Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Advance Tax Payment: A Comprehensive Guide

10 mins

10 mins 13.3K

13.3KWhat is Advance Tax Payment?

Advance tax can be described as income tax paid in advance for the income earned in a particular financial year. Usually, the tax is to be paid when the income is earned. As per the provisions of Income Tax Act related to advance tax, the payer has to estimate the income for the entire year. And based on this estimate the tax is paid at specific time intervals

Tax payment challans can be used to pay advance tax at bank branches that have been authorised by the Income Tax Department. It can be deposited in any of the authorised banks.

Another option for making an advance tax payment is to use the Income Tax Department's online tax payment website or the National Securities Depository.

Who is liable to pay Advance Tax?

In order to be liable (eligible) to pay advance tax, the following criteria must be meet:

As per section 208 of the Income Tax Act 1961, every person whose estimated tax liability for the year is more than or equal to `10,000 is liable to pay advance tax.

Those who are excluded from paying advance tax are Senior citizens, whose age is 60 years or more but have no income through business or profession.

- Your tax payable should be at least ₹ 10,000 or above.

- You should either be self-employed or salaried.

- Income earned or received on through capital gains on shares

- Fixed deposit interest earned.

- A lottery winner's winnings .

- Income or rent earned from a house property

What is the advance tax payment due date for FY 2022-23?

The final instalment of advance tax payment for Financial Year (FY) 2022-23 is due on March 15, 2023. Taxpayers must pay their entire advance tax liability by or before this due date .

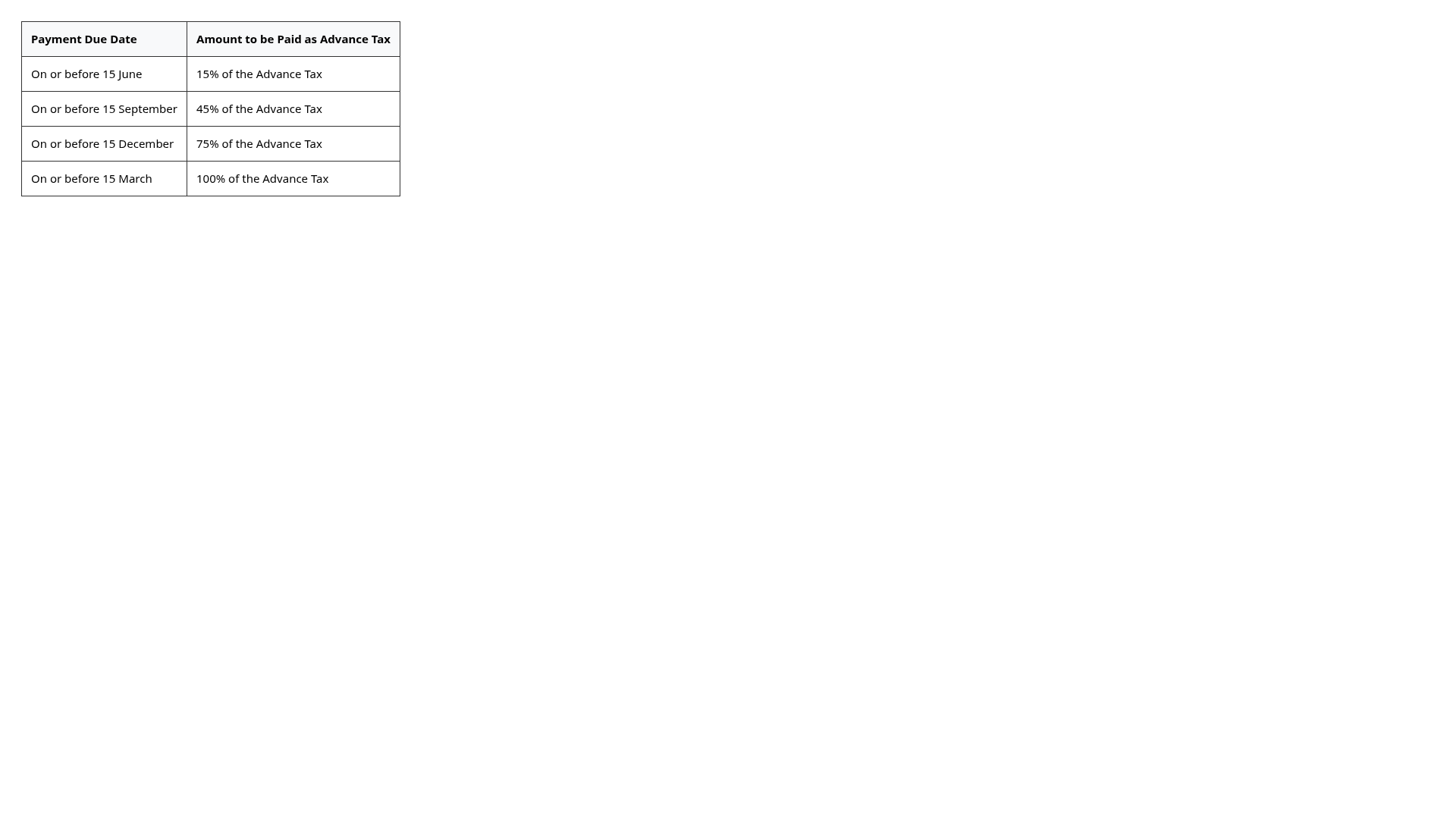

Advance Tax for Taxpayers (apart from the ones who are covered under section 44AD or 44 ADA):

Which forms are required in advance tax?

On or before the deadlines, the form Challan No. ITNS 280 must be properly filed. The Challan No. ITNS 280 has the following preconditions:

- PAN Details - Make sure you share the proper PAN details, or your tax will be placed in the name of someone else.

- Assessment Year - Because the tax is being paid in advance for the following financial year, make sure you select the correct assessment year.

- Choosing a Payment Type - In the form, the taxpayer must choose a payment type as given below:It is advance tax if the tax is paid for the same fiscal year based on the estimated income.It is self-assessment tax if the tax is paid after the end of the financial year.

A Challan Identification Number (CIN) will be supplied after the payment has been received. You must keep a record of this information and utilize this CIN when filing your income tax return . Also, double-check whether the Income Tax Department has received the online payment which was made through TNS 280.

What is advance tax challan 280?

On the website of the Income Tax Department of India, Challan 280 enables users to make online income tax payments. On the website, one has to select this challan and fill the form and then use it to pay taxes online/offline. Download the Challan 280 form from the Income Tax Website, fill it out, and take it to the bank if you want to pay your taxes offline.

How to calculate advance tax? Explained with an Example

You can estimate your advance income tax liabilities by following the 4 simple steps:

- Estimate your income to be earned during the financial year

This includes making an estimate of possible annual income one might get. Interest income, rental income, capital gains, professional income, and any other types of incomes must all be combined.

- Calculate the cost associated with the expected income.

- The deductions you intend to make under Chapter VIA should be calculated.

- Calculate the overall tax payable.

Make sure to consider these points when calculating your tax payable:

- The tax slab rates applicable to you

- Tax rebate under Section 87A

- The TDS to be deducted by other taxpayers on your income

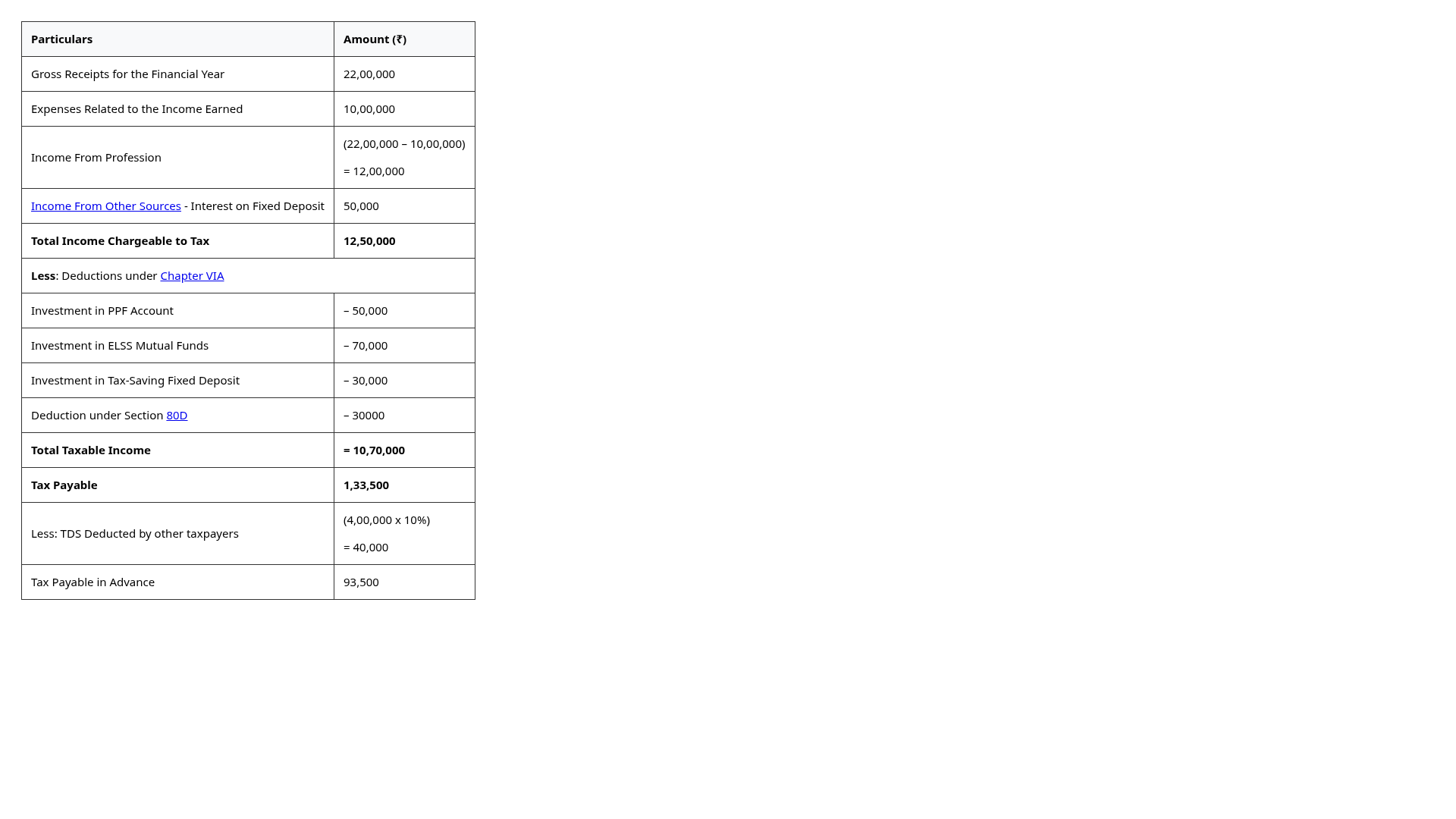

Example: Let us understand the entire process with the help of an example

Mr. Arun is a taxpayer who earned income under the head 'Business and Profession'.

- Estimated Gross Receipts for the financial year– ₹ 22,00,000

- Estimated Expenses related to income earned- ₹ 10,00,000

- Payments from which TDS is to be deducted - ₹ 4,00,000

- Interest Income- ₹ 50,000

Let us calculate the liability now:

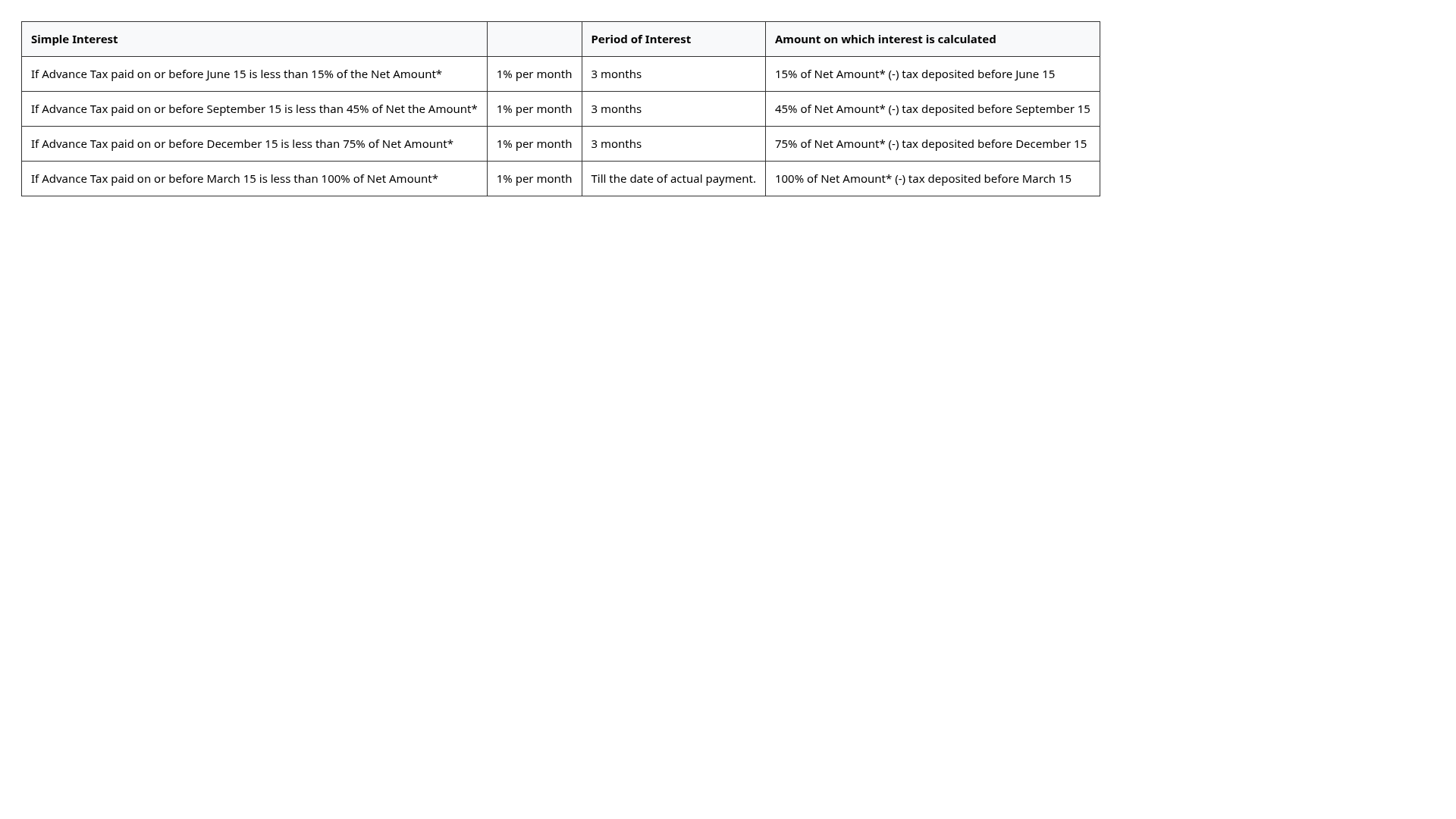

Advance Tax Late Payment and Interest

Interest is charged for failure of paying advance tax under Section 234C. From the due date of each instalment until the day of actual payment, interest is applied at a rate of 1%. Here's the list of all the applicable interest rates and how interest is calculated:

If a taxpayer has not chosen to use presumed income:

*Net Amount = Tax liability on total income chargeable to tax (-) tax paid

Tax Paid in terms of relief, TDS, TCS, or Tax Credit

Process to pay advance tax online?

Any authorized bank branch which has been given the go-ahead by the Income Tax Department is where advance tax payments can be made offline. An alternative is to pay advance tax payment online.

Below are the steps for payment of advance tax online:

- Visit the Tax Information Network website at https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

- Click on 'Proceed' under 'Challan No./ITNS 280' under 'Non TDS/ TCS'

- Enter the information on the screen to generate the challan

Tax Applicable

- For Companies- select '(0020) Corporation Tax (Companies)'

- For Other than Companies- select '(0021) Income Tax (Other than Companies)'

Type of Payment

Choose '(100) Advance Tax' from the available options to make the payment.

Mode of payment

Choose your preferred payment method; you can use a debit card or net banking option. In all situations, you must choose the "Bank Name" option from the drop-down box.

- Enter your PAN (Permanent Account Number) details

- Enter the Assessment Year. Select the assessment year very carefully. An incorrect AY would need a rectification by applying to the assessing authority. Be very careful to avoid any hassle.

- Enter your address with city/ district, state, and PIN Code being mandatory fields and your email ID and mobile number

- Enter the captcha code displayed on the screen

- Click on Proceed

- You will be to the bank's website to complete the transaction

- After completing the payment, you will receive the bank receipt. The bank receipt will contain the BSR code and challan serial number. Make sure for the future reference you save the challan copy.

How to download advance income tax payment receipt?

To view the advance tax payment challan, go to https://tin.tin.nsdl.com/oltas/index.html. Select CIN (Challan Identification Number) Based View. Enter the required details, and click on 'View'. Once the challan information is visible on the screen, you have the option of printing it off or saving a screenshot. By accessing the website of the bank where the advance tax payment was made, taxpayers can also download the receipt or challan for the advance tax payment. There will be a choice to download the receipt for the advance payment.

Exemption in Advance Tax Payments

- Senior citizens (who is aged 60 years and above) and who rank as senior citizens and who also don't own business establishments of any kind are those who are always exempted from making advance tax payments.

- The advance tax is not due from salaried people who fall inside the TDS net. However, advance tax will be charged on any earnings generated from sources including capital gains, interest income, rental income, and other non-salary sources of income.

- If TDS deducted is more than the tax payable for the year, then one does not have to pay the advance tax.

- Advance tax may also not be paid by tax payers who choose presumptive schemes in which business income is always assumed to be around 8% of the turnover.

- Business owners with a turnover of less than INR 2 crore may use presumptive schemes. Sections 44AE and 44AD deal with the presumptive scheme of paying income tax. Such schemes can be easily opted by business people whose annual business turnover is less than 2 cores. While the presumptive scheme for advance tax payments are usually reserved for business people alone, such a scheme has very recently been extended to architects, lawyers and doctors in the financial year 2016 to 2017 provided their yearly receipt totals to a maximum of Rs.50 lakhs.

Refund of Advance Tax

At the end of the financial year, in case the Income Tax Department finds out that you have paid more tax than you should have paid, then the IT department will refund the excess amount paid. By submitting the Form 30 the taxpayers can claim the refund. The taxpayer will have to file claim within a period of 1 year from the last assessment year.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.