Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

I pay for my parents’ healthcare can I get tax benefits?

5 mins

5 mins 20.5K

20.5KHere are a few ways in which you can take care of your parents’ health with income tax exemptions:

Deduction in respect of medical insurance premium [Section 80D]

- You - an individual taxpayer may deduct up to ₹ 25,000 for your own health insurance as well as their spouse and dependent children's insurance.

- If your parents are older than 60, you may be eligible for an additional/separate deduction of up to ₹ 50,000. If your parents are below 60 years of age, you may be eligible for deduction of up to ₹ 25,000 only.

- If you pay medical costs for senior citizens (yourself, your spouse, your dependent children, or your parents) that are not covered by health insurance, you may be eligible to get such expenses covered under the deduction limit of up to the ₹ 50,000.

- In 2013–14, the government passed a preventative health checkup deduction to motivate people to take a more proactive approach to their health. Through regular health examinations, the goal of preventative health check-ups is to spot any illnesses early on and reduce risk factors. A deduction of ₹ 5,000 is allowed under Section 80D for any payments made for preventative health checkups. This deduction will not exceed the overall cap of ₹ 25,000 or ₹ 50,000, as applicable. The individual may also claim this deduction on behalf of himself, his spouse, any dependent children, or his parents. Cash is accepted as payment for preventive health checks.

For Example:

For the financial year 2020–2021, Abhishek has paid a health insurance premium of ₹ 48,000 to cover the health of his dependent parents being senior citizens. He spent ₹ 5,000 on a health examination for his dependent parents as well.

Section 80D of the Income Tax Act allows Abhishek to deduct a maximum of ₹ 50,000. Hence, ₹ 48,000 have been approved for the payment of insurance premiums, and ₹ 2,000 have been approved for medical examinations. The deduction for preventative health exams has been limited to ₹ 2,000 because the total deduction in this instance cannot be more than ₹ 50,000.

Deduction in respect of maintenance including medical treatment of disabled [Section 80DD]

Payments qualifying for deduction: Any amount incurred for the medical treatment (including nursing), training and rehabilitation of dependent parents, being a person with disability, or paid or deposited under a scheme framed in this behalf by the Life Insurance Corporation or any other insurer or the Administrator or the Specified Company for the maintenance of dependent parents, being a person with disability qualifies for deduction.

Quantum of deduction: The quantum of deduction is 75000 in case of severe disability (i.e. person with 80% or more disability) the deduction shall be 125000.

Conditions:

- For claiming the deduction, the assessee shall have to furnish a copy of the certificate issued by the medical authority under the Persons with Disability (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995 along with the return of income under section

- Where the condition of disability requires reassessment, a fresh certificate from the medical authority shall have to be obtained after the expiry of the period mentioned in the original certificate in order to continue to claim the

Deduction in respect of medical treatment etc [section 80DDDB]

Section 80DDB of the Income Tax Act of 1961 allows tax deductions to taxpayers on the treatment of certain specified diseases. According to Section 80DDB, these taxpayers are individuals and Hindu Undivided Families (HUFs). However, deductions cannot be made from either long-term or short-term capital gains .

Note: Non-Resident Indians (NRIs) are not eligible for this deduction. Only Indian residents can claim such a deduction. No other entity can claim this deduction.

There is a difference between this and deductions made for health insurance premiums (which fall under Section 80D of the Income Tax Act 1961).

Whose Medical Expenses Can Be Claimed Under 80DDB?

A taxpayer or dependent who suffers from a disease prescribed is eligible for a deduction under Section 80DDB.

- Individuals or HUFs can claim it

- Resident Indians are allowed

- When the taxpayer has paid for treatment of a dependent

- A dependent is a spouse, a child, a parent or a sibling

- In case the dependent is insured, and some payment is also received from an insurer or reimbursed from an employer, such insurance or reimbursement received shall be subtracted from the deduction.

- Only expenses incurred during the previous year can be deducted.

- Moreover, when determining the deduction amount, the age of the person receiving medical treatment is used and not the age of the claimant or assessee.

- In respect to the amount claimed as deduction under section 80DDB, no deduction can be claimed under Chapter VI A .

What is the amount that can be claimed as deduction under Section 80DDB?

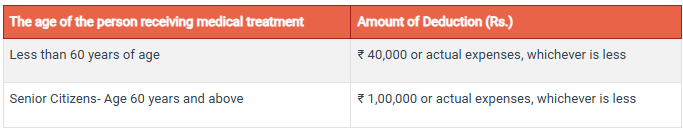

With effect from financial year 2018-19 (AY 2019-20 onwards), deductions under Section 80DDB can be calculated as follows:

All of the above deductions can be claimed per financial year only. All payments made towards the health insurance premiums of your parents should be made by you, either through net-banking, debit or credit card, cheque or bank draft. Keep in mind that any cash payments won’t get you tax benefits for parents’ healthcare needs.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.