Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

How Life Insurance Tax Benefits Help You Reduce Tax

13 mins

13 mins 3.1K

3.1KMost of us, especially the salaried people believe that the best time to start tax planning is always at the beginning of a financial year. That is the time we get our increments and bonuses, and self-employed/businessmen have a clear idea of how much they have earned during the previous year.

Invariably, we end up investing in a hurry without proper planning or evaluating various tax saving products and features during the last quarter of the financial year (January-March period). These tricky times pose several challenges for us. Investing a portion of your total savings in some securities is an ideal method of tax planning out of which life insurance is one of the most effective and preferred avenues across all investments.

While the main objective of life insurance is to provide financial protection to its beneficiaries, in case of unforeseen events, it also goes a step ahead to offer a host of tax benefits which is an icing on the cake. How much life insurance an individual needs largely depends on factors such as regular income, expenses, financial obligations, and future goals like education, marriage etc. Not only life insurance but health insurance also helps you save overall on the net tax liability, with greater advantage for senior citizens.

Both life and health insurance policies give you tax benefits. Let's start with life insurance and its tax benefits.

Under the Income Tax Act, 1961 total income from all the heads of income is referred as "Gross Total Income" (GTI). In order to arrive at taxable income, one has to deduct from Gross Total Income, the deductions allowable under Chapter VIA (i.e., under section 80C to 80U). In other words, we can say that Taxable Income = Gross Total Income less Deductions under section 80C to 80U.

For Example - Suppose the gross total income amounts to Rs 8,00,000. This means that your tax liability for the year would be computed for Rs 8,00,000 based on your income bracket in the absence of any deductions. Suppose you have invested in life insurance amounting to Rs 1,50,000 and health insurance amounting to Rs. 25000. Therefore, you can claim a deduction of Rs 1,50,000 per year under section 80C and Rs. 25,000 under section 80D. This will result in Gross Total Income being reduced by Rs. 1,75,000 which would be deducted from your taxable income, i.e. Rs 8,00,000. Thus, your tax liability would now be calculated on Rs 6,25,000.

Life Insurance

Payment of premium on life insurance policy and health insurance policy not only gives insurance cover to a taxpayer but also provides certain tax benefits. In this part you can gain knowledge about deductions available to a taxpayer on account of payment of life insurance premium, payment of health insurance premium and expenditure on medical. Let's check the life insurance tax benefits –

For Premiums Paid

- Section 80C

Section 80C provides deduction in respect of various items like life insurance premium, investment in Public Provident Fund, investment in NSC , repayment of principal component of housing loan, investment in Post Office Time Deposit Scheme, Senior Citizens Saving Scheme, children's tuition fees etc. We will focus on the provisions of section 80C relating to deduction on account of payment of life insurance premium. Overall deduction u/s 80C (along with deduction u/s 80CCC & 80CCD ) allowed is up to Rs. 1,50,000.

Premiums paid for a life insurance policy , whether it is traditional or ULIP qualifies for tax exemption under this section. The maximum allowable deduction is ₹1.5 lakhs and to claim this deduction your premiums should not be more than 10% of your sum assured if it has been issued after 1st April 2012. In case the policy is issued before 1st April 2012 then premium paid should not be more than 20% of sum assured. So, if you policy's sum assured is ₹10 lakhs, the premium should be up to ₹1 lakh to be eligible for 80C deduction from your taxable income.

Also, in case of death, the sum assured that's paid to the nominee continues to be tax-free.

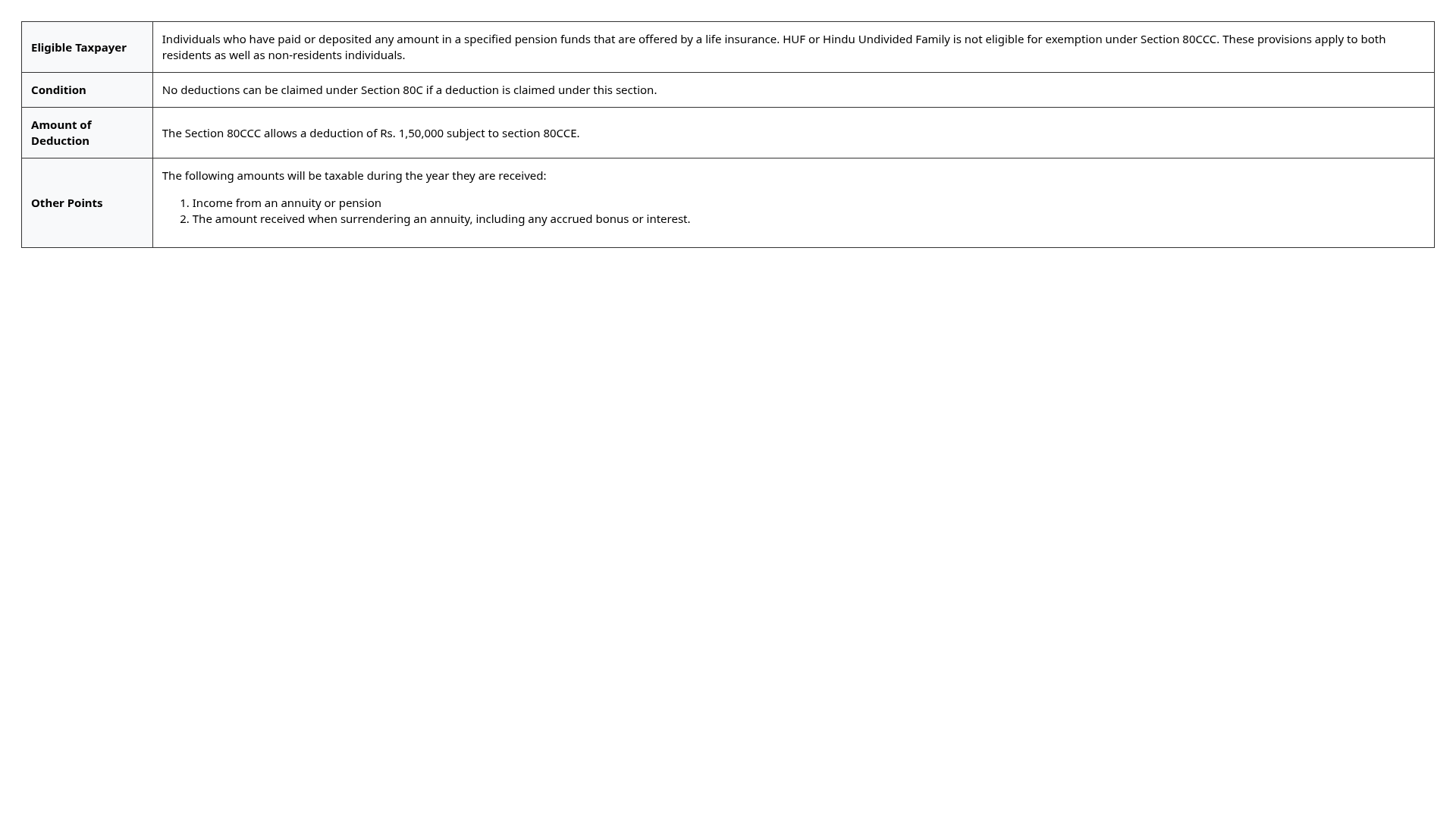

- Deduction under Section 80CCC–

For Benefits Received

- Section 10 (10D)

Under this section, any benefit received from a life insurance plan is tax-free in the receiver's hands. There is no maximum limit under this section. Any amount of money received through a life insurance policy is applicable for tax-exemption. The benefits can be maturity benefit, death benefit or surrender benefit. Individuals (salaried and non-salaried), Hindu Undivided Families (HUFs) , Associations, Trusts, Companies, Body of Persons, Foreign Companies, and others can claim these exemptions. However, in case of surrender benefit, the following points should be remembered for claiming tax-exemption -

- For single premium traditional life insurance plans (except pension plans), the surrender value is tax-free only if you surrender the policy after the completion of 2 policy years.

- If you have a regular premium policy, premium payment for 2 years is compulsory if you want to claim tax-exemption on the policy's surrender value.

- For ULIPs, there is a lock-in period of 5 years. Surrendering the plan only after the lock-in period makes the surrender value tax-free.

- Surrender value of pension plans is not tax-free. You have to pay income tax whenever you surrender a pension plan.

- Condition:10(10D) benefit will not be available in case the premium exceeds 10% or 20 % as the case may be.

Health Insurance

Health insurance premium payments made in a given year are eligible for deduction from total income for any "Individual" or "HUF" under Section 80D . Additionally, top-up health plans, critical illness insurance, and critical illness riders are also eligible for this deduction.

The deduction benefit is available when purchasing a health insurance plan for yourself, your spouse, your dependent children, or your parents.

What's best is that this deduction(s) can be claimed along with claiming deductions allowed by Section 80C.

Who is eligible for deduction under Section 80D?

Deduction for medical insurance premiums and medical expenses for senior citizens is allowed to the Individual or HUF category of taxpayers only. For individual or HUF taxpayers, insurance can be availed for:

- Self

- Spouse

- Dependent children

- Dependent Parents

- Dependent Parent-in-laws

Any other entity cannot claim this deduction. For example, a company or a firm cannot claim a deduction under this Section.

What payments are eligible as deduction under Section 80D?

The following payments are eligible for deductions under Section 80D for either an individual or HUF:

- A health insurance premium paid in any way other than cash for the self, spouse, kids, or parents who are dependent.

- Expenses related to preventative health checkups

- Costs associated with treating a senior (60 years of age or older) who is not covered by a health insurance plan.

- The payment given to the Central Government's health scheme or any other program that the government has announced.

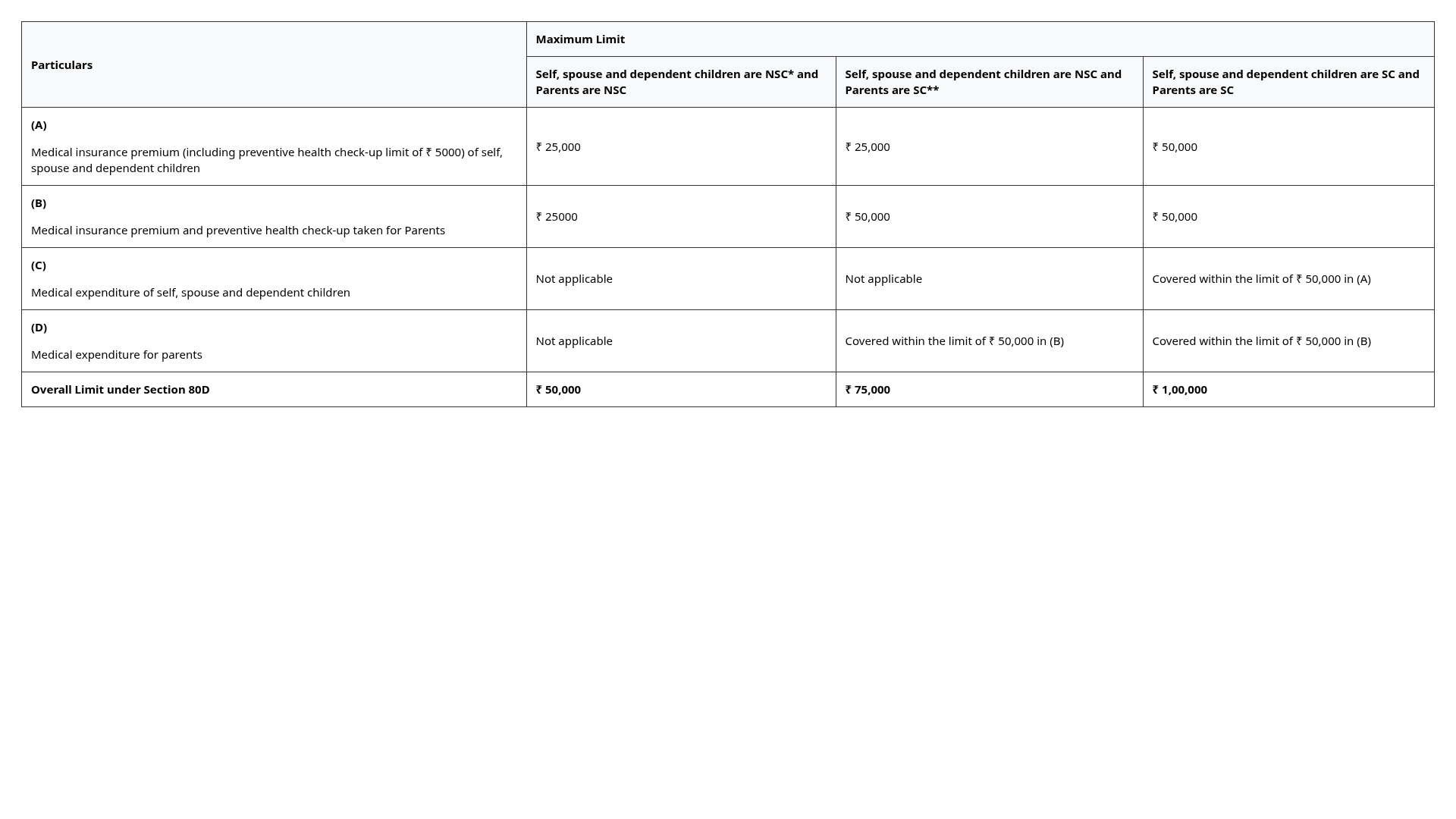

Deduction available under Section 80D

The amount of deduction that an individual taxpayer is eligible for under various circumstances is shown in the following table:

*NSC – Non Senior Citizen *SC – Senior Citizen

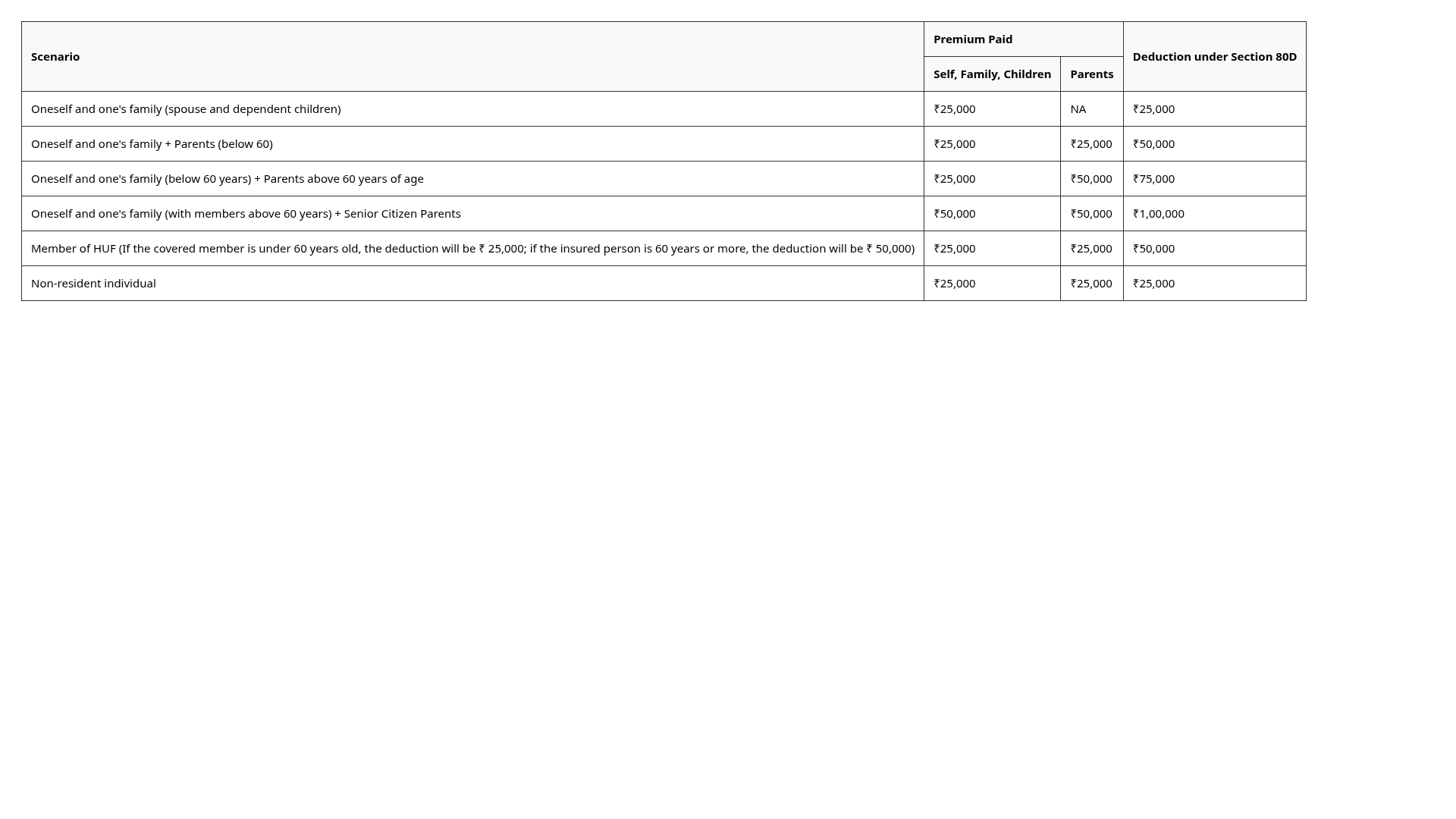

Individual:

- You - an individual taxpayer may deduct up to ₹ 25,000 for your own health insurance as well as their spouse and dependent children's insurance.

- If your parents are older than 60, you may be eligible for an additional/separate deduction of up to ₹ 50,000. If your parents are below 60 years of age, you may be eligible for deduction of up to ₹ 25,000 only.

- If you pay medical costs for senior citizens (yourself, your spouse, your dependent children, or your parents) that are not covered by health insurance, you may be eligible to get such expenses covered under the deduction limit of up to the ₹ 50,000.

- The maximum deduction available under this clause is ₹ 1,00,000 if both the taxpayer and the taxpayer's parents are older than 60 years old and have medical insurance. You may deduct the costs associated with treating elderly people (taxpayer/family and parents) for medical purposes up to the allotted amount if they are not covered by health insurance.

- Senior citizens over the age of 60 include both senior and very senior persons.

HUF - Hindu Undivided Family

- Any medical claim made for one of the HUF's members may be deducted under Section 80D.

- If the covered member is under 60 years old, the deduction will be ₹ 25,000; if the insured person is 60 years or more, the deduction will be ₹ 50,000.

Example:

Ashish is 45 years of age and his father is 75 years of age. The insurance premiums Ashish pays for his father's and his own medical coverage are ₹ 30,000 and ₹ 35,000, respectively. What is the highest amount he might deduct in accordance with Section 80D?

Answer:

Ashish is eligible to receive up to ₹ 25,000 for the insurance premium he paid. Regarding the policy bought for his father (a senior citizen), Ashish is eligible to receive up to ₹ 50,000. The permitted deductions in the example situation are ₹ 25,000 and ₹ 35,000. So, he can deduct a total of ₹ 60,000 for the entire year.

What is a preventive health check-up under Section 80D?

In 2013–14, the government passed a preventative health checkup deduction to motivate people to take a more proactive approach to their health. Through regular health examinations, the goal of preventative health check-ups is to spot any illnesses early on and reduce risk factors.

A deduction of ₹ 5,000 is allowed under Section 80D for any payments made for preventative health checkups. This deduction will not exceed the overall cap of ₹ 25,000 or ₹ 50,000, as applicable.

The individual may also claim this deduction on behalf of himself, his spouse, any dependent children, or his parents. Cash is accepted as payment for preventive health checks.

For Example:

For the financial year 2020–2021, Abhishek has paid a health insurance premium of ₹ 23,000 to cover the health of his wife and any dependent children. He spent ₹ 5,000 on a health examination for himself as well.

Section 80D of the Income Tax Act allows Abhishek to deduct a maximum of ₹ 25,000. Hence, ₹ 23,000 have been approved for the payment of insurance premiums, and ₹ 2,000 have been approved for medical examinations. The deduction for preventative health exams has been limited to ₹ 2,000 because the total deduction in this instance cannot be more than ₹ 25,000.

Note:

What we need to keep in mind is that if the mode of payment is in cash, you cannot avail of any tax benefits.

So, a life and a health insurance plan helps lower your taxable income by giving you tax-free deductions. So, if you want to lower your tax-outgo, invest in insurance.

Life Insurance: A Multi-Purpose Option

Let's see the options and benefits

- You need to ensure that the sum assured of the policy is at least 10 times that of annual premium in the year of premium payment.

- You can purchase life insurance in the form of a term plan, traditional savings and protection plan, whole life plan, ULIP or as a pension plan.

- You can avail a tax benefit by way of deduction towards premium paid on life insurance policies up to ₹ 1,50,000 under Section 80C of the Income Tax Act, 1961. This also includes premium paid by you for life insurance for your spouse or premium paid for your child's policy.

- If your nominee claims the insurance money in case of your unfortunate demise, the claim amount is also tax deductible under Section 10(10D). The same benefit is extended to Unit Linked Insurance Plans (ULIPs) and retirement plans under Section 80CCC.

- If you have taken any pension/annuity plan, you will be allowed a deduction up to ₹ 1,50,000 upon investment. On maturity of the accumulated amount, 2/3rd of the income is taxable, while the remaining 1/3rd is tax free.

- Unlike other savings instrument, life insurance has an additional EEE (Exempt-Exempt-Exempt) benefit – the amount you invest, the amount that your investment earns and the amount that you finally receive is all exempted from income tax.

- There are various riders or additional benefits that can be added to a life insurance plan, at a minimum cost, which will also offer tax benefits.

A Better Option to Choose-Other tax-saving instruments like a tax saving fixed deposit, for instance, will offer you peace of mind but there is usually a lock-in period where the money cannot be withdrawn before maturity. The interest that you earn on FDs is also taxable.

The ideal choice- Thus, life insurance is one of the most attractive propositions for those looking to provide protection to their families – with the added benefit of tax savings! This is a win-win situation towards achieving financial security as a tool towards optimising health, wealth and happiness.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.