Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

What is HUF (Hindu Undivided Family)?

9 mins

9 mins 11.1K

11.1KA HUF includes theKarta(the head of the family), andCoparceners(all the family members). Hindu law defines a HUF as a family of all persons who come from a common ancestor, including their wives and unmarried daughters. HUFs can only be created automatically within a Hindu family and cannot be created under a contract.

Even though Jain and Sikh families do not fall under Hindu Law, they are treated as HUFs under the Act.

In accordance with section 2(31) of the Income-tax Act, 1961 (hereafter called the Act), Hindu Undivided Family ('HUF') is viewed as a 'person'. HUF is a separate entity that is assessed under the Act.

The HUF has its own Permanent Account Number (PAN) and files its own tax returns.

Taxability of HUF

First, one has to determine the income of a HUF under the various heads of income (ignoring earnings exempted under Sections 10 to 13A of the Act). There are a few things to keep in mind when computing income:

- HUF funds that are invested in a company or firm may be treated as family income if the member receives fees or remuneration from the company or firm (if the fees or remuneration are earned essentially as a result of the investment of funds).

- Nevertheless, if a member earns fees or remuneration for services rendered in his capacity, it will be considered to be his personal income.

- If any remuneration is paid by the HUF to Karta or any other member for services rendered, the payment is deductible from the income of HUF if it is genuine, not excessive, and paid under a valid and bona fide agreement.

The following incomes are NOT taxed as income of HUF:

- If a member has converted or transferred his self-acquired property into the joint family property without due consideration, the income from such property is not taxable in the family's hands.

- Income from impartible estates (although they belong to family) is taxed in the hands of the holder of the estate, not in those of the HUF.

- The personal income of the members cannot be treated as the income of HUF.

- Individual income cannot be included in HUF income. Due to the fact that "Stridhan" is an absolute property of a woman, her income from it is not taxable.

- Income from the daughter's individual property is not taxable in the hands of HUF even if the daughter has transferred the property in the HUF.

- Deduction from Gross Total Income: While calculating taxable income, HUFs can take advantage of deductions available under Chapter VI-A (as applicable).

- Rate of Tax:

How to Create a HUF?

Tax advantages are one of the most important reasons to form a HUF. To create a HUF, however, one should be aware of the following terms and conditions:

- A HUF should be formed only by a family

- At the time of a marriage, a HUF is automatically created for the newly added member of the family.

- The HUF is made up of all descendants of a common ancestor, including their daughters and wives.

- HUF's assets tend to come in the form of gifts, inheritances, or wills.

- A bank account in the name of the HUF should be opened once the HUF has been created.

- Even though Jain and Sikh families do not fall under Hindu Law, they are treated as HUFs under the Act.

How to Save Taxes by Building a HUF?

One of the primary reasons to establish a HUF is to obtain an additional PAN card that is legally acceptable, in addition to tax benefits. Once the HUF is built, the members of the HUF will not have to pay individual taxes. After the HUF PAN card has been created, the family can begin paying its taxes individually.

HUFs can then begin filing ITRs using the new PAN card. If the family's annual income exceeds the prescribed limit, it will be taxed at 10%, 20%, and 30% of the income slab.

To help you better understand HUF, here is an example:

Consider a family consisting of a husband, a wife, and their two children. The husband earns Rs 20 lakhs per year and the wife earns Rs 16 lakhs per year. In addition, they earn Rs 6 lakhs in rental income from their ancestral land.

If the income from the ancestral land were kept separate, the rent would be either taxed on the husband or wife, or both. Now let's see how it works:

- The husband, if taxed, falls into the 30% tax bracket at present. Thus, he will have to pay 30% of Rs 6 lakhs which is Rs 1.8 lakhs in taxes.

- As the wife falls under the 30% of the income tax bracket, this would be taxed on her at 30% of Rs. 6 lakhs, which is Rs 1.8 lakhs.

- When taxed equally on husband and wife, each would have to pay 30% of Rs 6 lakhs. Ultimately, this would mean that both of them would have to pay Rs 90,000 + Rs 90,000 = Rs 1, 80,000.

- HUF, however, offers additional tax benefits on land rent. HUF members' taxes would be reduced by Rs 60,000 to Rs 70,000.

In that case, the couple will save around (Rs 1, 80,000 - Rs 60,000) Rs 1,20,000 on taxes.

Suggested Read: Other Tax-saving Options for You .

Illustration of HUF

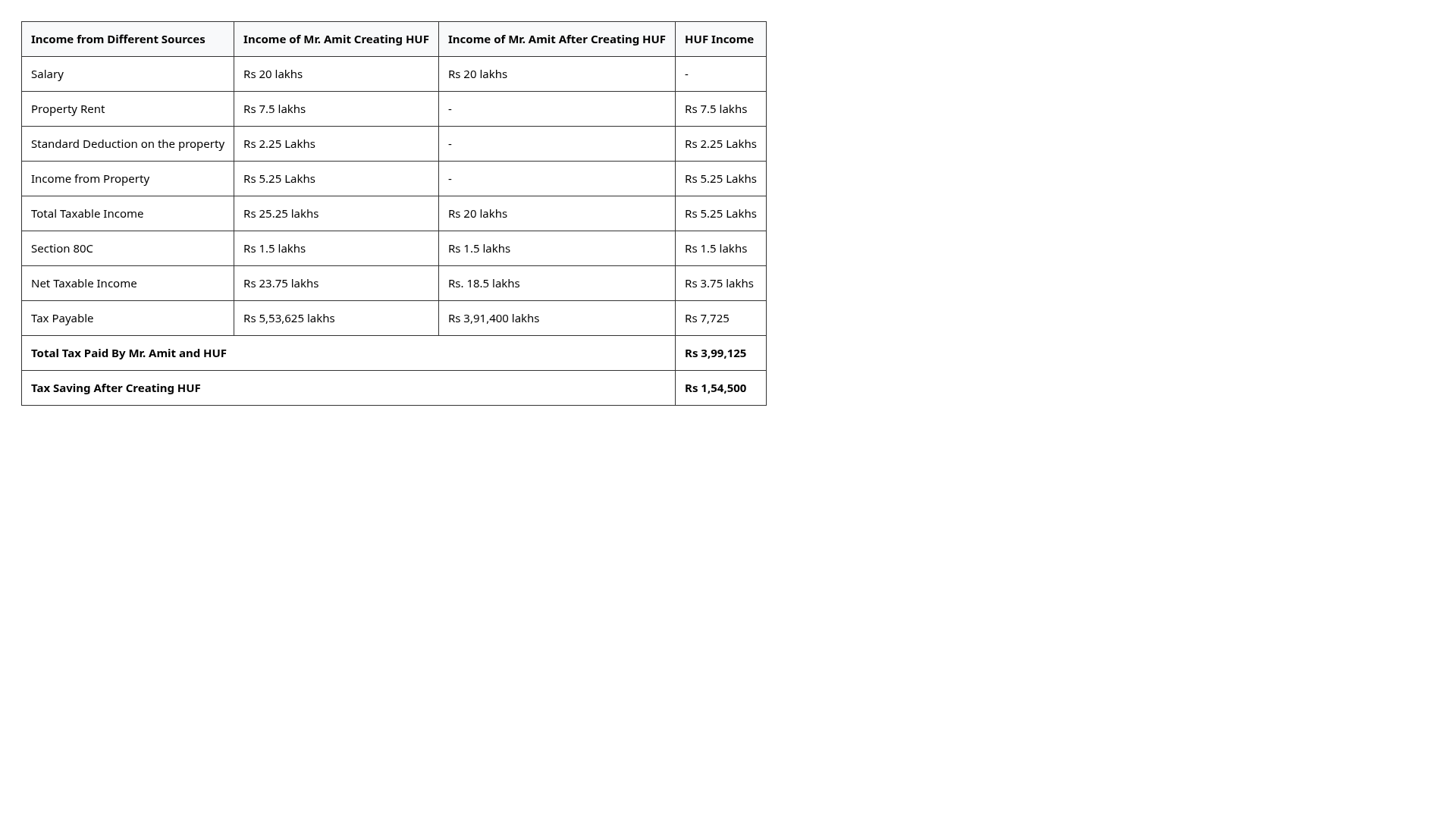

For instance, Mr. Amit, after his father passes away, starts a HUF with his wife, son, and daughter. Mr. Amit has no siblings, so his father's property has been transferred under HUF.

Suppose Mr. Amit's salary income is Rs 20 lakhs, and his father's property rent is Rs 7.5 lakhs. In this case, he can save taxes as follows:

Mr. Amit was able to save Rs. 1,54,500 in taxes as a result of the above-mentioned tax arrangement. Mr. Amit and the HUF (including other members of the HUF) are both eligible for tax deductions under Section 80C .

Advantages of HUF

The advantages of HUF are:

- Just like everyone else, members are also required to pay taxes. A member whose business turnover exceeds Rs. 25 lakhs or Rs 1 crore is required to perform a tax audit under the guidance of a CA as outlined in section 44AB of the Income Tax Act.

- The head of the HUF has full authority to sign pertinent documents on behalf of all the other members.

- A HUF can be broken into different taxable units. In the case of tax purposes, any assets or savings made or insurance premiums paid by the HUF will be subtracted from Net Income.

- Most families form a HUF so that they can create two PAN cards and file taxes separately.

- As long as her husband is a Karta, a woman can be her husband's co-partner in the HUF. Her additional earnings cannot be included in the HUF.

- If the Karta or the last member of the family dies, the official status remains the same. As a result, the ancestral and acquired assets of the HUF will belong to the widow and need not be divided.

- Additionally, an adopted child can be added to the HUF.

- A woman in a family can gift a property owned by her or her family in her name. Loans are readily available to Hindu Undivided Family members.

- The act is recognized in all states except Kerala.

Disadvantages of HUF

HUF has the following disadvantages:

- Equal Rights to Every Member of HUF- All members of the HUF have an equal right to property, which is one of the greatest disadvantages. Property cannot be sold without all members' consent. Also, each member has equal rights upon birth or marriage.

- Partition/ Splitting the HUF- It is more difficult to close a HUF than to open one. If a family is split into smaller groups, the HUF may also be split. The asset needs to be distributed among all the members of the HUF once the HUF is closed, which is a challenging task.

- Joint Families Are Losing Popularity- The income tax department treats the HUF as a separate tax entity. Joint families are increasingly becoming unimportant in modern society. There have been a number of reports that HUF members have a dispute over property. Further, divorce cases have increased, so HUF has lost its appeal as a tax-saving tool.

- HUF to Be Assessed As Such until Partition- After a HUF is formed, it must continue to file its tax returns, unless it is partitioned. An assessment officer must approve any partition request. On receiving such a claim, the assessing officer must contact the members and give them notice. The member's income from the property that was partitioned is taxable as individual income. In the event, the member forms another HUF with his wife and children, the income from the property which was transferred from the original HUF is taxed to the new HUF.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.