Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

How Life and Health Insurance Help You Save Tax in India

4 mins

4 mins 2.5K

2.5KHow life and health insurance help you save tax while securing your family’s future

With the tax season around the corner, you must be looking at ways to reduce your tax outgo. Well, you don’t have to look very far. Insurance helps you reduce your tax liability by offering deductions from your taxable income. Both life and health insurance policies give you tax benefits. Do you know how? Let’s find out –

Life insurance

In the case of life insurance, the premiums you pay and the benefits you receive are both tax-free under different sections of the Income Tax Act. Let’s check the life insurance tax benefits –

For premiums paid -

1. Section 80C – Premiums paid for a life insurance policy, whether it is traditional or ULIP qualifies for tax exemption under this section. The maximum allowable deduction is ₹1.5 lakhs and to claim this deduction your premiums should not be more than 10% of your sum assured. So, if your policy’s sum assured is ₹10 lakhs, the premium should be up to ₹1 lakh to be eligible for 80C deduction from your taxable income.

2. Section 80CCC – This section deals specifically with the premium paid for a pension or annuity plan. If you buy a pension plan from a life insurance company, the premium paid is exempted under this section. The maximum limit is ₹1.5 lakhs with effect from Assessment Year 2016-17, and it includes the limit under Section 80C. Thus, under Sections of 80C and 80CCC combined, the maximum available deduction is limited to ₹1.5 lakhs.

For benefits received

1. Section 10 (10D) – Under this section, any benefit received from a life insurance plan is tax-free in the receiver’s hands. There is no maximum limit under this section. Any amount of money received through a life insurance policy is applicable for tax-exemption. The benefits can be maturity benefit, death benefit or surrender benefit. However, in case of surrender benefit, the following points should be remembered for claiming tax-exemption -

- For single premium traditional life insurance plans (except pension plans), the surrender value is tax-free only if you surrender the policy after the completion of 3 policy years.

- If you have a regular premium policy, premium payment for three years is compulsory if you want to claim tax-exemption on the policy’s surrender value.

- For ULIPs, there is a lock-in period of 5 years. Surrendering the plan only after the lock-in period makes the surrender value tax-free.

- The surrender value of pension plans is not tax-free. You have to pay income tax whenever you surrender a pension plan.

2. Condition:10(10D) benefit will not be available in case the premium exceeds 10%.

3. Section 10(10A) – This section is relevant for pension plans, both ULIPs and traditional. Under pension plans, you can withdraw (also called commute) 1/3rd of the accumulated corpus on vesting. This commuted pension is tax-free under Section 10(10A). The rest of the corpus is paid as annuity pay-out and annuities are always taxable.

Health insurance

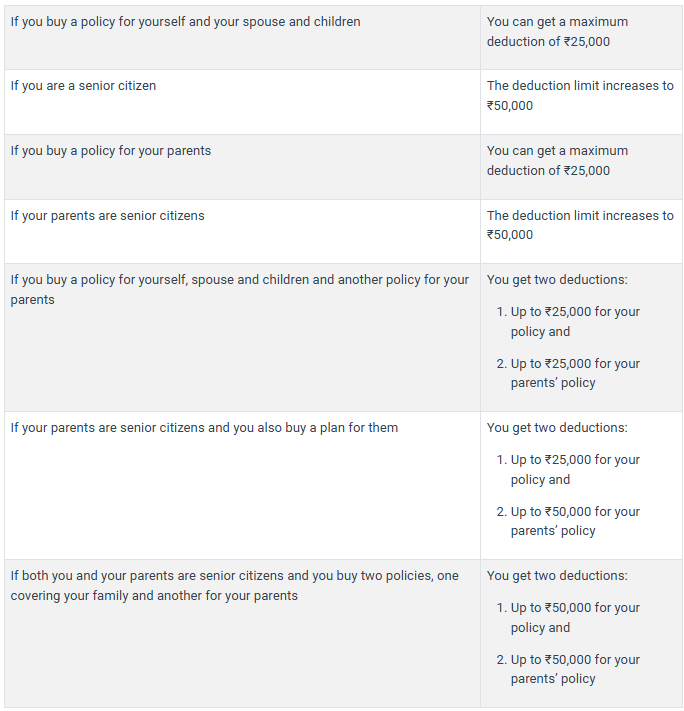

Health insurance policies also give you tax-exemptions. The premiums paid for a health plan gives you a deduction under Section 80D. There is, however, a limit to the amount of deduction which you can claim. Let’s understand health insurance tax benefits –

Thus, you get a maximum deduction of ₹1,00, 000 on your health insurance premiums if you buy a separate policy for your parents and both you and they are senior citizens. Hence, a life and a health insurance plan can help lower your taxable income by offering deductions under particular income tax slabs. If you want to lower your tax-outgo, investing in insurance is probably the right thing to do.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.