Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Understanding 80EEB Deduction for Electric Vehicle Buyers

5 mins

5 mins 58.8K

58.8KIn the union budget 2019 , the government has announced an incentive for purchase electric vehicle. In the budget speech, the finance minister has stated that advanced battery and registered e-vehicles will be incentivized under the scheme. A new Section 80EEB has been introduced allowing a deduction for interest paid on loan taken for the purchase of electric vehicles from the AY 2020-21.

The 2019 budget attempted to give some relief to taxpayers by bringing in two new sections:

- Section 80EEA for an affordable home loan

- Section 80EEB to give tax deduction on the interest of the loan amount on the purchase of EVs.

What is Section 80EEB?

Section 80EEB gives tax deductions of up to ₹1,50,000 on interest paid on loan amount on the purchase of electric vehicle. The deduction will be available for both personal and/or business purposes. The deduction under this Section would be available till the repayment of loan.

However, there are some conditions attached to Section 80EEB deduction. These are as follows:

- Loan should be taken for purchase of an electric vehicle

- This exemption can be taken for two wheelers as well as for three and four wheeler

- All the EV loans sanctioned between 1 April 2019 and 31 March 2023 will be considered under section 80EEB.

- The assessee should be an individual.

- Loan should must be taken from a financial institution or a non banking financial company.

- Any individual can only avail of the benefits of this section if he has not owned an EV before.

- Section 80EEB is effected from FY 2019-2020.

Along with introducing Section 80EEB, the government has also slashed GST on electric vehicles from 12% to 5%.

Quantum of deduction-

Maximum Rs 1,50,000 or the interest amount whichever is lower in any financial year.

What is the meaning of financial institution?

The meaning of financial institution is as follows:

- A bank or other financial institution covered by the 1949 Banking Regulation Act, or

- Any bank or organization that falls under the definition of the Act's Section 51, or

- Any NBFC accepting deposits, or

- A systemically significant non-deposit taking non-banking financial company is one that is registered with the RBI and has total assets of at least Rs 500 crore as of the most recent audited balance sheet.

What is the meaning of Electric Vehicle?

A vehicle which is powered exclusively by an electric motor whose traction energy is supplied exclusively by traction battery installed in the vehicle. The vehicle should have electric regenerative braking system, which during braking provides for the conversion of vehicle kinetic energy into electrical energy.

Example: The details are listed below.

- A loan was obtained to buy an electric vehicle.

- Loan availed during FY 2019–20

- Rs 2,00,000 in total interest paid during the year

- Loan taken from a close relative.

Since the loan was obtained from a family, no interest deduction is permitted in the situation mentioned above.

However, if a loan had been obtained in the aforementioned scenario from a financial institution, the total deduction allowed by Section 80EEB would have been Rs 1,50,000.

ILLUSTRATION:

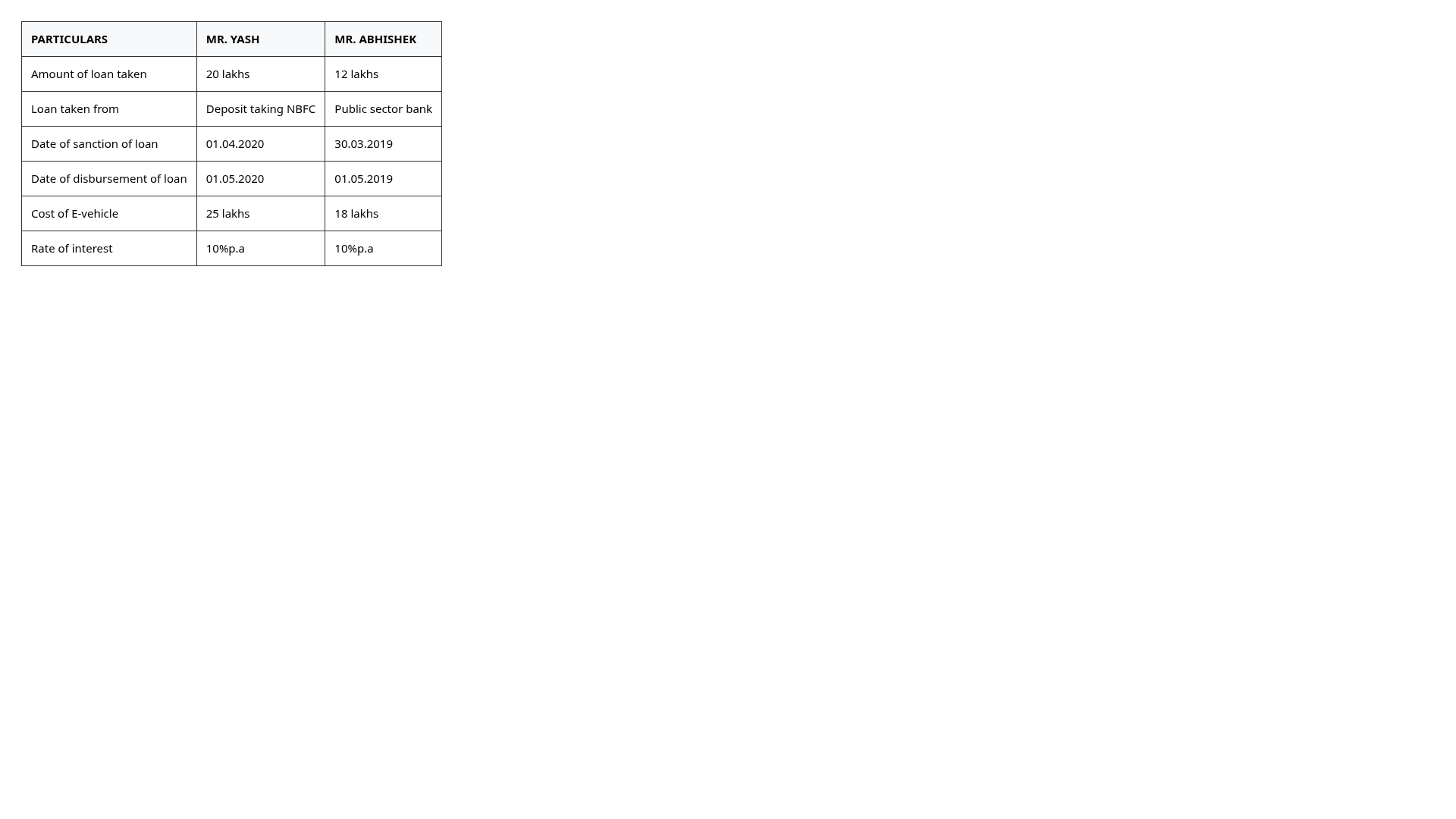

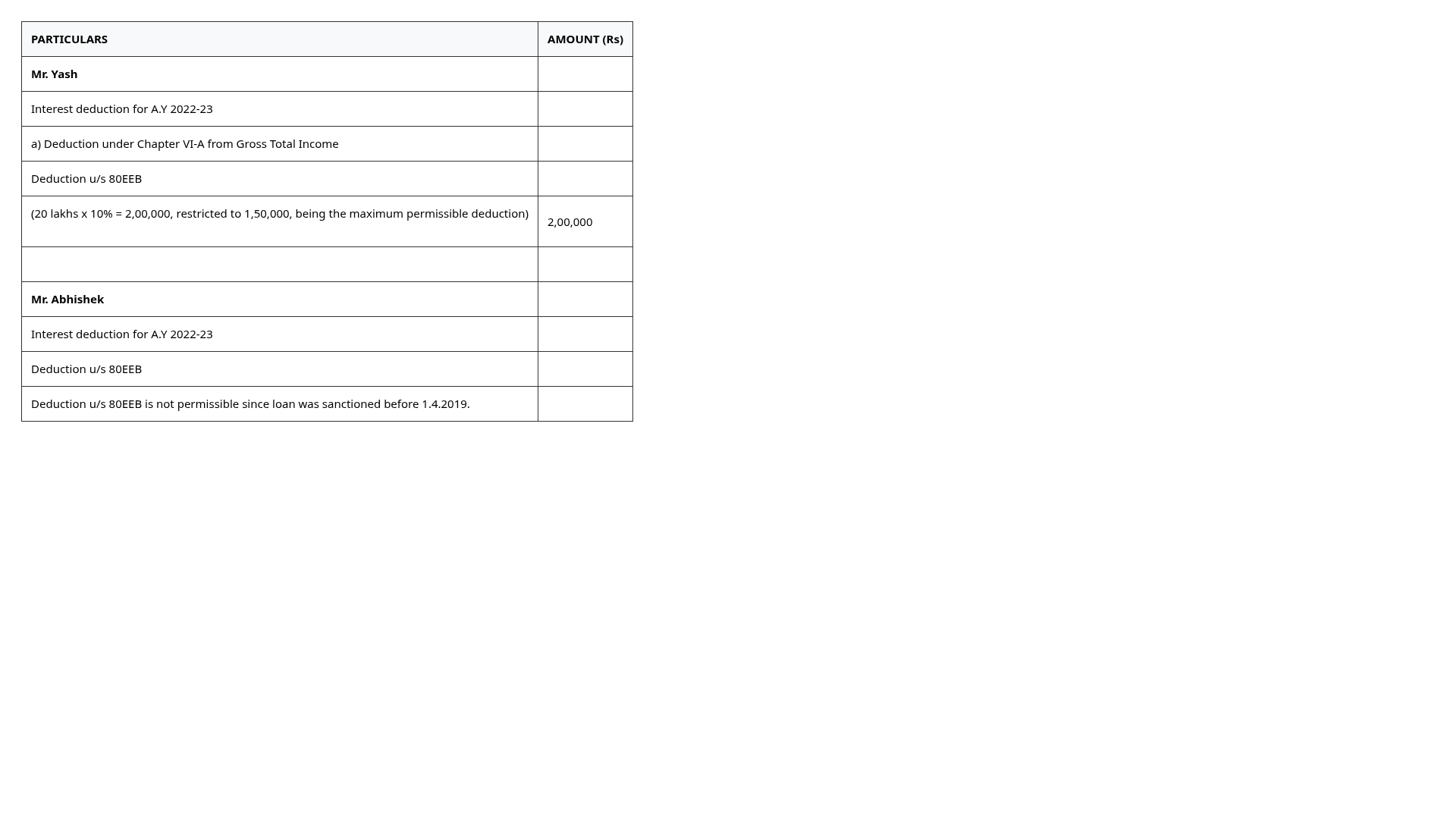

The following are the particulars relating to Mr. Yash and Mr. Abhishek salaried individuals, for A.Y.2022-23.

Compute the amount of deduction (if any) allowable under the provisions of the Income-tax Act, 1961 for A.Y.2022-23 in the hands of to Mr. Yash and Mr. Abhishek. Assume that there has been no principal repayment in respect of any of the above loans upto 31.03.2022.

SOLUTION

Conclusion

In conclusion, it can be said that people looking for a cleaner and cheaper mode of transport should consider electric vehicles as they are not only cost-effective but also futuristic. As fossil fuels are becoming costlier, electric vehicles are the way to go!

With the government's support in terms of tax exemption for loans, the vehicles are also more affordable than earlier, making it all the more valuable for individuals looking to own their first car.

However, the conditions of the new exemption clauses must be carefully read and considered before buying an electric vehicle. It would be best if you did not base a large chunk of your decision only on the available exemptions.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.