Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Understanding Section 80EE Deduction for Homebuyers

6 mins

6 mins 12.9K

12.9K"Happiness is buying your first home"

Indeed, the happiness of buying your first home is different. Especially, after going through a tedious process that begins with – finding the right home that fits within your budget and meets your needs – to the even more gruelling steps of availing a home loan.

However, this home loan can turn out to be beneficial for the first time buyer- taxpayer.

Tax benefits are available under Section 80EE for interest paid on loans (taken by a first time buyer-taxpayer) for the purpose of buying a residential property.

You (the taxpayer) can claim a deduction of up to Rs 50,000 every financial year as per this Section. The deduction can be claimed until you have fully repaid the loan.

What is Section 80EE of the Income Tax?

Section 80EE allows Income Tax Benefit on Interest on Home Loan to first time buyers in the following events:

- This deduction is available only if the purchase price of the property is less than Rs 50 lakhs and the loan amount is less than Rs 35 lakhs.

- The loan should be approved between April 1, 2016 and March 31, 2017.

- The benefit of this tax deduction would be available as long as the loan is being paid.

- From the Financial Year (FY) 2016-17 onwards, this deduction will be available to the eligible taxpayers.

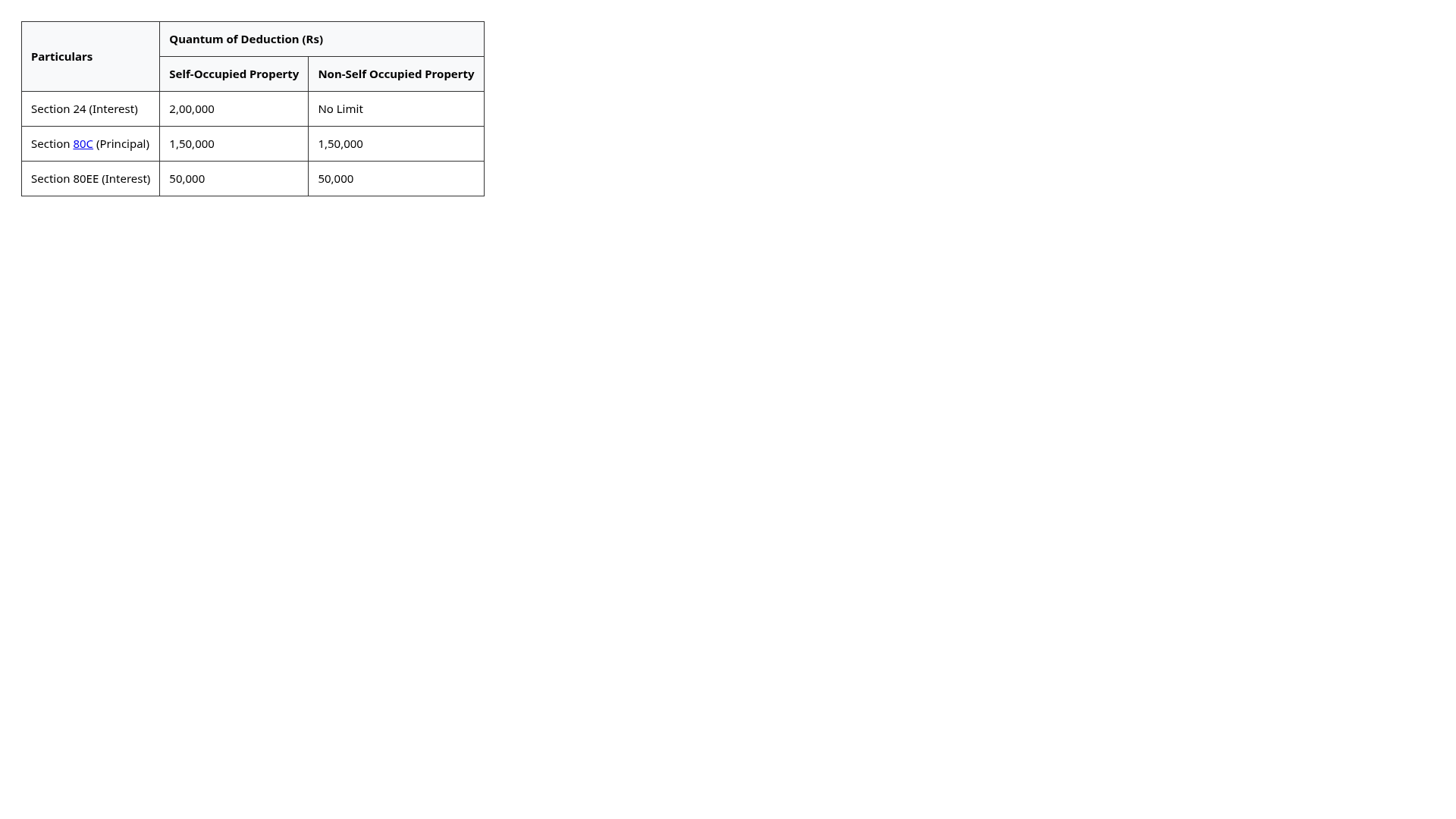

The following is a simple version of the above-mentioned section on home loan tax benefits:

Terms for Claiming Tax Benefits under Section 80EE

The conditions associated with claiming deductions under Section 80EE are as follows:

- Tax Deductions under Section EE are only available for the taxpayer's first house purchase.

- The deduction is only available if the house's market value is less than Rs 50,00,000.

- The tax deduction under this Section is available only if the amount borrowed as a home loan is not more than Rs 35,00,000.

- The loan should be approved between 1st April 2016 and 31st March 2017.

- Only the interest amount of the house loan is eligible for the tax deduction.

- It is compulsory that a recognised financial institution, like a housing finance company, a bank, or a non-banking financing company, approves the home loan taken by the taxpayer.

- A taxpayer would be expected to present the bank's declaration clearly stating the amount owed and paid towards interest and principal in order to claim the tax deduction under Section 80EE.

- The taxpayer who takes advantage of this deduction must not own another home at the time the loan is approved.

- The tax deduction is only available if the house loan is taken for residential purpose and not for commercial purposes.

- The tax deductions under Section 80EE are based per person and not per household. So, if a taxpayer bought a house together and took out a shared home loan, each person repaying the loan amount is eligible to claim the deduction separately.

- After declaring the above deductions of tax benefit on home loan, the balance Income of a person would be taxed as per the Income Tax Slab rates.

What is the eligibility criteria to claim tax deduction under Section 80EE?

The following are the requirements for claiming a deduction under Section 80EE:

- Under this Section, the individual taxpayers can claim tax deduction either individually or jointly.If a person and his or her partner bought a house at the same time and are both making loan payments, then both of them are eligible for this tax deduction.

- Only first-time home buyers are eligible for Section 80EE tax deduction. This means that the taxpayer must not own any residential house property at the time the loan is being approved.

- The taxpayer must have received the loan from a financial institution or bank to be eligible for this deduction.

- The tax deduction under Section 80EE is available as per person and not per property.

- This section allows you to claim a maximum deduction of Rs 50,000.

- As per Section 24, this tax deduction is above the limit of Rs 2,00,000.

- The tax benefit can be claimed regardless of whether the taxpayer lives in the house or rents it out to someone else.

- For example - You are still eligible to claim this deduction if you own a house in Pune but live in a rental property in Mumbai.

Who are not eligible to claim tax deduction under Section 80EE?

The following are not eligible to claim tax deduction(s) under Section 80EE:

- Association of Persons (AOP),

- Hindu Undivided Families (HUF) ,

- Companies,

- Partnership Firms or LLP,

- Trusts, and so on.

How to claim tax benefits under Section 80EE?

Here is what must be done to determine how much tax deduction can be claimed under Section 80EE:

- Calculate the total amount of interest paid on a property loan over the course of a Financial Year (FY).

- Claim a deduction up to Rs 2,00,000 (under Section 24(b) of the Income Tax Act, 1961) once the total interest amount paid is calculated.

- The extra amount can be claimed up to Rs. 50,000 under Section 80EE of the Income Tax Act, 1961.

How to claim tax benefits under Section 80EE and Section 24?

If you meet the requirements of both Section 24 and Section 80EE of the Income Tax Act, file your claim as soon as possible.

- First, use out your Section 24 deductible limit of Rs 2 lakh.

- Then, under Section 80EE, claim an additional tax benefit of Rs 50,000.

As a result, a total deduction of Rs 2,50,000 can be claimed.

What is the difference between Section 80EE and Section 80EEA?

The new Section 80 EEA in the Union Budget 2019 increases the tax benefits of the interest deduction up to Rs 1,50,000 for housing loans availed for affordable housing between 1st April, 2019 and 31st March, 2020. However, the individual taxpayer should be a first-time home buyer who is not eligible for the Section 80EE tax deduction.

–

Conclusion

As one can see, Section 80EE can result in huge annual savings. If you have a current home loan that you are repaying off, you should take advantage of Income Tax Section 80EE. Ensure that you use the tax deductions available under this Section and receive the much needed relief from paying taxes.

To get many more tax-saving tips, consult our trusted financial advisors NOW!

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.