Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

How to Plan for Your Child's Financial Future

6 mins

6 mins 6.7K

6.7KThe Cost of Raising a Child

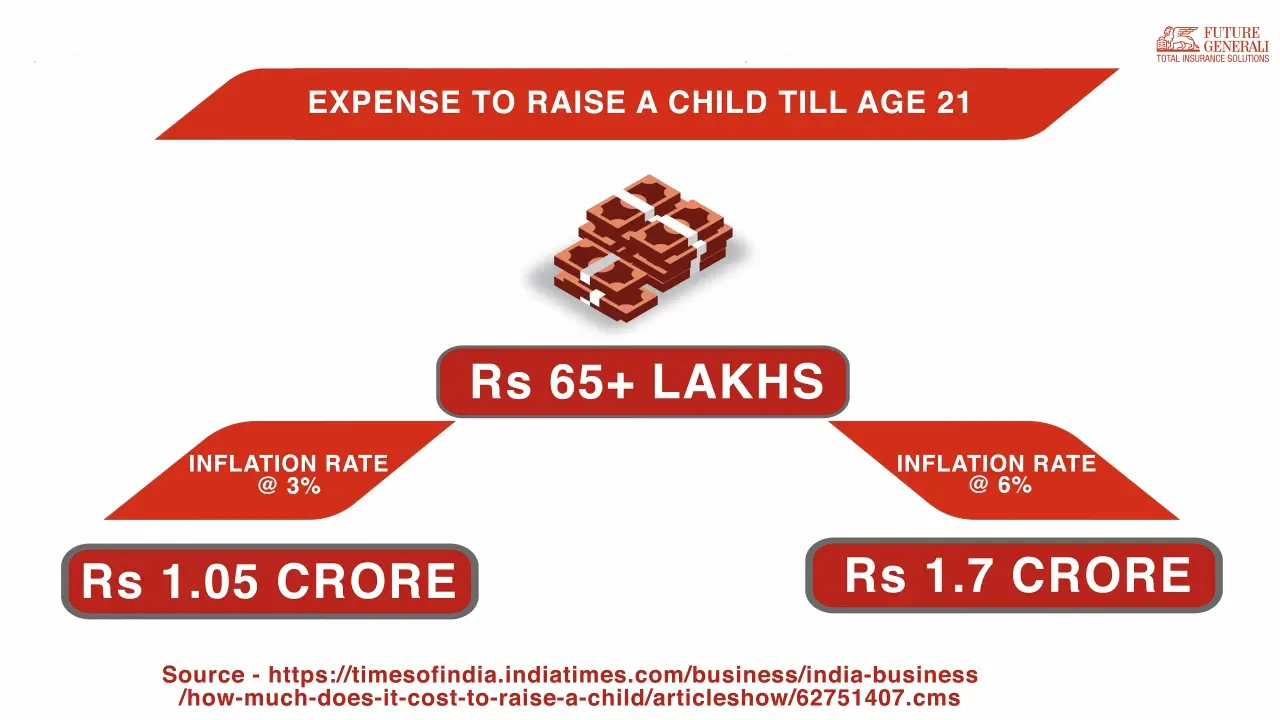

There are many costs associated with raising a child. The cost of raising a child up until the age of 21 can be staggering, according to a survey done by the Times of India. It might be a staggering 1.7 crores, assuming a 6% inflation rate. To cover these costs and make sure your child's requirements are met, financial planning is important.

Understanding the Major Expenses

Even though the overall cost could seem expensive, it's critical to understand how expenses are distributed. With almost 59% of all costs going towards education, it becomes clear that this is the most important expense. This indicates that roughly 40 lakhs of the 67 lakhs that are assumed will go towards your child's education in school, at the university, and in college.

How to choose the Right Child Education Plan

The major education milestone of a child starts when they complete their 12. At this point in time, your child is likely to be 17 or 18 years of age. As a parent, you should plan the period of your investment linked to the age of your child, and it is recommended that you save until your child turns 17 years of age.

The first and foremost thing is to identify the funds required currently for higher education. This will help you estimate the amount required in the future, which is calculated by inflating the current cost of education for the defined period. A simple thumb-rule to estimate this cost for the desired course is by doubling the current amount after a period of 10 years. A financial advisor can help you estimate the amount needed for your child depending on their age and the current inflation. However, the other important consideration is also the amount you can afford. It is recommended that you save at least 5-10% of your monthly salary towards your child’s education.

Up to class 12th, education expenses form a part of the monthly household expenses. It is post class 12 that the expenses rise sharply and cannot be met through the routine monthly household expenses. Professional education like medical science, engineering, computer science, and MBA cost higher. Your child’s first important education milestone is when they are completing graduation. Most graduation courses vary from 3 years to 5 years. You can safely assume that you will need money for 4 years. Also, keep in mind that a higher sum of money is required immediately after the child finishes their 12th board exams, usually for application fees to various courses, entrance exams, hostel fees, travel, etc.

This is the most important question while planning for your child’s education. Education should remain uninterrupted even after the death of the parent. Child plans offered by various life insurance companies score higher than other alternatives such as fixed deposits and mutual funds because they offer a significant amount of structured protection, which helps the family in case of the death of the earning parent. A good child insurance plan offers a lump-sum payment on the death of the policyholder, but the policy does not end. Also, all future premiums are waived, and the insurance company continues investing this money on behalf of the policyholder. There is an amount given to the child every year to fund the school education, along with the money pre-decided for specific milestones towards higher education. In this way, the parent ensures that their child's needs are taken care of even when they are not around.

The Solution - Generali Central Assured Education Plan

It's crucial to think about appropriate financing requirements if you want to handle the costs of your child's education properly. The Generali Central Assured Education Plan from Generali Central Life Insurance does just that by assisting parents in making regular savings for their children's future. This plan offers several advantages, such as:

Watch the Video

Having a child is without a doubt one of the most important decisions you will ever make. Are you financially ready?

Setting long-term goals and arranging funds should be a parent's top priorities. Watch as Happy Singh offers a few tips to help parents make financial plans for that.

Conclusion

Planning for your child's future is a responsibility that requires diligent financial preparedness. By understanding the significant expenses associated with raising a child and opting for suitable financial solutions like Generali Central Assured Education Plan, you can ensure your child's educational needs are met without undue stress. Start your financial planning today and secure a bright and worry-free future for your little one.

Disclaimers: For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Generali Group’s and Central Bank of India’s liability is restricted to the extent of their shareholding in Generali Central Life Insurance Company Limited.

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Planning for Childs Future

Child education plan: a comprehensive guide for young parents

4 mins

4.8K

Posted on: Jul 21, 2025

Planning for Childs Future

How to insure your child's future

5 mins

3.9K

Posted on: Dec 14, 2023

Planning for Childs Future

Here's How You Should Plan For your Child's Future

4 mins

4.4K

Posted on: Dec 08, 2023

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.