Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

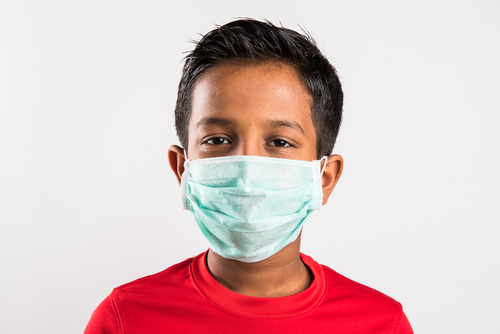

9 Ways To Protect Your Kids From The Novel Coronavirus

5 mins

5 mins 1.6K

1.6KThe COVID-19 scenario has created many challenges in our day-to-day lives. While being self-cautious with everyday dealings is not easy, what is even more difficult is to monitor children during this time as they don't understand the gravity of the situation. It is indeed a challenging time, but with some foresight, better planning and a positive attitude, we can make the grave situation slightly better to handle.

Firstly, it is essential to get your facts right on the impact of COVID-19 on children.

According to WHO, in China, children under the age of 18 made up only 2.4 per cent of all reported cases. Only 2.5 per cent of kids under the age of 19 developed a severe case, and only 0.2 per cent were critical.

Mild infection symptoms include fever, fatigue, cough, runny nose and sneezing.

Exceptions: Some kids have no fever but experience nausea, vomiting, abdominal pain and diarrhoea.

Moderate infection symptoms include pneumonia, frequent fever and a mostly dry cough, followed by wet cough and wheezing, but no apparent shortness of breath. Those who have fever and cough also experience gastrointestinal symptoms like diarrhoea. After a week, blood oxygen levels dip below 92%, and breathing becomes difficult.

Critical cases symptoms include breathing issues and vital organ failure.

If your child shows any of these symptoms seek help immediately on

More details available at https://www.mohfw.gov.in/

The good news is that going by the statistics; children are a lot less likely to get the virus. Yet going by the steep increase in cases of the COVID-19, you must take adequate care of your little ones.

If you're dealing with kids above the age of 8, make them aware of the situation. The best way to approach is to make them watch fun and verified educational videos available on the internet that educate them on the matter. That way, they will better understand the situation and also know what they need to do to be safe. However, while doing so, it is crucial not to make the case seem grim. State everything in a positive light and help them understand that it is a temporary situation. The main challenge arises in dealing with kids below the age of 8. It is best to not explain the situation to them because it might be too unpleasant or confusing for them to fathom. It is also important to teach them to wash their hands correctly.

Children love stories and games. Get creative and make them picture COVID-19 as a monster who would steal their toys if they don't follow some rules. Create a set of new "rules" to be followed at home. For, e.g. reward them with a gift if they wash their hands before touching their face. Maintain a points system. Reward them with additional points for washing their hands correctly and reduce points for not doing so. As you understand your children best, you can improvise on these games.

As parents, juggling work and home responsibilities can easily take a toll on either partner. Hence it is important to take turns to keep an eye on the young ones. Assign alternate hours to each partner to keep vigil.

Ask older siblings to take a share of the responsibility to look after their younger siblings. Simultaneously, request grandparents to keep an eye on the children too so that some load is taken off your shoulder.

On account of the lockdown, sourcing nutritious food might not always be possible. Yet try your best to provide nutritious food to kids so that their immunity is strong. Since outdoor playtime is a complete no during this time, encourage your kids to join you every day during workouts.

Dance together as a family. A family activity will not only help keep your kids physically fit, but also ease the tension in the air.

Create a list of "Don'ts" and stick it on a wall or door in the common areas of the house. In this list include nose-picking, face touching and getting too close to others.

It is challenging to maintain social distancing with children as you need to feed them, bathe, dress them up, etc. Yet for their safety, avoid physical contact whenever possible. Also sanitize your own hands before coming in physical contact with your kids.

Disinfect the whole house, flooring, doors, fittings, furniture, two times in a day to ensure that your kids don't touch anything that can be infected.

While there has been no conclusive evidence on whether children in the womb can be infected, it is best to follow the ground rules for COVID-19 for prevention.

In the case of the coronavirus situation, the best approach is prevention. So protect the community as a whole by social distancing and by staying at home.

Source: https://www.unicefusa.org/stories/coronavirus-children-complete-guide/37092

as on 28/03/2020

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Smart Living

Celebrate women’s day with generali central

4 mins

2.4K

Posted on: Jul 28, 2025

Smart Living

Simplify Your Life Insurance Premium Payments with Auto Pay

3 mins

3.8K

Posted on: Jul 28, 2025

Smart Living

FY22 is going to be a year of strong economic rebound in India

7 mins

1.7K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.