Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Tax Planning: Use Income Tax Section 80 to Save Tax Legally

13 mins

13 mins 19.1K

19.1KTax Planning: Use Income Tax Section 80 to Save Tax Legally

Taxes on your hard-earned income leave a sour taste in your mouth, don't they?

This is why you consult your tax advisor and Chartered Accountant to find ways to save tax. We have a little tip for you - if you understand how Section 80 works, you can save taxes yourself.

Tax-saving expenses and investments are described in Chapter VI A of the Income Tax Act and can be found in different variations of Section 80.

So, if you're looking for ways to save on taxes, check out the following sections.

Section 80C

Deduction for - Investments

Deduction Limit - ₹1,50,000

It is one of the most popular and preferred sections among taxpayers. This is because it allows you to save a maximum tax of ₹1,50,000 every year of your taxable income.

Investments eligible for Section 80C benefits include:

- Life insurance premiums paid which should be up to 10% of the sum insured

- Investments done in an ELSS scheme

- Investments done in ULIPs

- Public Provident Fund (PPF)

- Employees’ Provident Fund (EPF)

- 5-year tax saving Fixed Deposits (FDs)

- Sukanya Samriddhi Yojana (SSY)

- Senior Citizen Saving Scheme (SCSS)

- National Saving Certificates (NSC)

- Tuition fees paid for two dependent children

- Repayment of principal component of home loan, etc.

- Stamp duty and registration charges for purchase of property

Individuals and HUFs can benefit from this deduction. Companies, partnership firms, and LLPs are not eligible for this deduction.

Did You Know?

As per section 80CCE the combined maximum limit for deduction which can be availed under section 80c, 80ccc and 80ccd (1) is Rs 1,50,000.

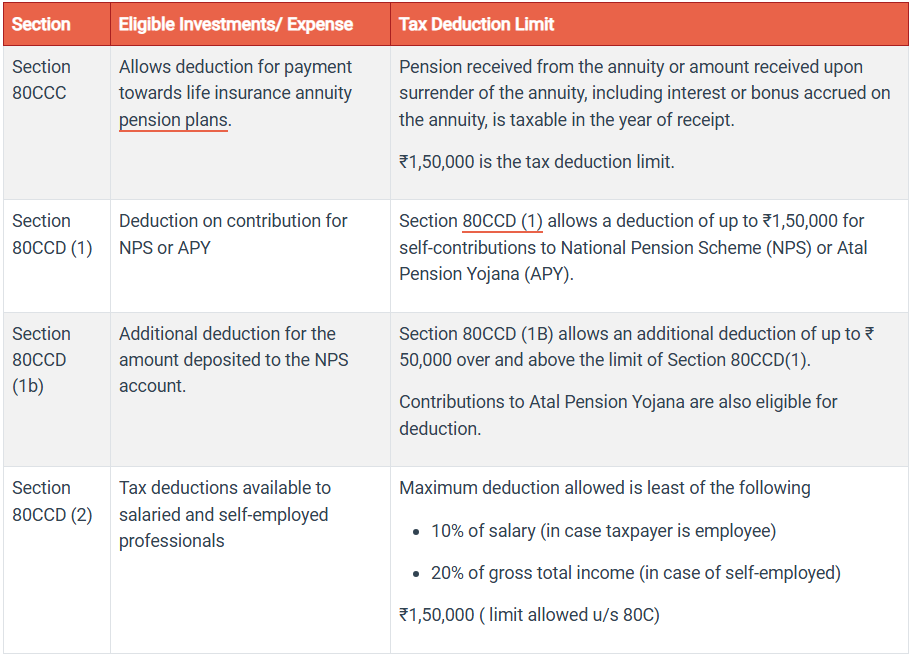

Under section 80C, there are subsections 80CCC, 80CCD (1), 80CCD (1b), and 80CCD (2).

Section 80CCC – Insurance Premium and Section 80CCD – Pension Contribution

The following are the eligible investments and/or expenses under the subsections of Section 80C:

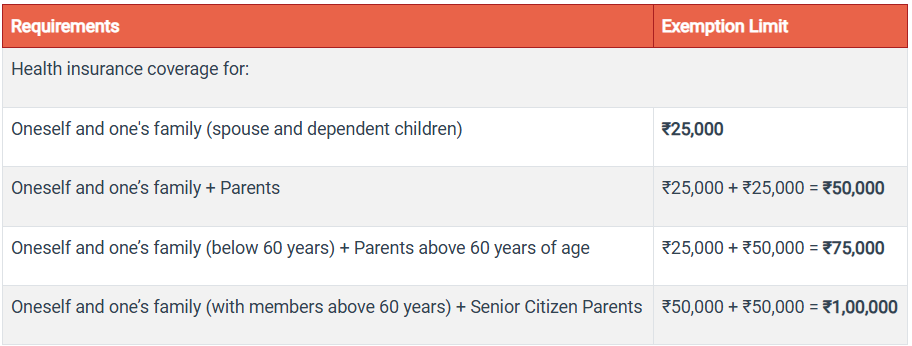

Section 80D

Deduction For: Premiums Paid Towards Health Insurance Policies

Deduction Limit: Subject to Specific Conditions

Health check-up expenses are also eligible for a tax rebate of ₹5,000 under Section 80D.

The health check-up exemption is inclusive of the ₹25,000 rebate on health insurance. In other words, people who have claimed ₹5,000 for medical check-up costs may be eligible for a rebate of ₹20,000 on their premium charges.

Section 80DD

Deduction For - Medical or rehabilitation expenses paid for a handicapped dependent.

Deduction Limit:

- ₹75,000 for people with 40% to 80% disability

- ₹1,25,000 for people with higher than 80% disability

It is related to the tax deduction available in the following cases:

HUFs and individuals paying for a disabled family member's treatment and wellbeing are eligible to claim exemptions under Section 80DD on the total income spent.

The coverage limit is determined by the percentage of disability, with people with 40-80% disability eligible for a deduction of ₹75,000.

Whereas, families that are caring for an individual with a disability of more than 80% can receive ₹1.25 lakh for all their related expenses. This benefit is only available to the dependent individual's family.

Suggested Read: Know Tax Deduction on Medical Expenses of Disabled Dependent under Section 80DD.

Section 80DDB

Deduction For - Medical expenses paid for oneself or dependents in treating a specific illness or disability

Deduction Limit - ₹40,000 (₹1,00,000 for senior citizens)

When you pay for the treatment of a family member diagnosed with one or more specific diseases, you may be eligible for a tax waiver.

Individuals under the age of 60 are eligible to receive a maximum of ₹40,000. Accordingly, such waivers are increased to ₹1 Lakh for senior citizens (60-80 years old) and super seniors (over 80 years old).

A waiver may be given for the treatment of critical illnesses such as malignant cancers, chronic renal disease, AIDS, haematological ailments, and neurological diseases (causing 40% or more disability).

Medical expenses reimbursed by an employer or insurer will be deducted from the amount the taxpayer may deduct under this section.

For such deductions, you will also need a prescription from the relevant specialist.

80DDB Eligibility

Procedure to Receive Section 80DDB Deduction

Section 80E

Deduction For - Interest Paid Towards Education Loan

Deduction Limit - No Limit

In the financial year, the interest part of the EMI is deducted. There is no maximum amount that can be deducted.

A bank certificate, however, is required. This certificate should separate the principal and interest portions of the education loan you paid during the financial year.

A deduction will be allowed for the total interest paid. No deductions will be allowed for the principal repayment.

According to the amount of funds required, an education loan can either be unsecured or secured.

It is important to note, however, that such waivers are limited to the first eight years of loan repayment. After eight years, interest paid will be taxable.

Section 80EE

Deduction For - Home Loan Interest for First-time Buyers

Deduction Limit - ₹50,000 | plus benefits from Section 24(b)

If the property value is less than ₹45 Lakh, first-time home-buyers can claim additional interest benefits up to ₹50,000 over Section 24(b) on home loan EMIs. This effectively allows up to ₹2.5 Lakh to be saved in taxes in addition to the Section 80C deduction.

For a tax rebate on EMI payments under Section 80EE, an applicant must not have owned any other property before applying for a home loan.

Section 80EE: Income Tax Deduction for Interest on Home Loan

Section 80EEA - Claim deduction for the interest paid on housing loan

Section 80G

Deduction For - Donations Made to Charitable Organisations

Deduction Limit - Either up to 100% or 50% with or without restriction as specified in the Section.

Entire contribution to a charitable organisation is exempt from taxes under Section 80G. The various donations specified in u/s 80G are eligible for deduction up to either 100% or 50% with or without restriction.

Cash donations are exempt from tax calculations for up to ₹2,000 per year. Such contributions must, however, be made to registered charitable organisations.

a. Donations with a tax 100% deduction

- Fund set up by a State Government for the medical relief to the poor

- National Illness Assistance Fund

- National Blood Transfusion Council or to any State Blood Transfusion Council

The Army Central Welfare Fund or the Indian Naval Benevolent Fund or the Air Force Central Welfare Fund, Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities

- National Sports Fund

- National Cultural Fund

- Fund for Technology Development and Application

- National Children’s Fund

- Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund with respect to any State or Union Territory

- National Defence Fund set up by the Central Government

- Prime Minister’s National Relief Fund

- National Foundation for Communal Harmony

- An approved university/educational institution of National eminence

- Zila Saksharta Samiti constituted in any district under the chairmanship of the Collector of that district

- The Maharashtra Chief Minister’s Relief Fund during October 1, 1993 and October 6,1993

- Swachh Bharat Kosh (applicable from financial year 2014-15)

- Clean Ganga Fund (applicable from financial year 2014-15)

- National Fund for Control of Drug Abuse (applicable from financial year 2015-16)

- Chief Minister’s Earthquake Relief Fund, Maharashtra

- Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of earthquake in Gujarat

- Any trust, institution or fund to which Section 80G(5C) applies for providing relief to the victims of earthquake in Gujarat (contribution made during January 26, 2001 and September 30, 2001) or

- Prime Minister’s Armenia Earthquake Relief Fund

- Africa (Public Contributions — India) Fund

b. Donations with a 50% tax deduction

- Prime Minister’s Drought Relief Fund

- Jawaharlal Nehru Memorial Fund

- The Rajiv Gandhi Foundation

- Indira Gandhi Memorial Trust

c. Donations to the following organisations are eligible for a 100% deduction subject to a 10% deduction of adjusted gross income

- A contribution by a company to the Indian Olympic Association or any other notified association or institution established in India for the development of sports infrastructure or for the sponsorship of sports in India.

- The government or any approved local authority, institution, or association can be used to promote family planning.

d. Donations to the following organisations are eligible for a 50% deduction subject to a 10% deduction of adjusted gross income

- Government or any local authority to be utilised for any charitable purpose other than the purpose of promoting family planning

- Any other fund or any institution which satisfies conditions mentioned in Section 80G(5)

- Any corporation referred in Section 10(26BB) for promoting the interest of minority community

- Any authority constituted in India for the purpose of dealing with and satisfying the need for housing accommodation or for the purpose of planning, development or improvement of cities, towns, villages or both

- For repairs or renovation of any notified temple, mosque, gurudwara, church or other places.

Section 80GG

Deduction For - House Rent Allowance (HRA), if NOT Included in the Salary Breakdown

Deduction Limit - Specified Conditions

Section 80GG allows you to claim exemptions on your total taxable income if your company does not include the HRA component in your salary breakdown. The following are the conditions where deduction for house rent paid are eligible for tax deduction under this section:

- Rent paid without HRA may be deducted under Section 80GG. The taxpayer, their spouse or their child should not have a residence at the place of work

- There should be no other self-occupied residential property owned by the taxpayer

- Taxpayers must live on rent and pay rent

- Individuals can take advantage of the deduction

In the case of tax-saving investments other than 80C, tax waivers are granted to the least of the following:

- Monthly ₹5,000

- The total annual income of 25%

- 10% of the basic annual income.

Section 80GGA

Deduction For - Donations for Scientific Research and Rural Development

Deduction Limit - No Limit

Tax exemptions can be claimed under Section 80GGA for donations for scientific research and rural development.

Such deductions can be made on 100% of the income spent, as long as it was made through a bank account and documented.

Section 80GGB

Deduction for: Donations Made to Political Parties or an electoral trust. (Indian companies are eligible to claim benefits)

Deduction Limit: No limit – subject to donation should not be made in cash or kind.

According to Section 80GGB of the Income Tax Act 1961, any Indian company that contributes any amount to a political party or electoral trust registered in India can deduct that amount from its income tax liability.

Section 80GGC

Deduction For - Donations Made to Political Parties or an electoral trust.

Deduction Limit - No Limit

The 80GGC can be claimed by any individual except by local governments or artificial juridical persons that receive government funding in whole or in part.

Individuals, Hindu Undivided Families (HUF), firms, AOPs, BOIs, and Artificial Juridical Persons are eligible for making contributions under Section 80GGC. However, the government should not fund the Artificial Juridical Persons.

Note that the contribution is available for deduction only if made through wired bank transfers.

Additionally, under the Representation of People Act (RPA) of 1951, the political party to which such contributions were made must be registered.

Section 80RRB

Deduction For - Income by way of Royalty of a Patent

Deduction Limit -Lower of ₹ 3,00,000 or income received

Any royalty income from a patent registered on or after 1 April 2003 under the Patents Act 1970 can be deducted up to ₹ 3,00,000 or the amount received, whichever is less.

The taxpayer must be a resident of India and an individual patentee. The taxpayer must submit a certificate duly signed by the prescribed authority in the prescribed form.

Section 80TTA

Deduction For - Interest Earned on Savings Account Deposits

Deduction Limit - ₹10,000

A maximum of ten thousand rupees can be deducted from the net total interest earned from the savings accounts with the bank and/or post office. FDs, RDs, and corporate bonds are not included in interest income.

Multiple savings accounts in different banks are treated as a single account, so that their cumulative interest is taxed under 'income from other sources'.

For interest income that exceeds ₹10,000 in one year, only the excess amount over the cap is taxed at rates determined by the aggregate annual income.

Suggested Read: Section 80TTA Can Help You Save Tax on Savings Account Interest Income

Section 80 TTB – Interest Income

Deduction For - Interest Earned on Deposits for Senior Citizens

Deduction Limit - ₹50,000

In Budget 2018, a new Section 80 TTB was introduced, which allows senior citizens to deduct interest income from deposits. The deduction limit is capped at ₹50,000.

Section 80TTA shall not be used for any further deductions. The TDS on interest income payable to senior citizens will also be raised by amending section 194A of the Act along with section 80 TTB.

Section 80U

Deduction For - Individuals with Disabilities Receive Income Tax Benefits

Deduction Limit:

- ₹75,000 for 40% to 80% disability

- ₹1,25,000 for higher than 80% disability

Section 80U allows disabled individuals to claim tax waivers if they are certified by a registered medical authority to be 40% disabled.

People with disabilities whose disabilities are between 40% to 80% can claim ₹75,000, while those with disabilities more than 80% can claim ₹1.25 lakhs in tax benefits.

Conclusion

So, these sections, under the purview of Section 80, help you in saving taxes. These allow tax deductions from your taxable income. Since the income is lowered, the tax liability also reduces. So, use these sections depending on their suitability and save your hard-earned money from the incidence of tax.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.