Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Chapter VI A Deductions: Complete Guide to Income Tax Savings

18 mins

18 mins 93.5K

93.5KThe tax system in India is progressive, meaning that as taxpayers' income increases, they end up paying higher taxes. Whereas, the taxpayers who fall into the low to medium tax brackets can save a significant amount of money.

Tax slabs help determine the total taxable income during a fiscal year. However, before you start calculating your taxes, you need to know the income on which tax will be calculated. This is because earned income is not the same as taxable income.

Suggested Read: Steps to Calculate Your Taxable Income and Tax Liability

Chapter VI A has various sub sections that you can use to claim deductions so as to reduce your taxable income.

What is Chapter VIA of Income Tax Act?

As per Chapter VIA of the Income Tax Act, a taxpayer can claim deductions from income on the basis of various tax-saving investments, permitted expenditures, donations, etc. The deductions under Chapter VIA are designed to benefit the taxpayer so that the tax burden is reduced.

For instance, deductions can be claimed under Sections 80C , 80CCC, 80CCD, 80CCE, 80D to 80U of the Income Tax Act.

Under deductions from Chapter VIA, you can not only save and invest money - but also save on taxes.

Below you will find all the information you need to know about Chapter VIA.

Conditions for Availing Deductions under Chapter VIA

The following conditions must be met to qualify for deductions under Chapter VIA:

- Under Chapter VIA, a taxpayer's deductions cannot exceed their gross total income. For example, the taxpayer earns Rs. 3, 00,000 in Gross Total Income. The total deductions under Chapter VIA amount to Rs. 3, 50,000. Due to this, the amount of deductions allowed to the taxpayer will now be Rs. 3, 00,000 because the deductions (Rs. 3, 50,000) cannot exceed the Gross Total Income (Rs. 3,00,000).

- Under section 111A and section 112 deductions under Chapter VIA will not be allowed for long-term capital gains and short-term capital gains .

Deductions underChapter VIA

The Sections which gives benefit of lowering the taxes to Individual and HUF taxpayers are listed below:

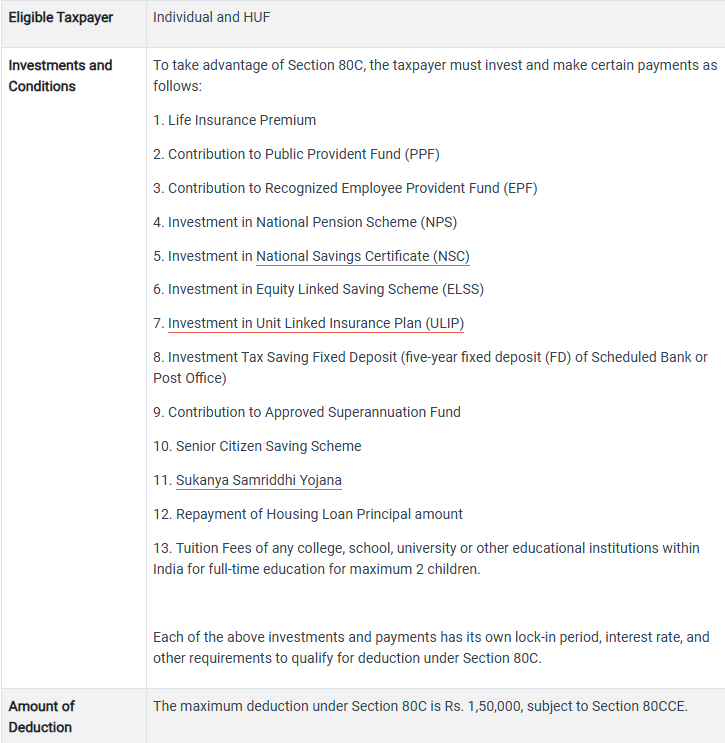

Deduction under Section 80C

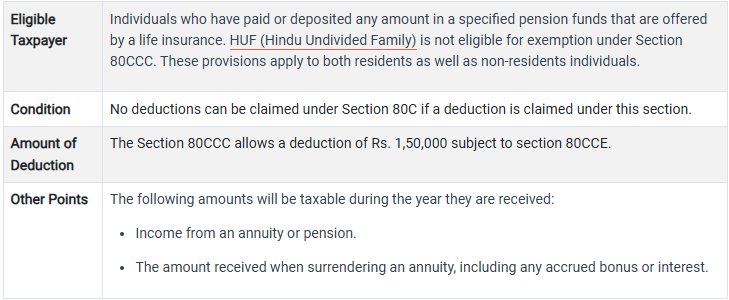

Deduction under Section 80CCC

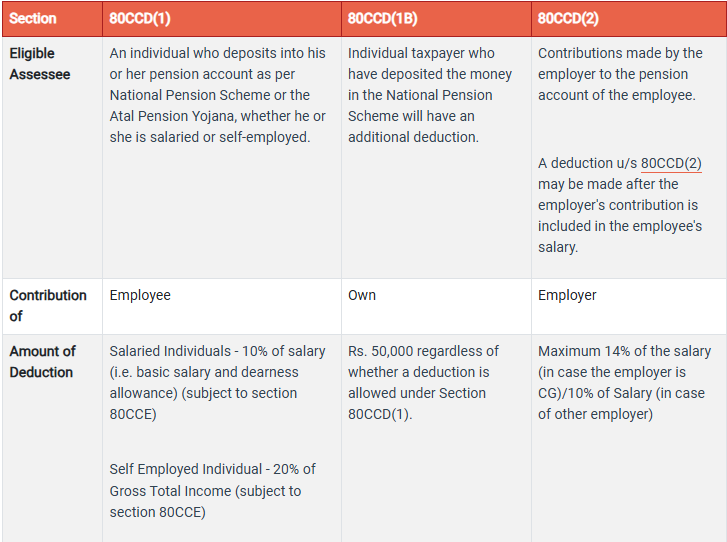

Deduction under Section 80CCD

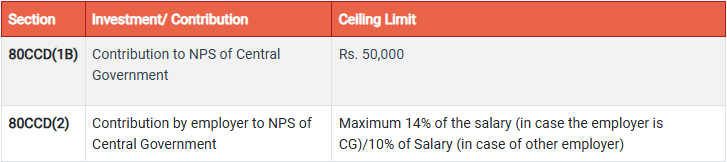

The government of India has notified deductions for contributions to pension schemes. The deductions fall into three categories:

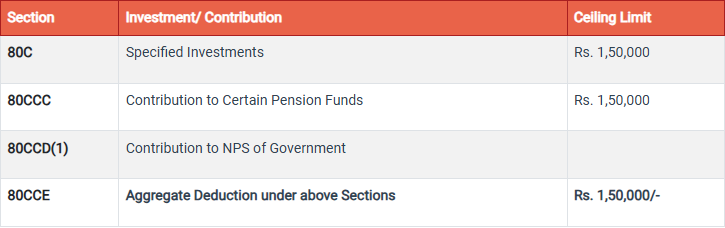

Deduction under Section 80CCE

There can be a maximum deduction of Rs. 1, 50,000 under section 80C, 80CCC , and 80CCD(1). The breakdown is as follows:

The following table lists the ceiling limits under other sections, which do not exceed the limit of Rs. 1,50,000 specified under section 80CCE:

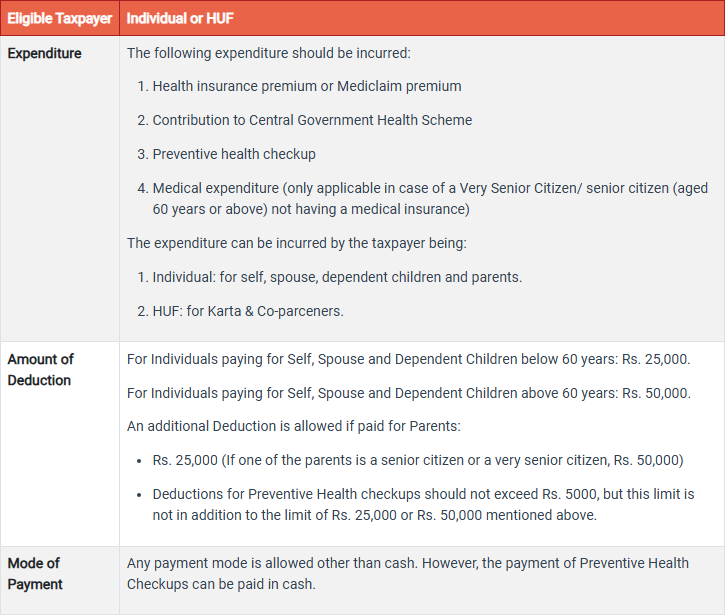

Deduction under Section 80D

Suggested Read: Section 80D Deduction - Eligibility, Deduction & Calculation

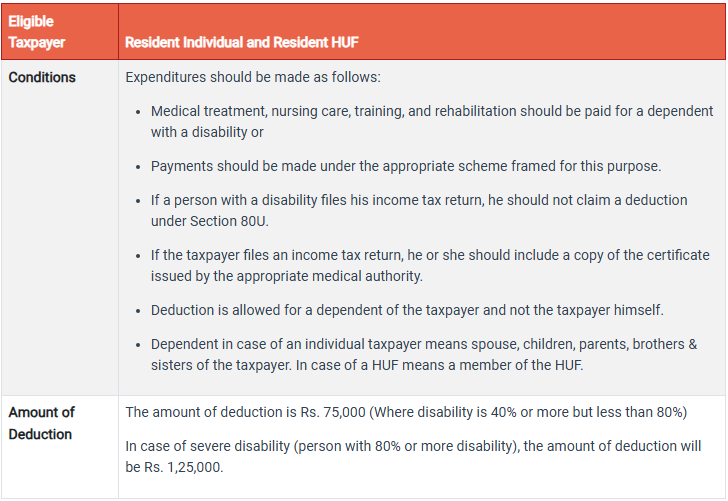

Deduction under Section 80DD

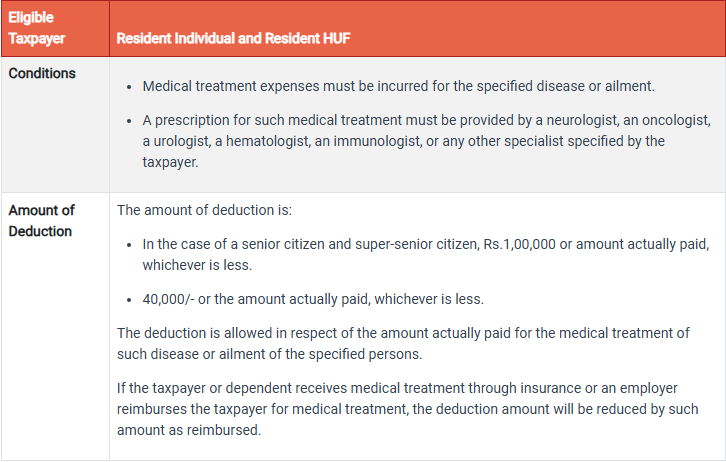

Deduction under Section 80DDB

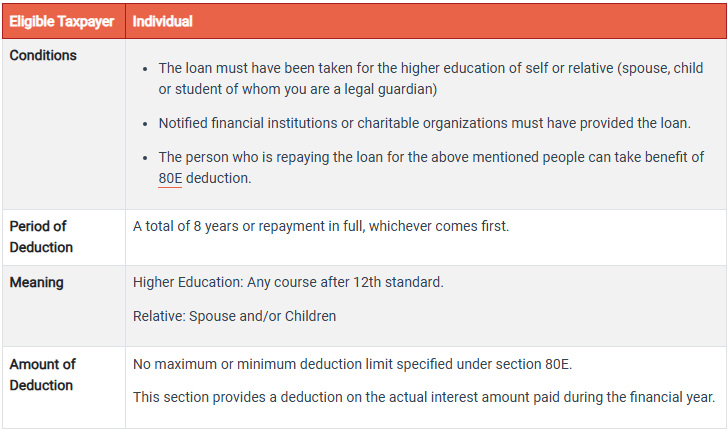

Deduction under Section 80E

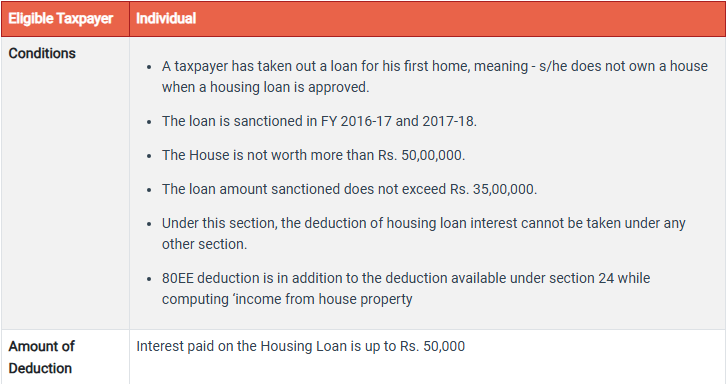

Deduction under Section 80EE

Suggested Read: Section 80EE: Income Tax Deduction for Interest on Home Loan .

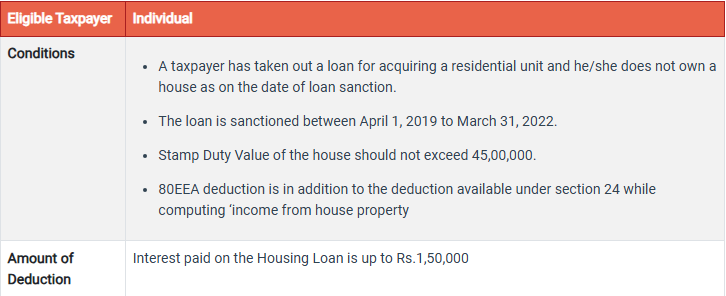

Deduction under Section 80EEA

- 80EEA deduction is in addition to the deduction available under section 24 while computing ‘income from house property

Interest paid on the Housing Loan is up to Rs.1,50,000

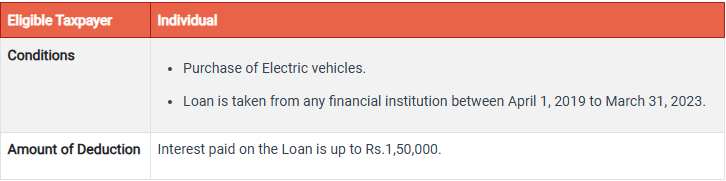

Deduction under Section 80EEB

Suggested Read: Section 80EEB Deduction: Tax Benefit of Buying an Electric Vehicle

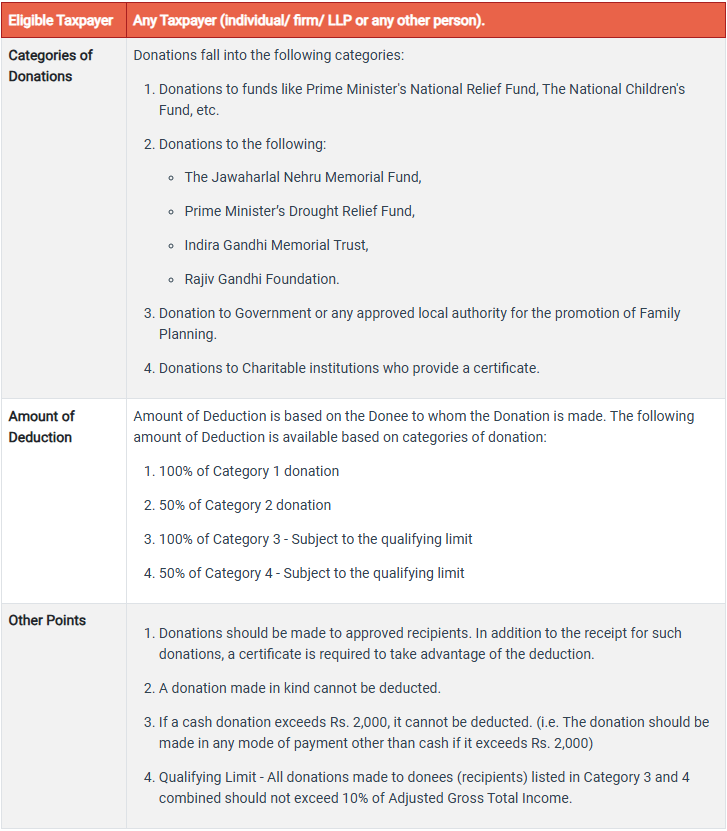

Deduction under Section 80G

List of Donee (recipients) in Category 1:

- The National Defence Fund set up by the Central Government

- Prime Minister’s Relief Fund

- Prime Minister’s Armenia Relief Fund

- The Africa (Public Contributions - India) Fund

- The National Children’s Fund

- The National Foundation for Communal Harmony

- Approved University or educational institution of national eminence

- Maharashtra Chief Minister’s Earthquake Relief Fund

- Any Fund set up by the State Government of Gujarat exclusively for providing relief to the victims of the Gujarat Earthquake

- Any Zila Saksharta Samiti for primary education in villages and towns and for literacy and post-literacy activities

- National Blood Transfusion Council or any State Blood Transfusion Council whose sole objective is the control, supervision, regulation or encouragement of operation and requirements of blood banks

- Any State Government Fund set up to provide medical relief to the poor.

- The Army Central Welfare Fund or Indian Naval Benevolent Fund or Air Force Central Welfare Fund established by the armed forces of the Union for the welfare of past and present members of such forces or their dependants.

- The Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

- The National Illness Assistance Fund

- The Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund

- The National Sports Fund set up by the Central Government

- The National Cultural Fund set up by the Central Government

- The Fund for Technology Development and Application set up by the Central Government

- National Trust for welfare of persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities

- The Swachh Bharat Kosh, set up by the Central Government

- The Clean Ganga Fund, set up by the Central Government (only Residents are eligible for deduction)

- The National Fund for Control of Drug Abuse

Suggested Read: Section 80G Deduction: Tax Benefits on Donation Made to NGO

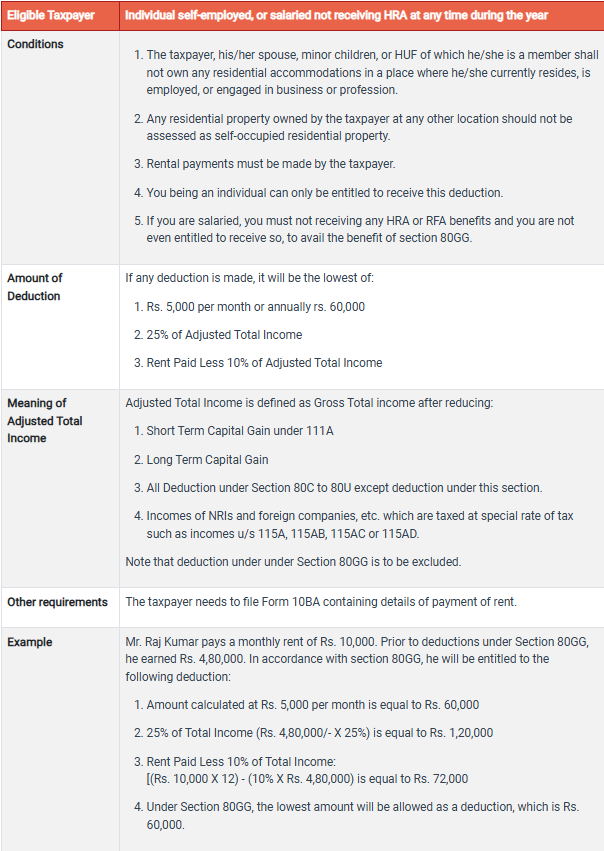

Deduction under Section 80GG

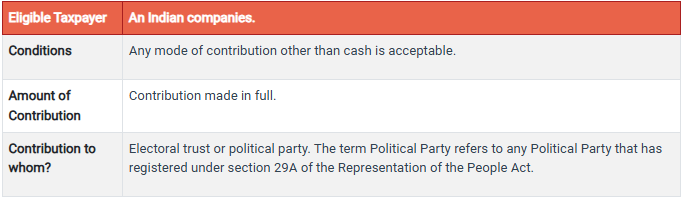

Deduction under Section 80GGB

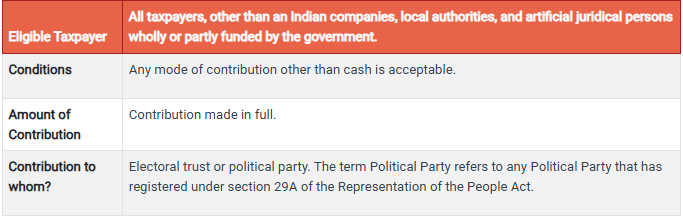

Deduction under Section 80GGC

Suggested Read: Donation to Political Party - Sections 80GGC and 80GGB Tax Deductions

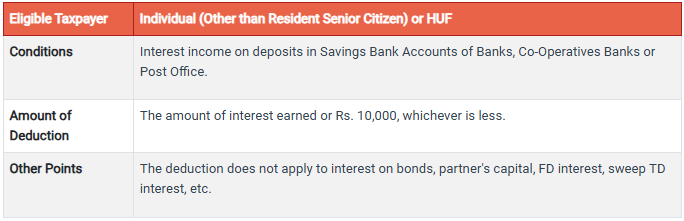

Deduction under Section 80TTA

Suggested Read: Section 80TTA: Claim Tax Deduction on Savings Account Interest Income

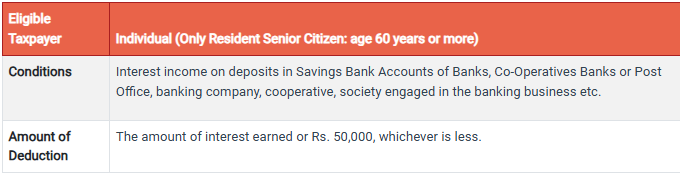

Deduction under Section 80TTB

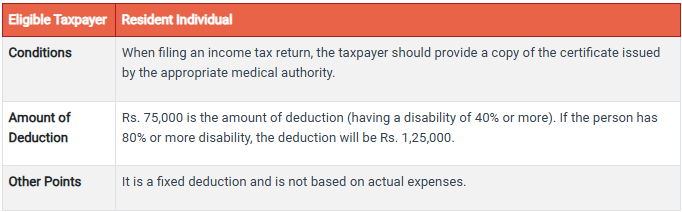

Deduction under Section 80U

The deductions under Chapter VIA are beneficial and efficient. Because a majority of these investments not only help you save money but also grow it. In the end, you would want to expand your corpus and protect it. Chapter VIA deductions can help you do both.

The best time to start investing in various Chapter VIA instruments and make the most of your money is now if you haven't already done so. Connect with our trusted financial experts today!

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.