Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Retirement: The Beginning of Your Dream Life

4 mins

4 mins 420

420Learn how thoughtful planning today can make your retirement years a time to live your passions, explore new places, and embrace the freedom you’ve always dreamed of.

Retirement is about living life at your own pace and enjoying life. After years of hard work, this is your time to explore, create, and rediscover yourself. For some, it means traveling the world. For others, it’s about learning a new skill, turning a hobby into a passion project, or simply spending more time doing what brings joy.

Take Sunita, for instance. After decades in science and research, she now spends her mornings painting in a sunlit studio and her weekends exploring art galleries. Her foresight and planning gave her not just financial freedom, but creative freedom too.

Your Retirement Dreams

Before you plan your finances, why don’t you visualise what a fulfilling retirement looks like for you. It will help you get clarity on what all might need to save for and clarity is the cornerstone of any planning.

Travel and Vacations: Whether it’s cruising through Europe, visiting scenic towns across India, or returning to your roots, your travels can be as ambitious or intimate as you like — as long as they’re backed by the right financial plan.

Pursuing Hobbies and Passions: Retirement offers the rare gift of time. Rajiv, a former regional sales head, travelled constantly for work but never got to enjoy the places he visited. Post-retirement, he took up photography. Today, he documents the people and places he once only passed through — and has even held his first photo exhibition.

Learning New Skills: From digital design to baking or a new language, retirement opens doors to lifelong learning. Meera, a retired physiotherapist, took online courses in design and now sells her handmade cards — finding both purpose and profit in her passion.

Planning Your Dream Retirement

Dreams take shape when you plan them right. Once you think through what you want to do during your retirement you can:

- Identify Financial Needs: List out the costs for travel, hobbies, healthcare, and daily living. The earlier you know what you’ll need, the better you can plan.

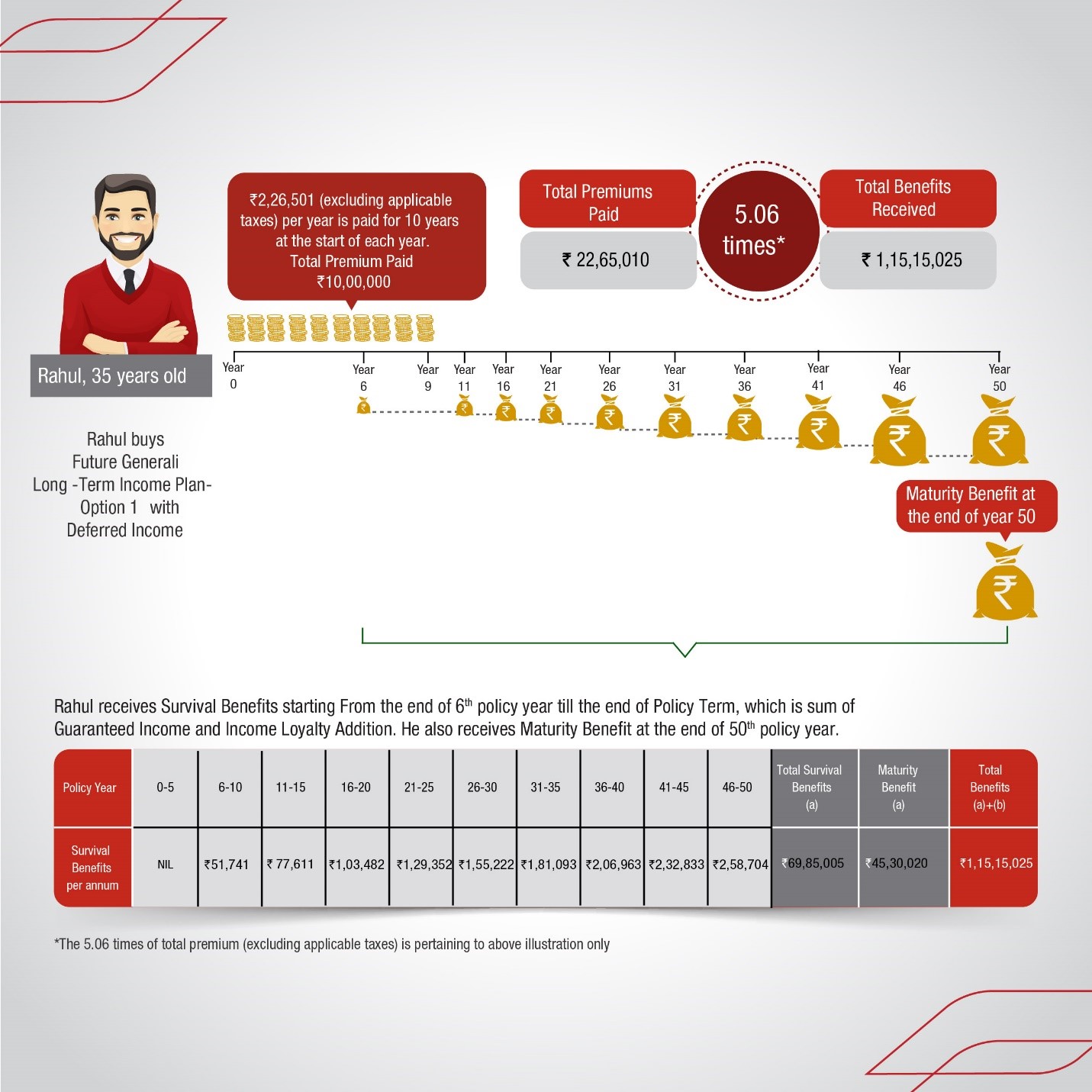

- Start Saving Early: The earlier you begin, the more your savings grow. Long-term investment options like retirement plans can help you build wealth while providing life coverage. Compounding over the years turns consistent saving into a strong retirement corpus and the annuity of retirement plans can give you a good income if you plan well.

- Allocate Dedicated Funds: Set aside separate funds for different goals and requirement like vacations, hobbies, emergencies, and health.

Unlock The Power of Annuity Plans

An annuity plan can provide the financial foundation for a confident retirement. Unlike market-linked investments, annuities offer stable returns with minimal risk, safeguarding your capital while ensuring a fixed, predictable income for life. They also provide the flexibility to choose between immediate or deferred annuities, and tailor payment frequency and duration to suit your lifestyle. Annuties provide:

Predictable Income: It ensures a steady stream of income that lets you budget comfortably — unaffected by market ups and downs.

Protection Against Longevity Risk: One of retirement’s biggest risks is outliving your savings. Annuities eliminate that risk by providing regular income for life.

Peace of Mind and Financial Security: Knowing that your essential needs are covered gives you the confidence to live your retirement on your own terms.

Choosing the Right Annuity Plan

When selecting an annuity plan, consider the following:

Financial Goals: Align your annuity with your retirement needs — healthcare, travel, or daily living. It should complement your overall retirement strategy.

Inflation Protection: Choose an option that helps your income keep pace with inflation so your purchasing power stays intact over the years.

Fees and Charges: Compare plans carefully — understanding costs ensures better long-term returns.

Liquidity: If you want access to funds early, immediate annuities offer flexibility, while deferred ones help grow your corpus before payouts begin.

Retire to a New Life

Retirement is your opportunity to rediscover, explore, and enjoy the life you’ve worked so hard to create. With the right planning, you can make every year of retirement rich in experiences, security, and fulfilment.

An annuity plan like Generali Central Saral Pension Plan for a lifetime guaranteed income can be a key part of your retirement journey providing predictable income, low risk, and peace of mind for life.

Your dream retirement is waiting — all you need is the foresight to make it real.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Retirement Planning

Your retirement days might be far, but the planning should start now

4 mins

4.9K

Posted on: Jul 21, 2025

Retirement Planning

When should you kick-start a pension plan?

4 mins

5K

Posted on: Jul 21, 2025

Retirement Planning

What tax benefits are available on savings for retirement?

6 mins

7.8K

Posted on: Jul 21, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.