Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

What Will Be the Cost of a 50 Lakh Term Insurance Plan?

3 mins

3 mins 4.8K

4.8KBefore diving deep into numbers and knowing ; let us understand what exactly a term insurance plan is.

A term insurance policy is the purest and most cost-effective type of life insurance policy . This policy is designed in such a way that it only pays out benefits on the death of the life insured during the policy term. This plan is an essential step for taking care of your family’s future needs and requirements in your absences. Before we move further, let us understand the following:

Who should buy term insurance plans?

The answer may vary from person to person, but what's common is any individual, between 18 to 55 years, having a financially dependency on their income, should seriously consider purchasing a .

Death is undoubtedly a tragic event. Practically, losing the sole breadwinner, the family head, or the father will probably bring financial instability. Hence, buying a term insurance plan is a smart choice for individuals who want to protect their families in their absence.

Term insurance plans can benefit various people with varied kinds of income, such as:

Moreover, anyone wanting to keep their family under an umbrella of financial security can purchase a .

--

Since you have decided to buy a policy for 50 lakhs, this amount must be sufficient to ensure that you have the following covered:

50 lakhs - the decided sum assured of your term plan must cover the above costs. If it is doing so, you can relax – you are adequately covered. It is as simple as that! If not, you will need to recalculate and decide on a sum assured amount that covers the above costs.

The important thing to remember – Purchase a term insurance plan with a sum assured amount for which you can pay premiums. Assuming that you need a term insurance plan with a sum assured of Rs 1 crore, but the premiums are a huge burden on your finances, then buy a plan with a sum assured that you can easily afford.

--

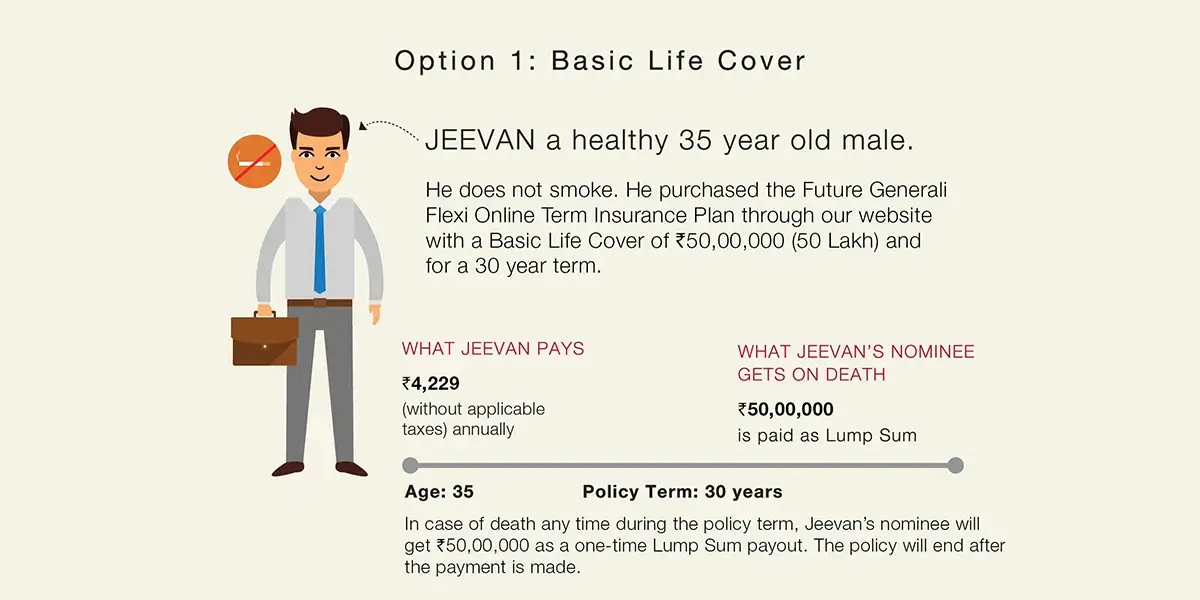

With the various aspects of a term insurance plan covered, it is time to learn how much a Rs. 50 lakh term insurance plan would cost.

Before purchasing, analyze you periodically to ensure higher returns.

Let us understand it with an example.

For more details refer the product brochure .

For more details refer the product brochure .

For more details refer the product brochure .

How to apply for a Rs. 50 lakh term insurance plan?

To apply for a Rs 50 lakh term insurance plan through Generali Central Life Insurance, follow the steps below:

Conclusion

One of the topmost priorities for any individual is to provide for his/her family’s well-being, regardless of its presence. The from Generali Central Life Insurance may just be the plan suited for your family’s needs in the future, without taking a toll on your pocket in the present.

Click on the link - Life Insurance Made Simple to learn more about life insurance, explore other related products, and read more about and financial planning today.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Life Insurance

Life Insurance: Protecting Today, Enabling New Beginnings

4 mins

527

Posted on: Oct 20, 2025

Life Insurance

Which Is a Good Term Insurance Policy for Women?

4 mins

3.7K

Posted on: Oct 01, 2025

Life Insurance

Up to what age can I get term life insurance coverage?

4 mins

6.4K

Posted on: Oct 01, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.