Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Union Budget 2018: 7 Key Highlights of Personal Income Tax

7 mins

7 mins 1.9K

1.9K

Union Budget 2018: 7 Key Highlights of Personal Income Tax

The budget every year brings important considerations that impact individuals across the country. There are several deductions available in the Budget, which often allow individuals to save a lot more on their taxes as well as invest for their future. Here we bring you key highlights of the 2018 Budget and how it impacts your Income Tax.

The standard deduction for the salaried group: -

A standard deduction is a deduction allowed in income tax irrespective of the expense incurred or the investment made by the individual. No disclosures are required for this type of Income Tax Standard Deduction as it is allowed at a standard rate.

The standard deduction in Budget 2018 has been introduced for a salary of Rs. 40,000 or above and is applicable from 1st April 2018. This deduction is allowed irrespective of the actual expense incurred by the employee. The employee is not required to submit any bills or proof to the employer for claiming the deduction. This deduction has been introduced instead of Transport Allowance & Medical Reimbursement which was earlier allowed to employees against bills as proof for claiming these benefits.

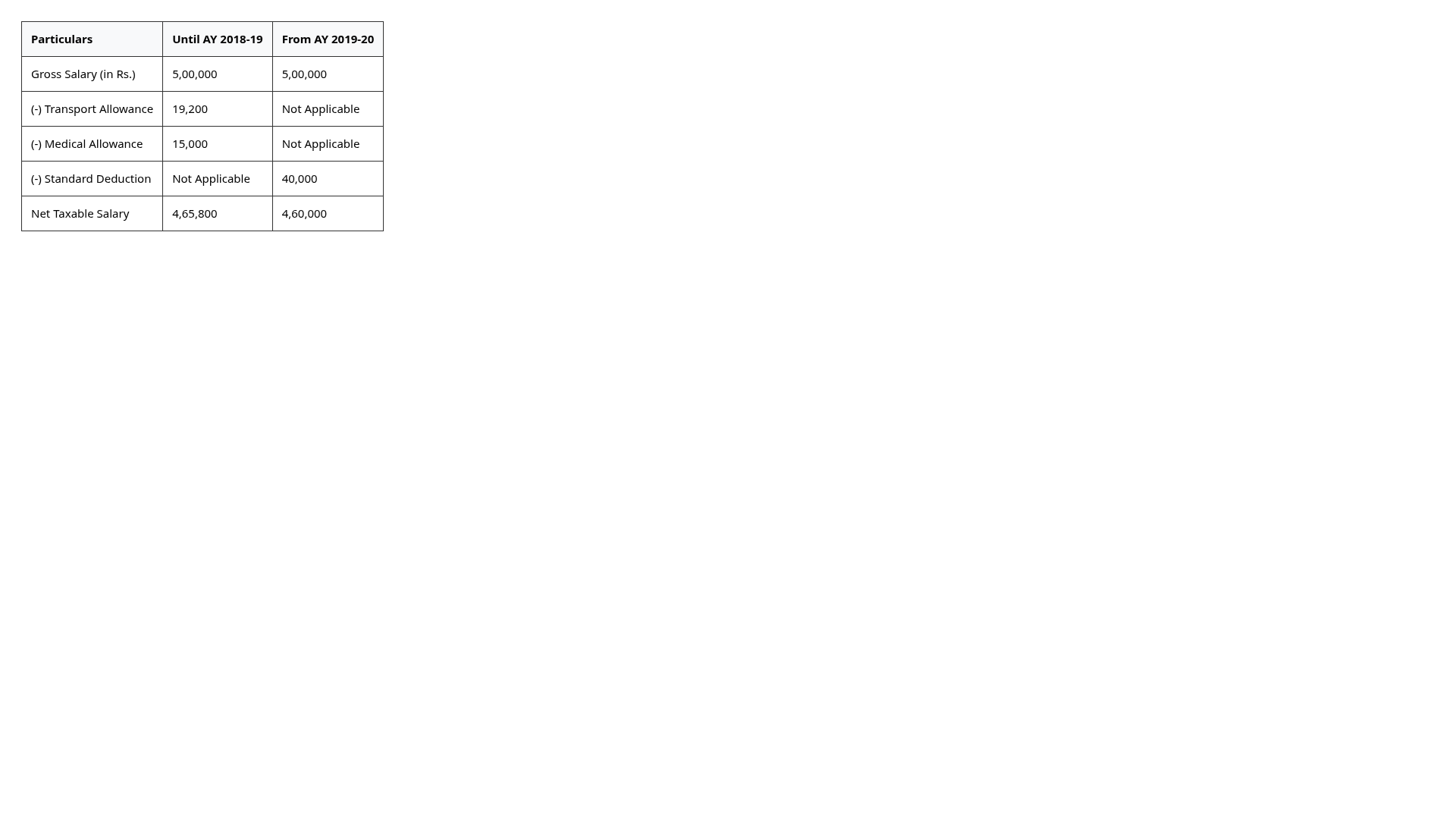

Thus, the standard deduction of Rs. 40,000 replaces medical allowance of Rs. 15,000 and transport allowance of Rs. 1600 per month, i.e. 19,200 per annum, in turn allowing for an additional benefit of Rs. 5,800.

Example: -

Relief for Senior Citizens: -

The 2018 Budget also considers the considerations of Senior Citizens with the following provisions.

Exemption of interest income on deposits with banks and post offices to be increased from Rs. 10,000 to Rs. 50,000 and TDS (Tax Deducted at Source) will not be required to be deducted on such income, under section 194A. The benefit of exemption will also be available for on interest from all fixed deposits schemes and recurring deposit schemes.

The government has raised the limit of deduction for health insurance premium or medical expenditure from Rs. 30,000 to Rs. 50,000 under Section 80D . All senior citizens will now be able to claim the Rs. 50,000 per annum in respect of any health insurance premium or any general medical expenditure incurred.

The limit of deduction for medical expenditure in respect of certain critical illness has been raised from Rs. 60,000 in case of senior citizens and from Rs. 80,000 in case of very senior citizens, to Rs. 1 lakh in respect of all senior citizens, under section 80DDB . The government also envisions to continue Pradhan Mantri Vaya Vandana Yojana up to March 2020, while proposing to increase the current investment to Rs. 15 lakhs from the existing limit of Rs. 7.5 lakh per senior citizen.

Increased education cess from 3% to 4%: -

Furthermore, the cess has been increased by 1%, in the name of Health Cess, making it effectively 4% 'Health and Education Cess'. As of now, an education cess of 3% was levied on personal income tax. While this move may help the government in meeting the healthcare and education needs of the rural families, it is certain that the tax liability of both individuals and corporates will increase.

Long Term Capital Gain on Equity and Equity Oriented Fund: -

The new tax will be levied on redemption of equity mutual fund units or sale of shares after April 1, 2018, provided they have been held for more than one year. The long-term capital gains exceeding Rs. 1 lakh arising from the redemption of mutual fund units or equities on or after April 1, 2018, will be taxed at 10%, without any indexation benefit. However, the gains up to 31st January 2018 will not attract the said tax to the extent of the fair market value as on 31 January 2018.

According to the income tax department, the cost of acquisition for the long-term capital asset acquired on or before 31st of January 2018 will be the actual cost. However, if the actual cost is less than the fair market value of such an asset as on 31st of January 2018, the fair market value will be considered to be the cost of acquisition.

Further, if the full value of consideration on sale is less than the fair market value, then such full value of consideration or the actual cost, whichever is higher, will be considered to be the cost of acquisition.

Scenario 1: -

Purchase price on January 1, 2017 is Rs. 100

Price on January 31, 2018 is Rs. 200

Sold on March 31, 2018 at Rs. 250

Since it is sold on or before March 31, 2018, there is no tax liability.

Scenario - 2

Purchase price on January 1, 2017, is Rs. 100

Price on January 31, 2018 is Rs. 200

Sold on April 1, 2018, at Rs. 250

As the investment is sold after March 31, it will attract long-term capital gains. Since the actual cost of acquisition is less than the fair market value as on 31st of January 2018, the fair market value of Rs. 200 will be taken as the cost of acquisition, and the long-term capital gain will be Rs. 50 (Rs. 250 - Rs. 200).

Scenario- 3

Purchase price as on January 1, 2017, is Rs. 100

Fair market value is Rs. 200 on 1st of January 2018

Sold on 1st of April 2018 at Rs. 150

Here, the actual cost of acquisition is less than the fair market value as on 31st of January 2018. The sale value is also less than the fair market value as on 31st of January 2018. So, the sale value of Rs. 150 will be taken as the cost of acquisition and the long-term capital gain will be NIL (Rs. 150 - Rs. 150).

Scenario- 4

Purchase price on 1st of January 2017 is Rs. 100

Fair market value is Rs. 50 on 31st of January 2018

Sold on 1st of April 2018 at Rs. 150

In this case, the fair market value as on 31st of January 2018 is less than the actual cost of acquisition. So, the actual cost of Rs. 100 will be taken as the actual cost of acquisition, and the long-term capital gain will be Rs. 50 (Rs. 150 - Rs. 100).

Scenario- 5

Purchase price on 1st of January 2017 at Rs. 100

The fair market value on 31st of January 2018 is Rs. 200

Sold on 1st of April 2018 at Rs. 50

The actual cost of acquisition is less than the fair market value as on 31st January 2018. The sale value is less than the fair market value as on 31st of January 2018 and also the actual cost of acquisition. Therefore, the actual cost of Rs. 100 will be taken as the cost of acquisition in this case. Hence, the long-term capital loss will be Rs. 50 (Rs. 50 - Rs. 100) in this case.

Reduction of the corporate tax rate from 30% to 25%: -

This has been a relief for Micro, Small & Medium Enterprises (MSME's) as the government had declared to decrease corporate tax rate to 25% in the Union Budget of 2017.

Deductions not to be allowed unless the return is filed by the due date: -

The benefit of deduction under the entire class of deductions under the heading "C.—Deductions in respect of certain incomes" in Chapter VIA shall not be allowed unless the due date files the return of income .

Employee Provident Fund: -

For new EPF accounts, women's' contribution has been reduced to 8% with no change in employer's contribution for the first three years of their employment.

The Government would contribute 12% of the wages for new employees for the next three years in all the sectors.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Tax Hacks

What are the special income tax benefits for women?

4 mins

18.8K

Posted on: Jul 30, 2025

Tax Hacks

What is the section 10(10D) tax benefit of Generali Central Big Dreams Plan?

2 mins

3.9K

Posted on: Jul 22, 2025

Tax Hacks

Which Generali Central Life Insurance plan can give me section 80C tax benefits?

2 mins

2.9K

Posted on: Jul 22, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Centre

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.