Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Can I Invest in ULIPs for My Children?

3 mins

3 mins 4.8K

4.8KWhy should you invest in ULIPs?

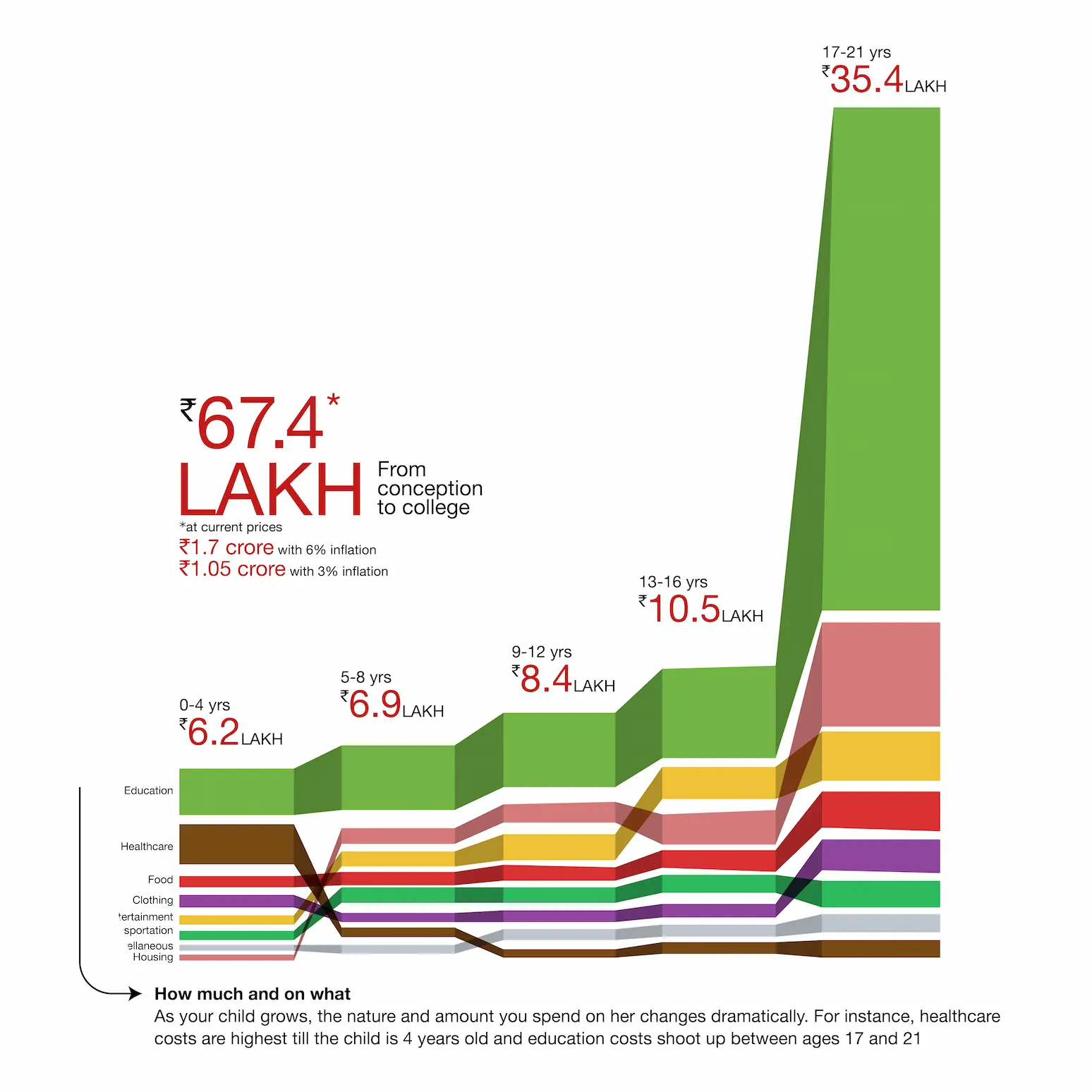

Education costs have gone up due to inflation. If you look into admission fees for engineering colleges or for getting an MBA, a degree would cost around 30 lakhs and 50-60 lakhs respectively. Most of a parent’s savings and earnings go into their child’s education. If that doesn’t suffice, children are forced to take out student loans. Estimates show that more than one million students are staggering in debt from student loans.

What are the benefits of investing in ULIPs?

Investing in your child’s future is key to keeping it financially secure. With child ULIP plans you have the benefit of both insurance and investment. They take care of your child in your absence. In case of an emergency, you can be assured that your child’s future is secured. If you’re worrying about the affordability of , you can make small investments and get larger returns as small fractions of your money will grow into a lump sum when compounded. This amount will ease your financial burden and can be withdrawn in partial amounts, if you need them to help your child secure major milestones in his/her life.

There are ULIPs that cater to your child’s education only. ULIP child education plans focus on your child’s education needs, depending on investments based on your financial capacities and monetary goals. You can withdraw the amount partially, as per your requirements.

An added advantage to ULIPs comes with tax benefits is that they come with tax benefits as well.

So, if you are thinking, “Should I invest in ULIPs for my children?”, the answer is yes. Child ULIP plans help you create a corpus that will fund your child’s education as well as marriage. In case the insured expires, the assured sum will go to the child.

Child ULIP plans allow you to invest once you fulfill the criteria of minimum and maximum requirement for age as per the policy. Your age must fall in the range that is required by the terms and conditions of the policy at the policy’s maturity.

In order to apply for a policy, you will have to submit the following documents:

Other Documents

The Insurance Company may call for additional information or documents depending upon the amount of cover applied, the premium that you will be paying and your profile, including but not limited to your lifestyle, habits, family history etc.

Being a parent means having a huge responsibility on your shoulders. You have to be efficient in managing your finances to secure what’s best for your child. Child ULIP plans come with a number of benefits like building corpus, life insurance , death cover and others.

You do get maturity benefits from child ULIP plans; the assured sum comes to the parent or guardian and on their demise it is handed over to the child. They also waive off your future premiums and on your behalf the insurance company continues to invest this money.

In general, portfolio switching between debt and equity is also possible in ULIPs , but it mostly depends on your risk appetite and knowledge about market performance. On the other hand, though it has been mentioned here that you can partially withdraw money before maturity, you must know that that may force you to lose a portion of your returns. You must abide by the lock-in period which is normally 5 years from the starting date of the ULIP. After the lock-in period, you can surrender the policy and the stamp duty and related expenses for maintaining and issuing the same will be deducted by the insurance company.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

Which Is a Good Term Insurance Policy for Women?

4 mins

3.7K

Posted on: Oct 01, 2025

Life Insurance

Up to what age can I get term life insurance coverage?

4 mins

6.4K

Posted on: Oct 01, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.