Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Income Tax Return Due Date for AY 2022-23/2023-24/2024-25

15 mins

15 mins 278.4K

278.4KHas the Income Tax Due Date for AY 2022-23 Extended?

The one word answer to this is "NO" to income tax due date for AY 2022-23 has not extended. However, if you have missed filing your income tax returns, here's what you have to do.

What if the due date for filing the return is missed?

If the original due date for filing an income tax return is missed, you can file a return later after the due date - such return is known as a "belated return". The income tax department also mentions the date by which the belated return must be filed. This deadline has been pushed back three months to December 31st of the assessment year (unless extended by the government).

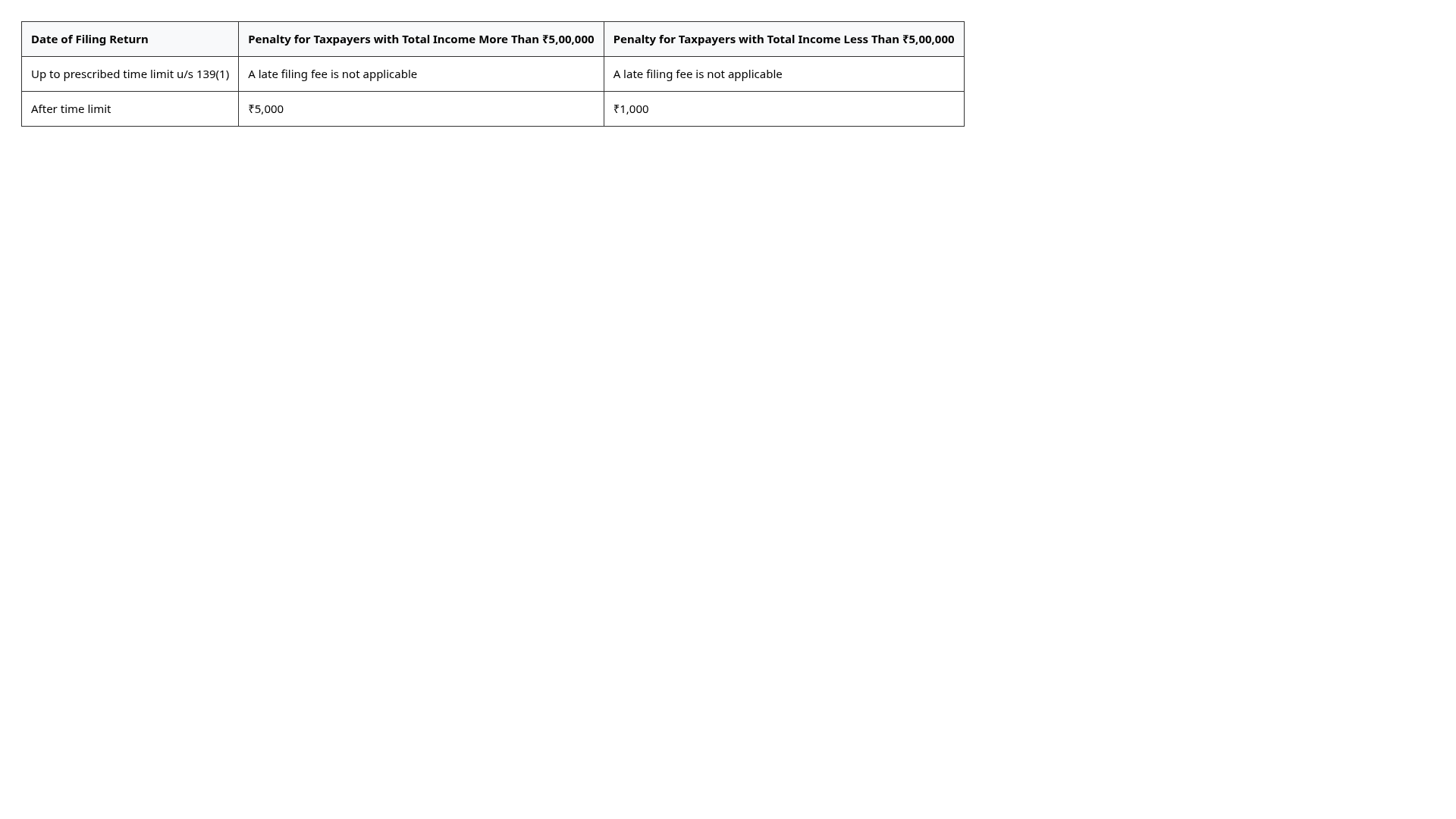

However, if you file your ITR after the deadline, you'll have to pay a penalty under Section 234F. A taxpayer can be charged up to ₹10,000 in late filing fees. The IT Department, on the other hand, imposes a ₹1,000 penalty on those whose income does not exceed ₹5,000,000. This provides financial relief to these taxpayers.

The penalty for filing a late return is described in the following table:

How to claim an income tax refund after the due date?

You can only claim an income tax refund at the time of filing an ITR (Income Tax Return). If you miss the deadline for filing your ITR, you can submit a belated return on or before December 31st of the Assessment Year (AY). For late filing of a return, a penalty of Rs 5,000 is charged. Having said that, if the person's total income is less than Rs 5 lakh, the cost is only Rs 1,000.

Suggested Read: How to Check the Status of Income Tax Refund

After the due date, under what Section of the Income Tax Return is filed?

A belated return, that is, the return filed after the due date, is allowed under Section 139(4). For late filing of a return, a penalty of Rs 5,000 is charged. Having said that, if the person's total income is less than Rs 5 lakh, in that case, the penalty to-be paid is only Rs 1,000.

How do you make changes to your tax returns after the due date?

Due to some amendments, if the taxpayer needs to make changes to the original return, he or she can do so by using a revised return under Section 139(5). On or before the 31st of December of the Assessment Year, you can file a revise return.

Once this deadline has past, taxpayers will not be able to file any returns. If the return was missed due to an unforeseen circumstance, you can ask your A.O. asking for permission to file past returns under Section 119.

Otherwise there is one more option; The government introduced the ITR U form for updating income tax returns in the Union Budget 2022. The ITR-U form is a lifesaver for people who either failed to file their ITRs or filled them out incorrectly and with false information.

Using the ITR-U form, taxpayers have two years from the conclusion of the applicable assessment year to update their returns and correct any errors or omissions on their ITRs. For the assessment year 2021–2022, for instance, if the taxpayers failed to report some income, an updated return may be filed by 31 March 2024.

An Updated Return can be filed if:

- Return previously not filed

- Income not reported correctly

- Wrong heads of income chosen

- Reduction of carried forward loss

- Reduction of unabsorbed depreciation

- Reduction of tax credit u/s 115JB/115JC

- Wrong rate of tax

Time Limit to File the ITR-U

The time limit for filing an updated return is 24 months from the end of the relevant assessment year. For example in the current financial year 2023-24, updated returns for AY 2021-22 and AY 2020-21 can be furnished.

--

What is the meaning of "due date" as per Income Tax?

After the conclusion of each financial year, certain specified people are required to file an Income Tax Returns with the Income Tax Department.

To ensure that returns are filed on time, the tax department has established a deadline by which a person can file a return without having to pay late fees. This last date is known as the "Income Tax Return Due Date".

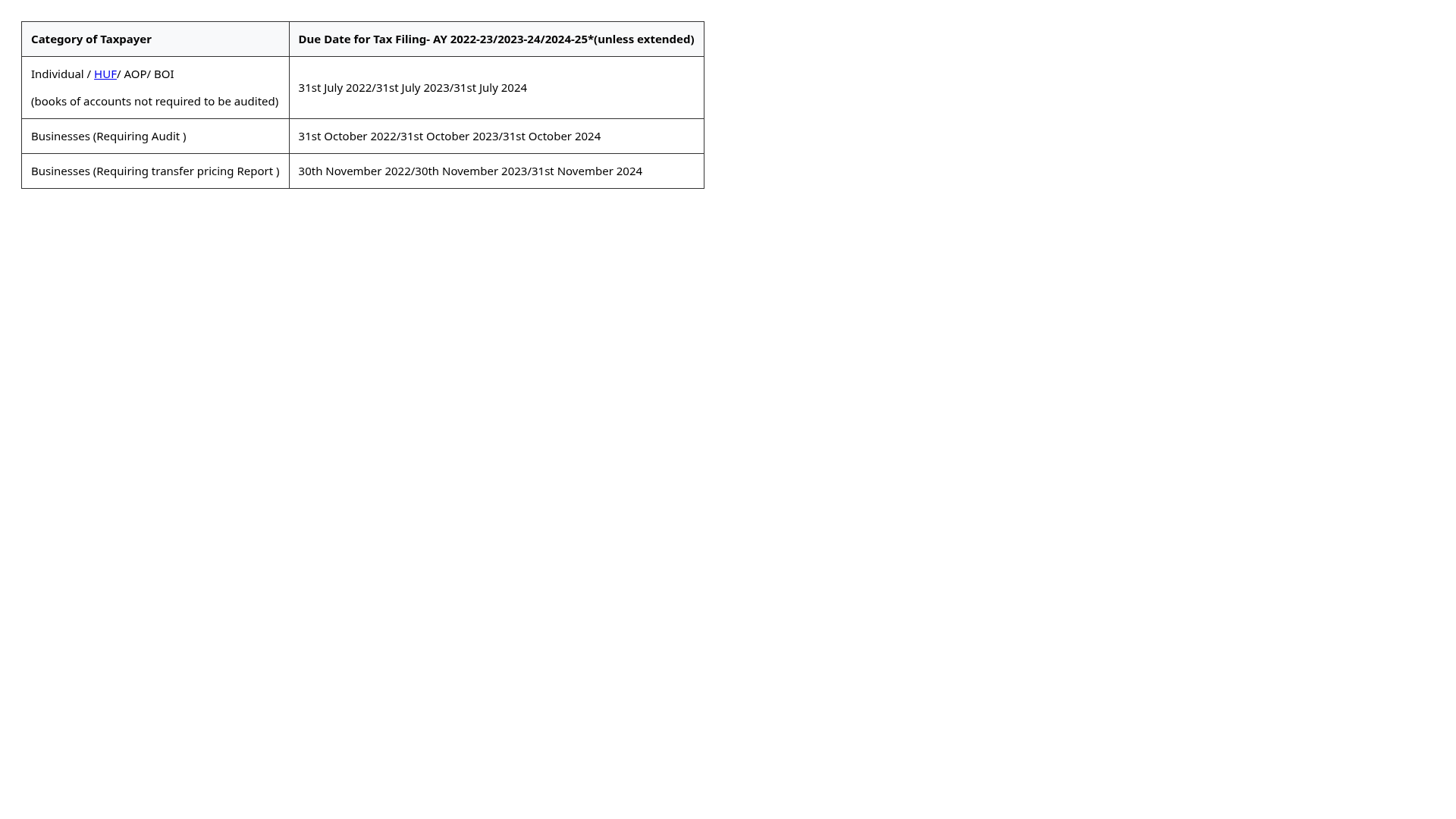

The deadline for filing an Income Tax Return varies based on the type of the taxpayer; for example - Individual, HUF, firm, LLP, company, trust, and AOP/BOI; and whether or not an audit is required.

Taxpayers who file their return beyond the due date will be subject to interest under Section 234A and a penalty under Section 234F.

What are the due dates of Income Tax Return Filing for AY 2022-23/2023-24/2024-25?

For Individuals and HUFs - the due date for filing their income tax returns for financial year 2021-22/2023-24/2024-25 (AY 2022-23/2023-24/2024-25) are as follows:

Do You Want to Save Tax while Saving Money?

Under Section 80C , you can avail tax benefits on premiums paid towards Unit Linked Insurance Plans (ULIPs). When you save money in ULIPs for long term, you can get high returns of up to 8%. Moreover, it is best to save more to get more. Here's one such example for you!

Fill in below details toget a call back

Disclaimer13

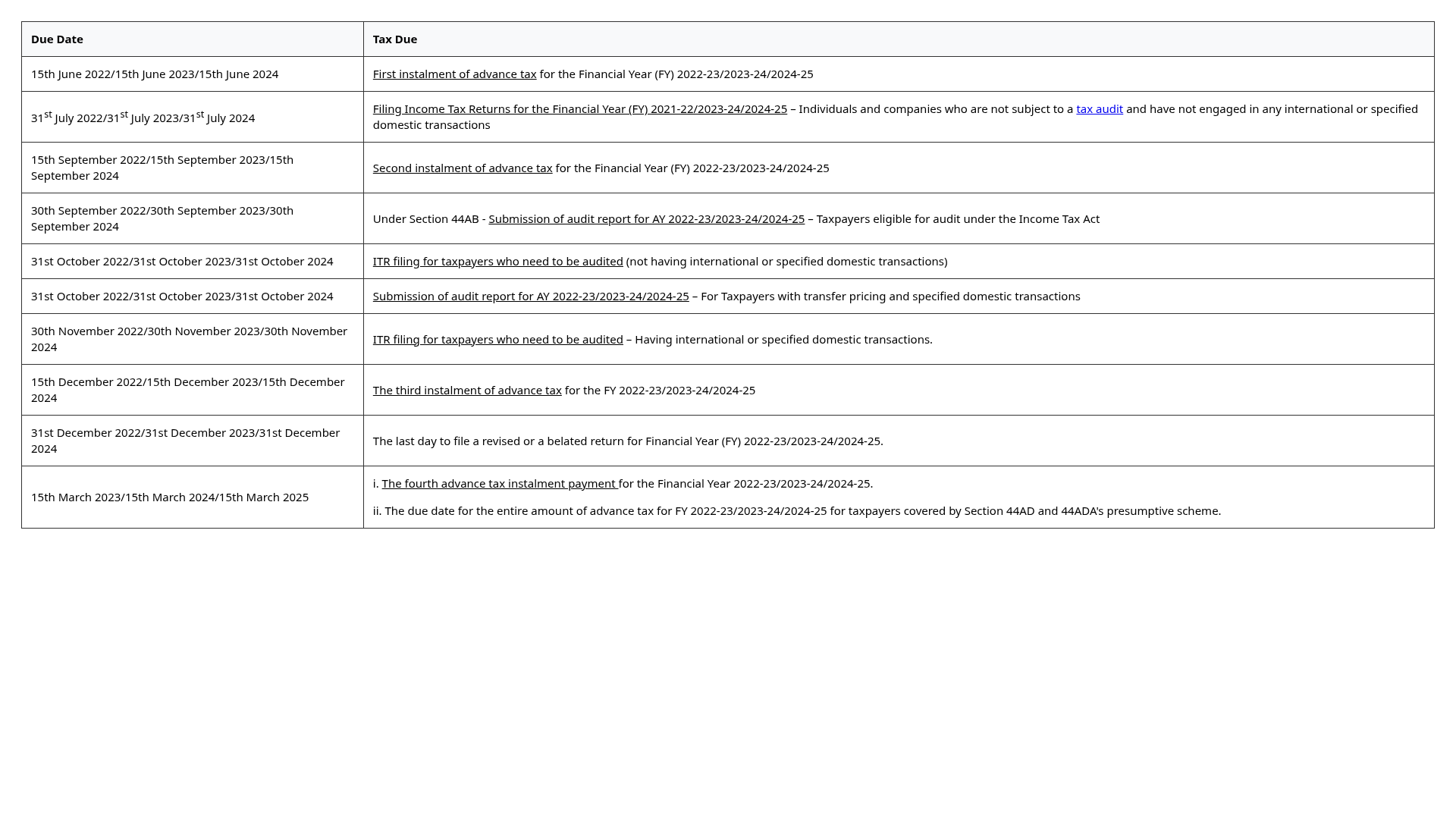

Important Income Tax Return Filing Due Dates for AY 2022-23/2023-24/2024-25

When it comes to income tax, there are a number of mandatory tax formalities that must be completed within the specified due dates/ deadlines, for example, filing income tax returns and paying advance tax on time, and so on.

Here is the TAX CALENDAR for the AY 2022-23/2023-24/2024-25;

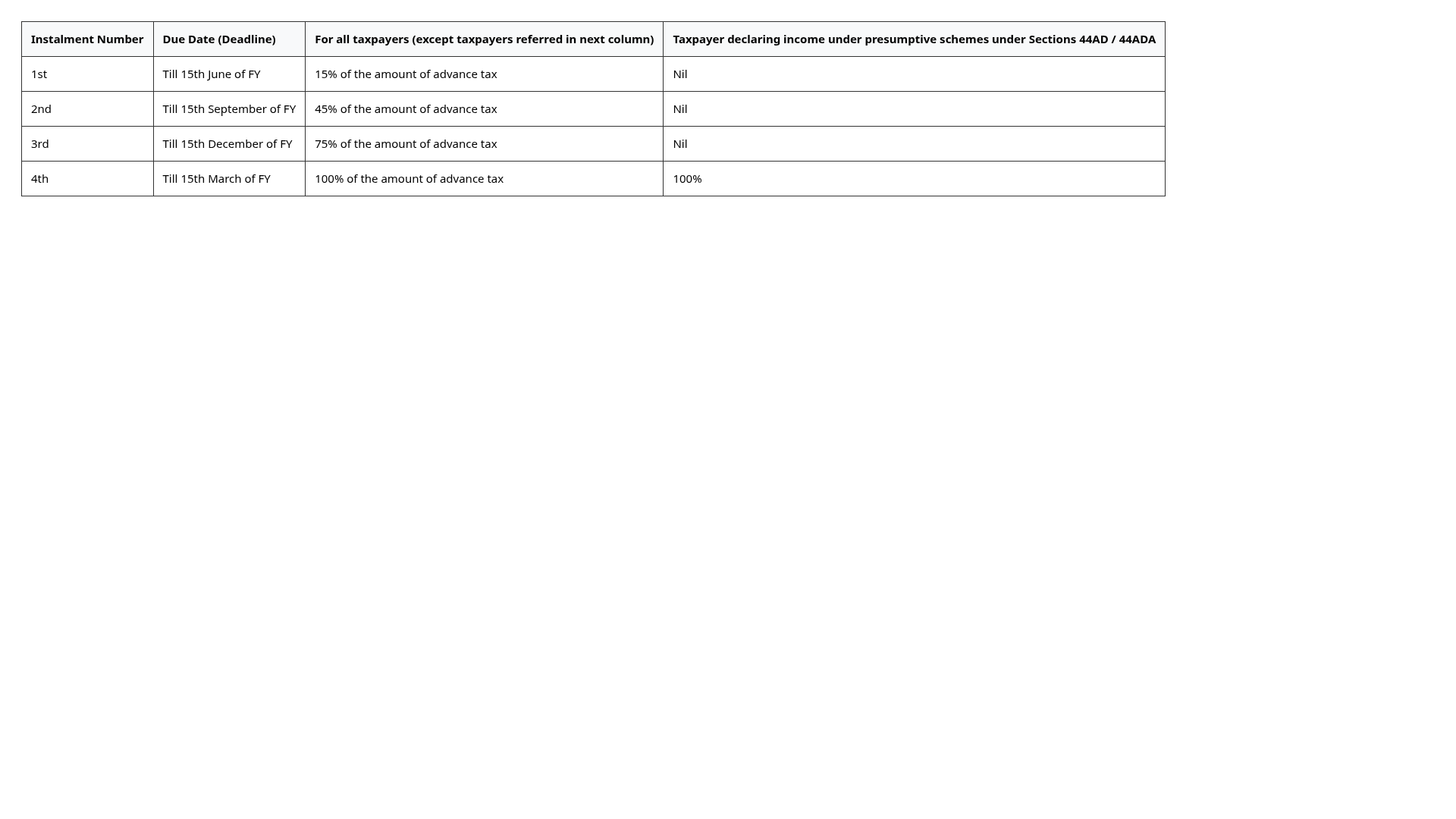

What is the due date to pay advance tax instalments?

Having learned when the last date for filing an ITR is, the following table will help you to find out when advance tax payments are due for the current financial year.

The deadlines/ due date for paying advance tax are as follows:

Note:

- If your total tax payable in a financial year is ₹ 10,000 or higher only than you must pay advance tax.

- Any tax payment made on or before the 31st of March of the same financial year is considered advance tax.

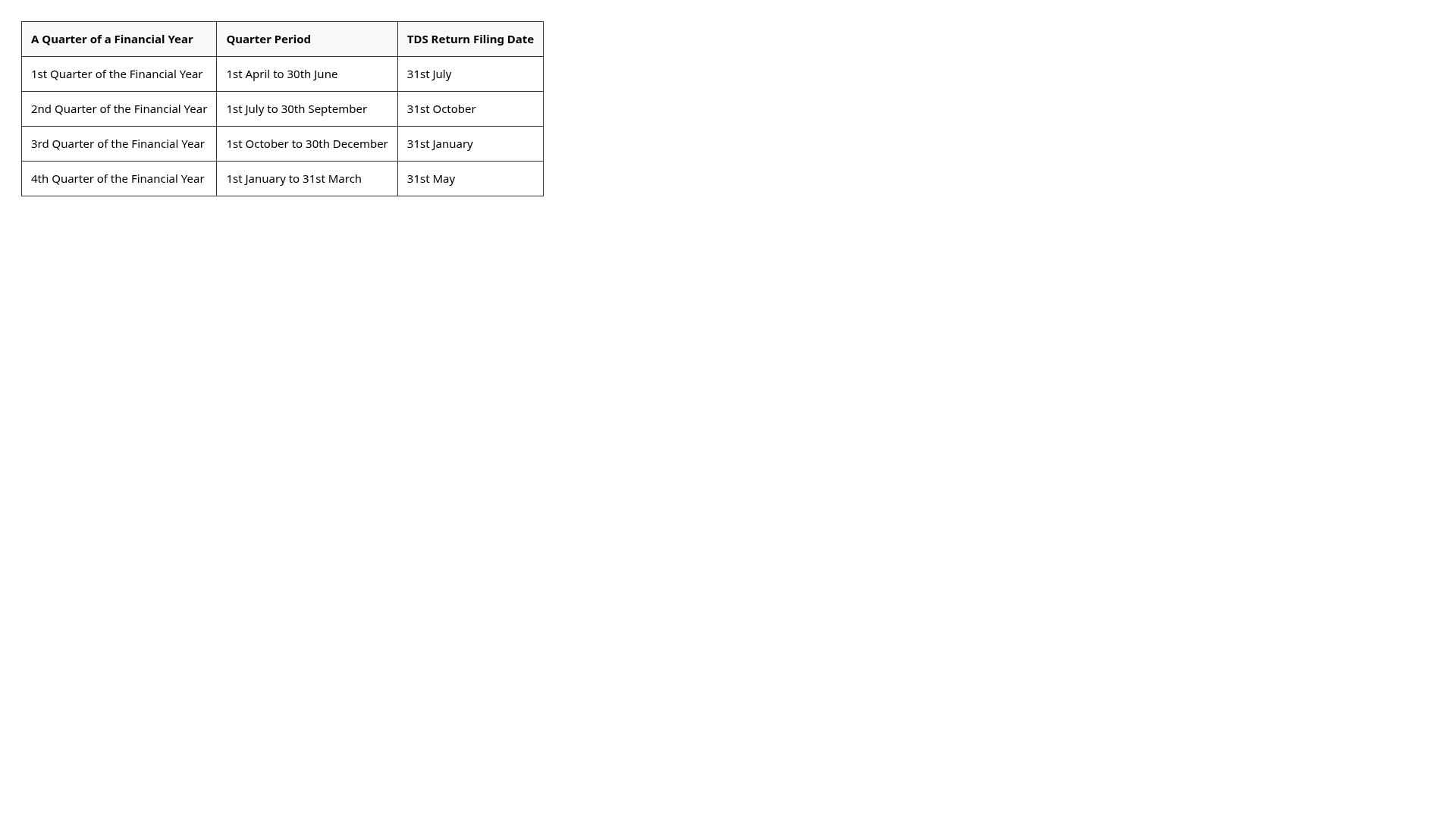

What is the due date to file TDS returns?

A deductor must file a TDS return after paying TDS. The following is the TDS return deadline:

What are the benefits of filing ITR before the due date?

Filing ITRs on time not only makes you a responsible citizen of the country, but it also provides you with a number of advantages. The following are a few of these benefits:

- If you file your income tax returns on time your chances of getting a car loan, a house loan, and other types of loans improve.

- When you file your ITR on time, you will receive your refunds as soon as possible.

- ITRs can be used to prove address and income, both of which are required when applying for a loan or visa.

- Most consulates and embassies need you to submit copies of your income tax returns for the previous two years when applying for a visa.

- Taxpayers are unable to file an ITR without first paying their taxes. Section 234A requires the payment of interest at the rate of 1% per month beginning on the due date of taxes and continuing until the date of payment. You can avoid paying additional interest if you file your tax return on time. As a result, the longer you delay to pay taxes and file returns, the higher your tax bill will be.

Suggested Read: Benefits of Filing Income Tax Returns Regularly

Conclusion

The conclusion of this article is now at hand. Using this guide, you can file tax returns with ease. Having a clear understanding of all tax-related dates can make this process smoother and more convenient.

Similarly, knowing about various tax-saving financial products, can help you save tax. To do so, fill in your details and connect with a trusted financial advisor NOW!

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.