exempt from paying taxes if the reward is approved by the government. In order to avoid facing any penalties from the income tax department, you must understand the implications of tax and know how much tax is due.

In conclusion, it is important to remember that the majority of sizable prize money and gifts are subject to taxation under the Income Tax Act, and it is advised to pay your taxes on time to avoid government inspection.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.