Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

A basic guide to calculating your income tax liability

7 mins

7 mins 13.8K

13.8K

A citizen's first income tax payment is a milestone in his or her life. For a first-timer, however, the process can seem overwhelming and tedious, and even some of the terms can be difficult to understand. However, there is no need to worry. For beginners, here is a compilation of basic income tax information that can help you understand the tax implications of your income.

Calculating your income tax liability is easy. Just follow the simple formula:

Sum of all Your Earnings = Total Gross Income – Deductions = Taxable Income

There are five sources of income as per income tax act ,1961-

- Income from salary.

- Income from house property.

- Income from capital gain.

- Income from business and profession.

- Income from other sources.

(First, add up your earnings to arrive at your total gross income and then subtract applicable deductions-the answer is your taxable income).

Here’s a brief guide to help you calculate your taxable income:

Salary Income: Collect all your salary slips as well as Form 16. Add all allowances (HRA, TA, DA, medical, etc.) and reimbursements, including any bonuses to arrive at your gross salary. Deduct the applicable exemption amounts for HRA, LTA, and medical expenses, if any. Keep in mind that you are allowed standard deductions of ₹50,000 on your annual salary.

House Income: Firstly, calculate the net income you receive from your property, mainly the rental income. Profit from a self-occupied house will also need to be computed (although, it will generally be a nil or negative value). Deduction U/S 24 also available to reduce the taxable income.

- U/S 24 (a) , 30% of NAV (Net Annual Value ) should be available as deduction.

- And u/s 24 (b), Interest on borrowed capital is allowed as deduction.

You can deduct a maximum claim of Rs 1,50,000 under section 80c of principal payments from taxable income each year. This is applicable for both self-occupied and rental properties. It also includes registration fees and stamp duty paid.

Income from Capital Gains: Income from Capital Gains is any income you get from the sale of capital asset like stocks, bonds, or property. Your capital gains may either be short-term or long-term. So, the third step is to calculate both your short-term capital gains and long-term capital gains. Also claim any deductions under Sections 54, 54G and 54EC, if they apply. What remains after this is your capital gains income.

Business Income: To calculate the taxable income from your business, take the net profit made in the financial year as the base value. deduct all the deductions allowed as per the IT act and add back all the expenditures disallowed from your net profit to arrive at taxable value.

Income from Other Sources: Income from interest earned on fixed deposits or savings accounts, dividends from mutual fund schemes, any income from gifts, family pensions, lottery, or horse races are classified under this category. Add them up and subtract any deductions to arrive at your net income.

Gross Total Income: Add up all your earnings from the sources above. That equals your total gross income. Set off losses, if any, when you calculate income tax.

Deductions Under Chapter VI A: These deductions include investments made under Section 80C to 80U of the Income Tax Act, 1961 like ELSS, PPF, ULIPs, NPS, VPF, NSC, tuition fees, life insurance policies, and mediclaim/heath insurance policies.

Suggested Read: What is Chapter VIA of Income Tax Act?

Calculate Your Net Taxable Income: To calculate net taxable income, you finally need to subtract Step 7 from Step 6. Now apply the tax rates under which your income falls. The result is the final income tax amount you’ll be required to pay.

Calculate Your Tax Payable: Once you have effectively reduced your tax liability in the prudent way described above, you may proceed with the calculation of your tax liability, as per the latest income tax slabs.

Suggested Read: How to Calculate Income Tax on Salary with Example

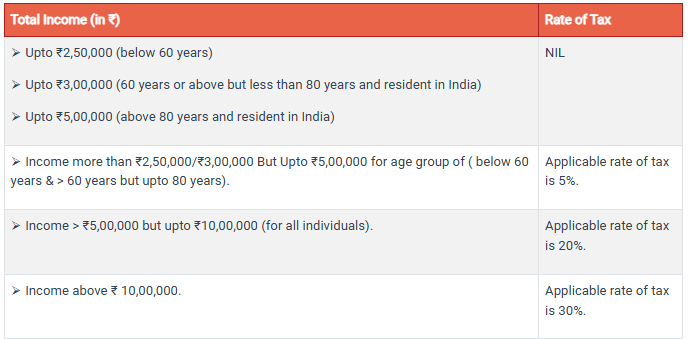

An income tax calculator in India calculates the tax payable by individuals for FY 2020-21, based on the following tax rates:

Income Tax Slab rate as per Old regime :

If an individual’s total taxable income is upto ₹ 5,00,000 then he will get the tax benefit (under section 87A) of (whichever is lower):

- Rs 12,500

OR

- The amount of tax payable

It may be noted that resident individuals of the age of 60 years or more and 80 years or more would not be entitled to higher basic exemption limits of ₹3 lakhs and ₹5 lakhs, if they opt for section 115 BAC.

Note that these rates apply for the tax year 2020-21 that corresponds to the assessment year 2021-22. In addition, the total tax rate is subject to surcharge and health & education cess above the total amount payable.

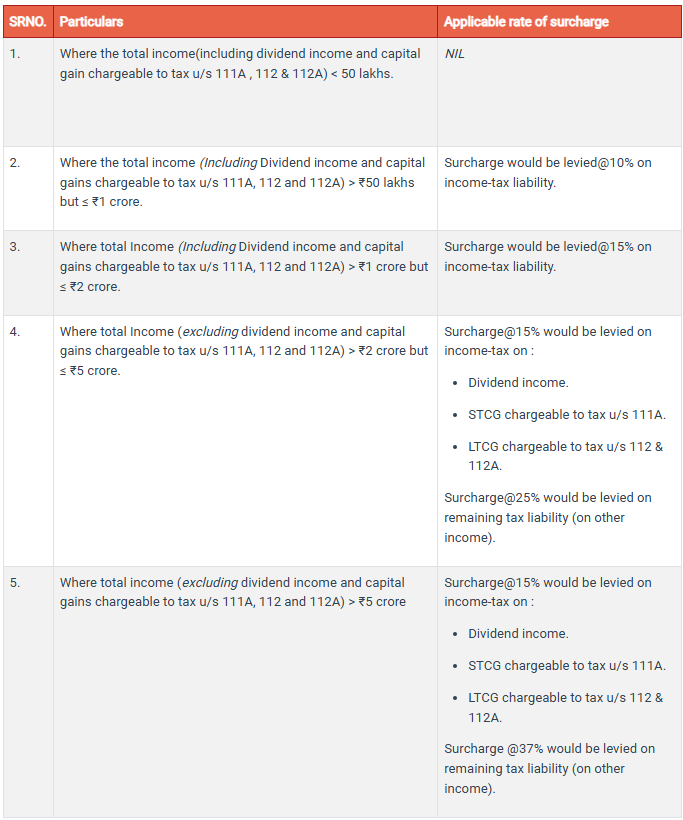

Applicable Surcharge Rate for Individuals and HUF:

Applicable rate of Health and Education cess:

4% cess is applicable on (taxable income + amount of surcharge).

Also, the taxpayers opting for concessional rates in the New Tax regime will have to forgo certain exemptions and deductions available in the existing old tax regime. In all, there are 70 deductions and exemptions that are not allowed. Please go through the list beforehand.

Knowing one's total taxable income for the year is crucial to successfully and accurately completing an ITR. Depending on one's annual income, one will fall into a specific tax slab and pay a certain percentage of the tax. To calculate tax liability, one can use an online income tax calculator since it provides instant and accurate results. Furthermore, to help make your investment planning easier, feel free to contact our financial advisor right away.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.