Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Have You Planned Your Tax Savings? Read on To Start Now

6 mins

6 mins 2K

2KHave You Planned Your Tax Savings? Read on To Start Now

You may be surprised to know that the history of taxation in India goes back almost 2,300 years. Before our ancestors pioneered the concept of currency, taxes were paid with cattle, grains, or even silk. Later, people had to pay a portion of their income to the government in the form of gold, silver or copper coins. Even today, all salaried resident and self-employed individuals are required to pay taxes on or before the culmination of each financial year. That said, most tax liable individuals wait till the very last hour to plan their tax savings, even though tax payments are a certainty.

At the end of each financial year, most people scramble to get their tax investment proofs in order or start looking for tax-saving instruments. As a result, they end up making investments into inefficient tax saving instruments. Therefore, it is essential that you start planning your taxes as early as possible for the new financial year. This will not only help you choose the best tax saving investments but also maximise your savings into long-term gains.

What is Tax Planning?

In simple terms, taxes are fees charged by the government on an income, service or product. While paying tax is obligatory in India, there are several ways in which you can reduce your tax liability. Depending upon your current financial status, you can meet your tax obligations through systematic tax planning. You can reduce your total payable tax by accounting for all payables, deductions, permissible exemptions and reliefs available under the Income Tax Act.

Through efficient tax planning, you not only protect your capital but also ensure long-term wealth creation. Therefore, you can save more through tax planning and put a strong foot forward towards fulfilling your life goals.

Tax Planning Process

When we talk about tax planning, it is important to remember that you cannot create an effective tax saving plan overnight. Instead, you need to step-by-step ascertain your position regarding your Net Taxable Income and Gross Total Income. This would help achieve your objective of long-term wealth creation and capital protection. Here’s how you can proceed with the process of tax planning:

Step 1: Calculate Your Gross Total Income

To start your tax planning exercise, first calculate your Gross Total Income, which would be your cumulative income after adding up income from salary, income from house property, business, capital gains (both short-term and long-term) and other sources, if any. This step helps you ascertain your total income earned during a financial year without reducing any tax deductions as specified under the Income Tax Act.

Step 2: Calculate Your Net Taxable Income

After calculating your Gross Total Income, you need to proceed with the computation of your Net Taxable Income. For this, you need to reduce the various deductions set out under Income Tax Sections from your Gross Total Income. Here are some deductions that can help you reduce your tax liability, along with the relevant Sections:

- Investments made into tax saving instruments like life insurance plans (Under Section 80C)

- Premium paid under health insurance (Under Section 80D)

- Expenses on a handicapped dependent (Under Section 80DD)

- Interest paid for education loan (Under Section 80E)

- Interest paid on a home loan (Under Section 80EE)

- Donations made towards charitable organisations (Under Section 80G)

- Rent paid for residential accommodation (Under Section 80GG)

Step 3: Calculate Your Tax Payable

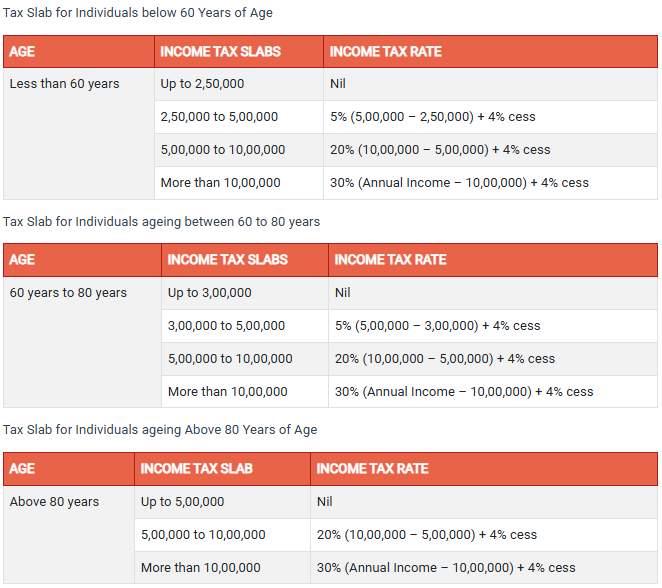

Once you have effectively reduced your tax liability in the prudent way described above, you may proceed with the calculation of your tax liability, as per the latest income tax slabs. Given below are the tax slabs for the AY 2019-2020.

Smart Tax Planning Tips

- Age

If you are young, then for prudent tax planning, you must opt for market-linked tax saving instruments such as Unit-Linked Insurance Plans (ULIPs) or Equity-Linked Saving Scheme (ELSS). At a younger age, your risk tolerance is generally high. By starting with tax planning early; therefore, you can make more aggressive investments and create a corpus over the long term, to create a financially secure future for yourself.

- Income

Similarly, if your income is high, you can be more willing towards investments into riskier tax saving options. Therefore, you can park more money into market-linked tax saving instruments, which have the potential of generating higher returns over the long term. In case your income is not much, or you don’t want to put your investments at risk, you can opt for tax saving tools that offer assured returns. Therefore, you can put your money into instruments such as Public Provident Fund (PPF), 5-year Bank Fixed Deposits, National Savings Certificates (NSC), 5-year Post Office Time Deposits and Senior Citizen Savings Scheme (for senior citizens)

- Financial goals

Tax planning exercise is also influenced by your financial goals. For example, if you wish to retire five years from now, you must have a tax saving portfolio that is less skewed towards riskier investment options such as market-linked tax saving instruments, and more towards investment options that are less affected by market volatility. Tax planning is crucial if you don’t want to lose a significant portion of your hard-earned income. With an effective tax saving plan, you can systematically meet your tax obligations, while keeping your current financial status in mind. Also, tax planning helps you work consistently towards your future goals by making use of various income tax saving options after considering your age, financial goals, investment horizon and risk appetite. Therefore, you need to complement your tax planning exercise with your overall investment planning, to reap maximum benefits.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.