Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

11 salary components that can help you save on tax

9 mins

9 mins 35.4K

35.4K11 salary components that can help you save on tax

Income Tax is applicable to the salary earned by an employee from the employer. Income Tax Act, 1961 gives power to the government to take income tax from salaried persons. It is a direct tax which helps increase the revenue of the government for it to be able to spend throughout the year.

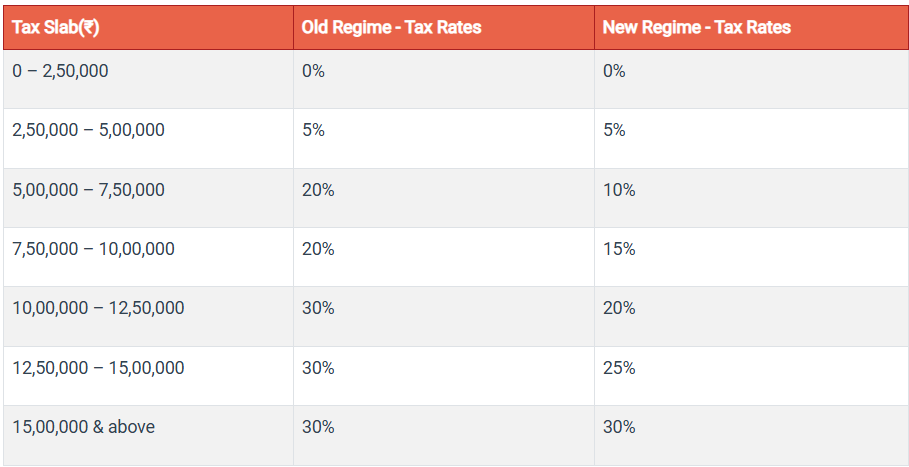

In India, there are different income tax slabs and income tax is charged according to these slabs. The government can only change the slabs of income tax from time to time. In India, the slabs for income tax for the Financial Year 2021-22 (Assessment Year 2022-23) are as mentioned below. In addition to income tax, a salaried person also has to pay education CESS as a percentage of the total tax liability.

In India, there are different tax rates for different slabs of income. Every salaried person has to pay applicable Income-tax while as per the provisions of the law. This very much depends on the salary structure given by the company, until and unless specified by you.

Below mentioned are 8 highly recommended salary components in your CTC to reduce the outgo of income tax from your salary.

#1. House Rent Allowance (HRA)

Least of the following is exempt:

- Actual HRA Received

- 40% of Salary (50%, if house situated in Mumbai, Kolkata, Delhi or Chennai)

- Rent paid in excess of 10% of salary.

If you live with your parents, and you are paying them rent and getting a receipt for the same, you can claim the HRA deduction for the same. Additionally, your parents must report the rental income in their tax return.

Suggested Read: How you can claim even if you don’t receive HRA.

#2. Employee Contribution to Recognised Provident Fund (EPF)

EPF is a very good tax-saving and investment scheme.

The employer is required to contribute to a recognised provident fund for the employee's benefit. The employee can also make a contribution. The employer’s contributions of up to 12% of pay (Basic + DA) are tax-free. The amount

- The employer's contribution amount will be included in the C.T.C.

- Employee contributions to Recognized P.F. will be eligible for the 80 C deduction.

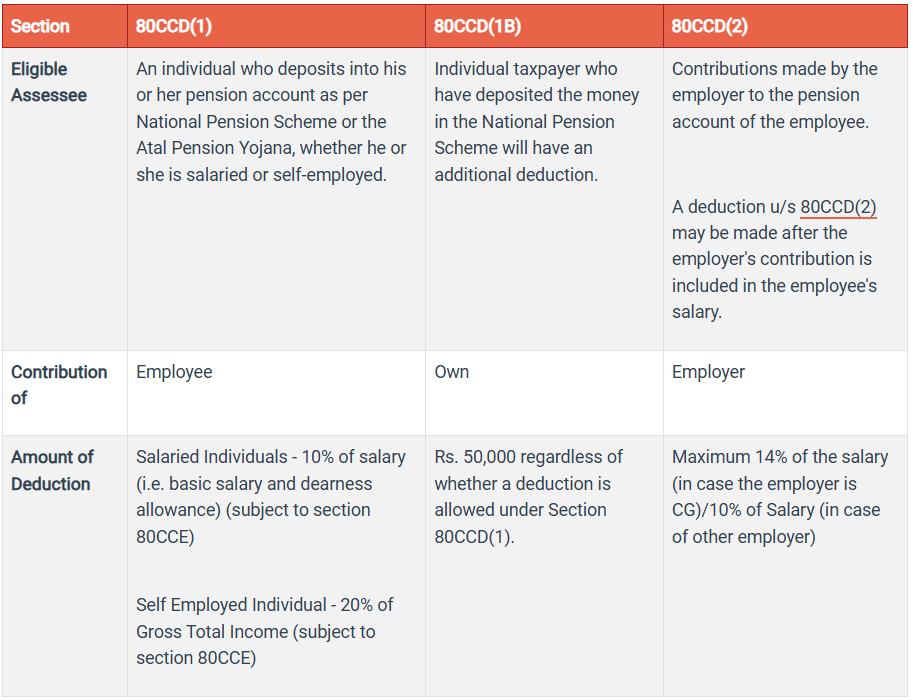

#3. National Pension System (NPS)

The government of India has notified deductions for contributions to pension schemes. The deductions fall into three categories:

#4. Standard Deduction

Rs 50000 or the amount of salary, whichever is lower is allowed as deduction from the year 2019 and it covers both conveyance allowance and medical allowance, which were earlier calculated separately.

#5. Mobile Phone and Internet Bill Reimbursement (refund)

It is a compensation for the employee's house landline phone, broadband connection, and cell phone. The exemption amount will be the lesser of the two;

- Total amount spent

- Amount of compensation received

Suggested Read: Can my work-related phone and WiFi bills help me reduce taxes?

#6. Meal Coupons

Some workplaces issue food coupons that can be used to pay for meals at various restaurants. These meal vouchers are tax exempt up to Rs 50 per meal.

#7. Uniform allowance

You may be eligible for a refund for the costs of buying and maintaining the office uniform. The exemption amount will be the lesser of the two;

- Total amount spent

- Amount of compensation received

#8. Leave Travel Allowance

You are eligible to claim exemption for LTA if you are going on a vacation subject to exemption limit as specified under the Income Tax Act, 1961. This exemption applies to the employee's when the journey is performed by rail, aircraft, or bus. The exemption is as below :

If travel by Air : Maximum exemption shall be economy fare calculated by the airlines considering shortest route to the Destination.

Where place of origin and destination is connected by Railways and the Journey is performed between such places : Maximum exemption shall be not more than air-conditioned first class rail fare by the shortest route.

Where place of origin and destination is not connected by Railways : In case recognized public transport exist, maximum exemption will be of amount not exceeding first class fare of such transport by shortest route. In case recognized public transport does not exist, amount equal to air conditioned first class rail fare.

This exemption does not apply to any additional local transportation, sightseeing, hotel accommodations, meals, or other expenses. The lower of the two exemptions will be allowed:

The employer provides LTA.

Exemption based on expenses incurred or the applicable amounts subject to the conditions covered above for each method of transportation.

#9. Transportation or Conveyance Allowance

This refund is offered for travel to and from work.

You can claim a monthly exemption of up to ₹ 1,600. However, tax exemption on conveyance allowance has been replaced and included in the Standard Deduction allowed. Therefore, no separate exemption will be allowed for conveyance allowance.

The exemption is increased to ₹ 3,200 in the case of handicapped individuals.

#10. Medical Reimbursement and Medical Allowance

Medical allowance is a part of the salary, exactly like dearness allowance. It is totally taxed.

Medical reimbursement is a refund of the employee's or his family's medical expenses. The exemption amount will be the lesser of the two;

- Amount actually reimbursed or

- Rs 15,000

However, with the amendment coming in Budget 2018, tax exemption on medical reimbursement has been replaced and included in the Standard Deduction allowed. Therefore, no separate exemption will be allowed for Medical Reimbursement from FY 2018-19.

#11. Car maintenance allowance

If an employee uses a company's car and the company repays the driver's wage, insurance, maintenance, and fuel expenses, the taxable value is Rs 2,700 per month (cars with cubic capacity within 1.6 Litre) or Rs 3,300 per month (cars with engines over 1,600 cc) (car with cubic capacity exceeding 1.6 Litre).

An exemption of Rs 2,700 per month or Rs 3,300 per month in respect of the driver salary, maintenance, and fuel expenditures paid and refunded by the employer if the employee owns the car.

How are these Allowances Calculated in a Salary?

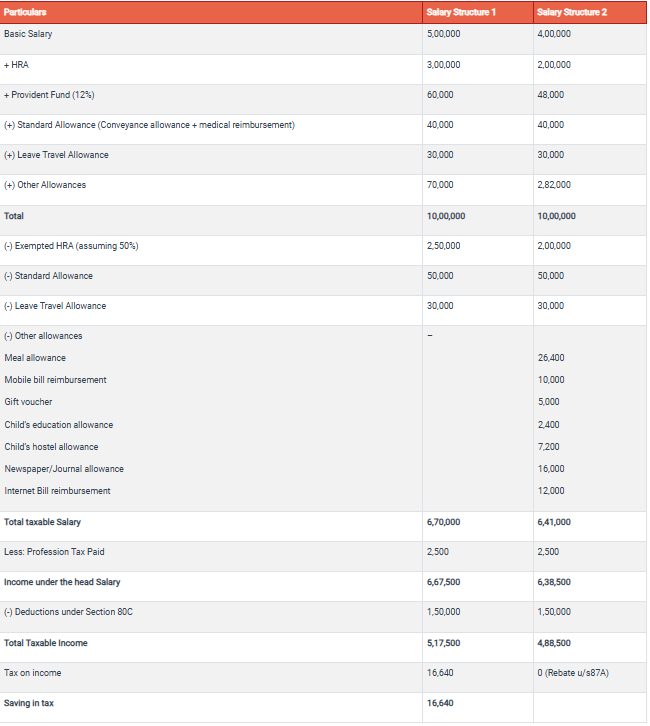

Let's look at an example to see how you can save money on taxes by properly structuring your salary.

Mr. Shah works for a reputable company and earns INR 10,00,000 per year. Let's look at his pay structure from different angles:

Conclusion

The earlier-mentioned components help employees save money by providing tax-free methods to pay for things like lodging, meals, and phone calls. Make the most of them by structuring your salary in such a manner that you can plan your taxation.

Sections 80C and 80D can help you save even more money on taxes. Connect with a trusted advisor to learn more!

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.